Hyundai Motor India Limited (HMIL) debuted on the stock exchanges on October 22, 2024, at a discount with shares opening at Rs 1,934, a 1.32 per cent discount from the IPO price of Rs 1,960. The price quickly dropped to Rs 1,882 and today at the close, it is around Rs 1,807, nearly 7.5 per cent down from the listing price.

It is opportune to look at the major losers and gainers in the primary market in 2024.

IPO in 2024: Top Losers

Looking at the top losers in the IPO segment this year, it is evident that Small and Medium Enterprises (SMEs) are more riskier than Main board IPOs. Many mainboard IPOs resurged from their listing losses, in a few months. However, SME IPOs seldom regain from their listing losses.

For instance, a main board IPO, JG Chemicals Limited, debuted on March 13, 2024, recording a 16 per cent loss on its listing day. However, in a turnaround, the company is now trading at an impressive gain of 74.91 per cent. Jana Small Finance Bank also has a similar story. It started with a listing loss of 11.06 per cent but has subsequently rebounded, and currently trading at a profit of 23.14 per cent.

Gopal Snacks also rebounded from its tough debut. On the other hand, two other mainboard IPOs--Capital Small Finance Bank and M.V.K. Agro Food continue to struggle and exacerbate the loss made on the listing date.

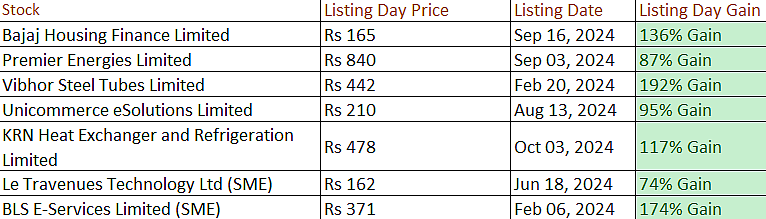

IPO in 2024: Top Gainers

Bajaj Housing Finance Limited, one of the biggest IPO this year, has emerged as one of the standout performers this year, boasting a staggering 136 per cent gain on its listing day. Premier Energies Limited also impressed with an 87 per cent increase since its debut on September 3, 2024. Vibhor Steel Tubes Limited another mainboard IPO achieved a remarkable 192 per cent gain on February 20, 2024.

Other noteworthy performances from the SME segment include Le Revenues Technologies Ltd with a solid 74 per cent gain and BLS E-Services which recorded a substantial gain of 174 per cent gain.