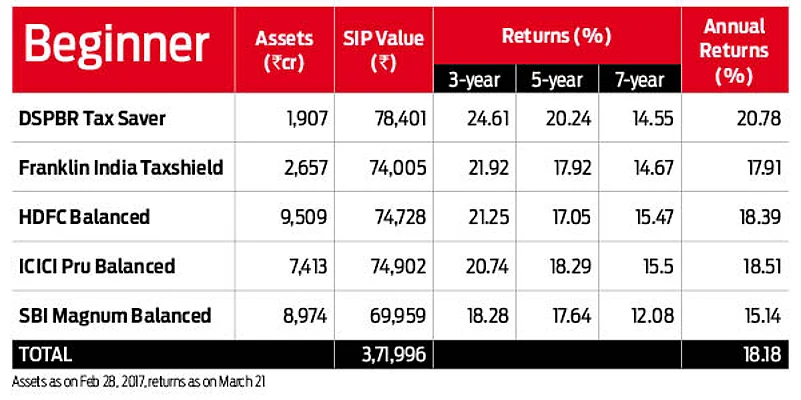

The challenge faced by a first time investor is, more often, about making a decision to invest. As most of them are also looking at ways to save on taxes; the funds recommended include a healthy dose of equity-linked savings scheme (ELSS). Investing in ELSS helps you save taxes and the equity exposure with a three year lock-in enables new investors to experience equity investing and benefit from long-term investing. There are balanced funds in this list, which follow a dynamic asset allocation between equity and debt, demonstrating investment discipline.

DSPBR Tax Saver

This scheme seeks to generate medium to long-term capital appreciation from a diversified portfolio, which it achieves by investing in stocks with strong earnings growth. The fund has a large-cap tilt, which checks on performance volatility. The fund avoids investing in businesses where predictability is poor, which has resulted in its consistent performance.

Franklin India Taxshield

This fund has an investment style that marries growth and valuation, which has resulted in this fund faring well during both the down and up cycle of the markets. The strategy to stick to large-caps has augured well, which is visible in its long term performance when it has consistently done better than its benchmark.

HDFC Balanced

The hallmark of this fund’s consistent performance is its discipline to maintain a steady asset allocation between equity and debt, with a 68-72 per cent equity allocation. Further, the approach to investing in companies with quality business growth, ROE and quality management have all paid off over the years making it a strong first choice of first investment.

ICICI Pru Balanced

This is a hybrid scheme which invests money in both equity and debt instruments, which is periodically balanced to maintain an approximate 30:70 debt to equity ratio. It also offers investors stable returns and consistent performance as it is structured in a manner that the downside is well managed when the markets tank.

SBI Magnum Balanced

This hybrid fund adopts a multicap approach to its equity allocation, which could tend to be risky when the market slides. It does extremely well during bull phases of the market, and is equally deft in containing the fall when the markets fall. An actively managed debt allocation has helped in its performance.