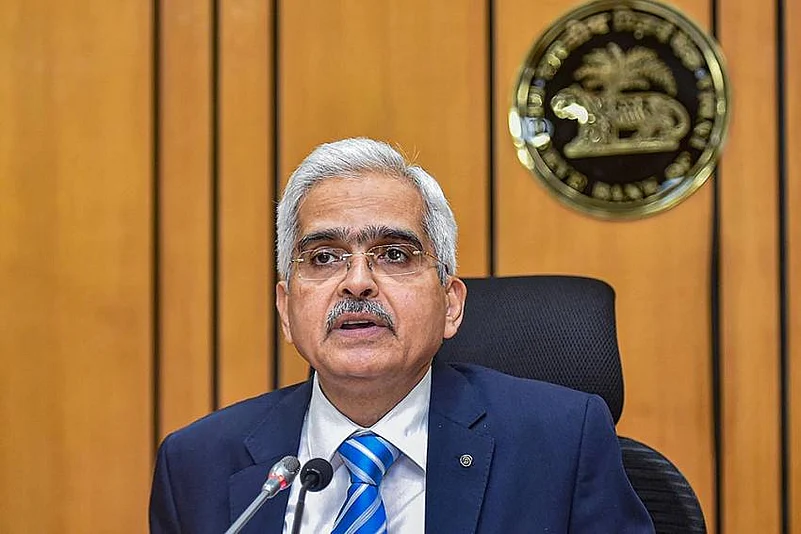

Reserve Bank of India Governor Shaktikanta Das today, at the Monetary Policy Committee meeting, flagged the systemic risks posed by some NBFCs as they follow irresponsible lending practices. He also said that foreclosure charges are not henceforth allowed on loans taken by Medium and Small enterprises (MSE).

After MPC's previous commentary on the likelihood of stress buildup in a few segments RBI governor, this time asked Banks and NBFCs, to carefully assess their individual exposures in these areas, both in terms of size and quality. Their underwriting standards and post-sanction monitoring have to be robust, he said. The segments are unsecured loan segments like loans for consumption purposes, microfinance loans and credit cards outstanding. However, he reminded me, that the health parameters of banks and NBFCs continue to be strong.

Responsible Lending Conduct: Levy of Foreclosure Charges on Loans

Das flagged that some NBFCs, including MFIs and HFCs, are pursuing excessive returns on equity, using interest rates, and high fees, which could lead to potential financial stability risks. Das began by stating, "While the overall NBFC sector remains healthy, I have a few messages to the outliers."

"Some NBFCs – including microfinance institutions (MFIs) and housing finance companies (HFCs) – are chasing excessive returns on their equity. While such pursuits are in the domain of the Boards and Managements of NBFCs, concerns arise when the interest rates charged by them become usurious and get combined with unreasonably high processing fees and frivolous penalties. These practices are sometimes further accentuated by what appears to be a ‘push effect’, as business targets drive retail credit growth rather than its actual demand. The consequent high-cost and high indebtedness could pose financial stability risks, if not addressed by these NBFCs," he added.

Banks and NBFCs currently are not allowed to charge foreclosure fees or pre-payment penalties on any floating rate term loan given to individual borrowers for non-business purposes. These regulations will now also cover loans to Micro and Small Enterprises (MSEs), the governor communicated an RBI proposal. A draft circular regarding this will be issued for public consultation, he added.

RBI kept repo rates unchanged at 6.5 per cent for the month consecutive time. Dovish commentary from the Reserve Bank of India (RBI), and changing its monetary policy stance to neutral indicates that the RBI is leaning towards a monetary policy that prioritizes economic growth and employment over controlling inflation. This could mean that the RBI will support lower interest rates in the future.