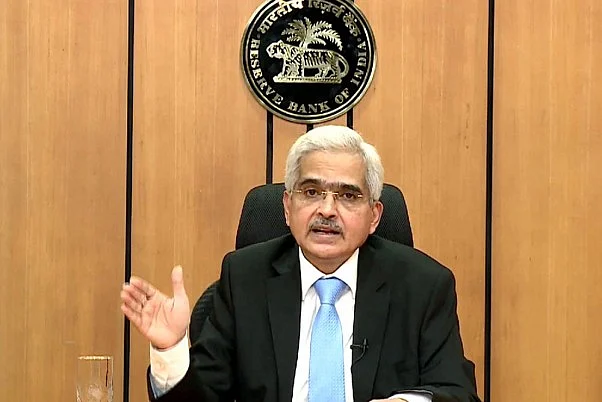

The Reserve Bank of India (RBI) Governor Shaktikanta Das on March 4 announced that the launch of an interoperable payment system for internet banking is expected to occur within the current calendar year. Says Das at the Digital Payments Awareness Week event: “We have given approval for implementing such an interoperable system to NPCI Bharat BillPay Ltd (NBBL). The new system will facilitate quicker settlement of funds for merchants.”

“In our Payments Vision 2025, we had envisaged an interoperable payment system for Internet banking transactions,” Das said. Interoperability refers to the fundamental capability of various digital systems, applications, and databases to link up and exchange information. Payment platforms utilize financial technology to facilitate connectivity and data sharing among ecosystem participants such as banks, payment gateways, processors, merchants, and consumers.

He expressed that this initiative will enhance user trust in digital payments. "As regulators, we are dedicated to contributing to India's digital payment advancement," he emphasized. He urged all stakeholders including industry players, payment system operators, media, digital payment users, and others to take responsibility for achieving the goal of 'Har Payment Digital' (Every Payment Digital). He stressed that this mission is not only for the Reserve Bank but for the entire nation.

Das stated that the leading payment system, 'UPI,' has garnered significant attention as the foremost fast payment system, not just within India but globally as well. "It stands as the primary driver of digital payment expansion in India, with UPI's contribution to digital payments nearing 80 per cent in 2023," Das highlighted.

From a broader perspective, the volume of UPI transactions surged from 43 crore in the calendar year 2017 to 11,761 crore in 2023. "In addition to its user-friendly interface and support for QR code-based payments, UPI has advanced to incorporate additional features including offline payments via near field communication (NFC) technology (UPI Lite X), payments using feature phones (UPI 123Pay), and AI-driven conversational payments (hello! UPI)," he elaborated.

According to Das, reaching the tipping point of the next 1000 crore transactions in UPI has taken considerably less time. He highlighted that while it took 1668 days (4.56 years) to reach the first 1000 crore UPI P2M transactions, the latest 1000 crore transactions were achieved in just 45 days. Similarly, for UPI P2P transactions, the journey to the first 1000 crore transactions took 1329 days (3.63 years), whereas the latest 1000 crore transactions took only 65 days, slightly over two months. "The recent advancement of UPI has been remarkable. Currently, UPI is handling close to 42 crore transactions per day," Das remarked.

"There is significant potential for furthering the adoption of digital payments in India," he remarked. He noted that since the initiation of the mission in March 2023, there have been 6.65 crore new UPI users added between March 1, 2023, and January 31, 2024. Additionally, he stated that the Reserve Bank's Payments Infrastructure Development Fund (PIDF) has played a crucial role in this expansion, facilitating the deployment of over 1.2 crore additional digital payment touchpoints.