Raising a claim is an important aspect of life insurance. When it comes to life insurance, claims can be of two types—maturity of the policy or demise of the policyholder. While the maturity claim is pretty simple and can be raised by the policyholder, the death claim is made by the nominee or dependents. The procedure is simple with clearly listed process.

For instance, when a policy is maturing, the insurer will usually send you an intimation along with a discharge voucher a couple of months in advance of the date of maturity giving details like the maturity amount payable. You then need to send it back to the insurance company along with the original policy bond to enable it to make the payment towards the maturity of the policy. In case it is assigned in favour of any other entity, like a home loan company, the maturity claim will be paid only to the assignee who will give the discharge.

In case of the unfortunate demise of the policyholder, the death claim sets in. You need to intimate the insurer about the policyholder’s death. The intimation can be done by the nominee or close relative of the nominee or the policyholder.

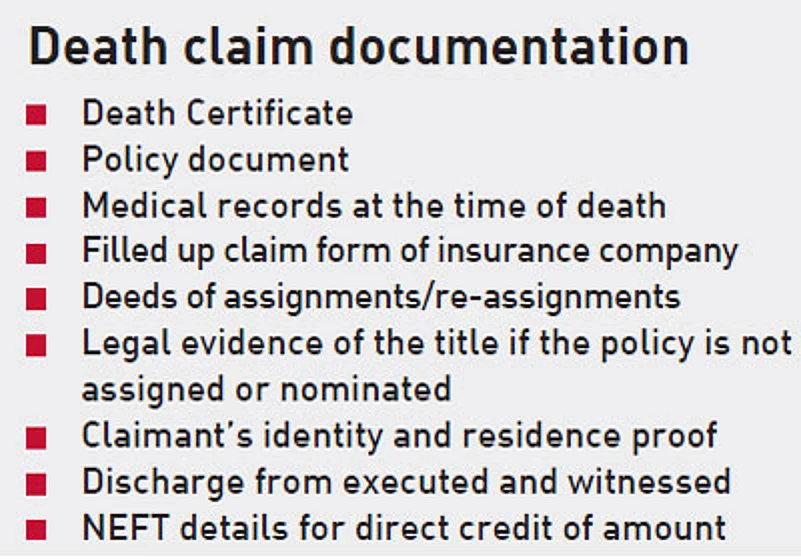

To make a claim, you need the intimation letter, death certificate, policy bond, KYC of the nominee and the person intimating death and NEFT documents. Normally, the agent who sold the policy would help with the formalities. Once the insurer receives the claim intimation, they would ask for supplementary documents, which are not mandatory for all claims but depend on the event leading to death, such as employer certificate, attending physician’s certificate, etc. In certain cases, hospital certificate, copy of police report and post mortem report may be sought, as applicable. Once all the necessary documents are submitted, the insurer after performing due dilligence on the veracity of the claim settles the same with the nominees.