The erstwhile Tata Pure Equity fund has been a steady performer, which does not post stupendous returns when the markets go up, and neither does it lose much when the markets tank. The large-cap tilt ensures portfolio discipline which is reflected in the way Tata Large Cap Fund’s returns have been steady across cycles.

Tata Large Cap : Big stocks tilt

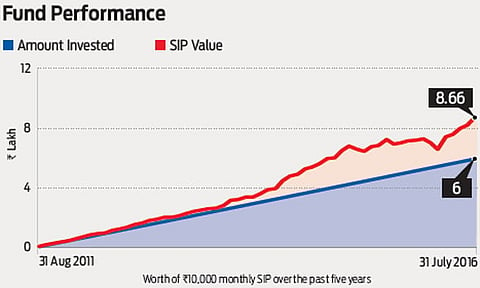

Tata Large Cap has beaten the benchmark with dependable returns

Advertisement

The portfolio is made from the top 125 companies by market capitalisation, which is very tightly managed with no exposure to small-caps and a very small mid-cap exposure. The stock selection strategy adopted follows earnings growth and capital efficiency, along with growth at a reasonable price (GARP) style. Further, the core portfolio holdings follow a buy and hold approach, with the remaining used as a tactical move to benefit from opportunities. The fund is a good bet for dependable returns that beat the benchmark, contains downsides during market corrections, though is not spectacular during bull runs.

Other funds based on stable returns :

Advertisement

Show comments

Published At: