Among the most significant announcements in Union Minister of Finance Nirmala Sitharaman’s Budget Speech in July 2024 was the proposal to undertake a comprehensive review of the Income-tax Act, 1961.

In her Budget Speech, she said: “The purpose is to make the Act concise, lucid, easy to read and understand. This will reduce disputes and litigation, thereby providing tax certainty to the taxpayers. It will also bring down the demand embroiled in litigation. It is proposed to be completed in six months.”

Sitharaman further said that the changes proposed in the Budget were like a precursor to this overall review. Budget 2024 simplified the tax regime for charities, the tax deducted at source (TDS) rate structure, provisions for reassessment and search provisions, along with rules on taxation of capital gains.

The Union Ministry of Finance has also formed a panel headed by chief commissioner of income tax V.K. Gupta to review the provisions.

"The review of the tax law has been long pending. The Direct Tax Code, which was proposed in 2009, promised to undertake similar reforms, but was never implemented"

The review of the tax law has been long pending. It is not the first time that the government has initiated tax reforms in recent decades.

The Direct Tax Code (DTC), which was proposed in 2009, promised to undertake similar reforms. After roughly a decade-and-a-half, tax reforms may finally see the light of the day.

“My top expectation from the proposed income tax reform is the creation of a tax framework that acknowledges the dynamic nature of freelance income. I would like to see more clarity and flexibility in the deductions allowed for business-related expenses and a simpler and streamlined tax filing process. The tax structure should provide greater financial support and stability to freelancers.”

The questions now on taxpayers’ minds are: Will their lives be really simplified with the reformed law? Will the simplification mean easier income tax return (ITR) filing, more tax relief, lesser disputes? Will the law be completely overhauled or only bits of tinkering is to be expected?

Says Sameer Gupta, national tax leader, EY India, a consultant firm: “As per our understanding, the government proposes to undertake a comprehensive review of the existing Income-tax Act, 1961, in terms of simplification. A complete overhaul of the Act seems unlikely as a part of this exercise.”

The timeline of the review is also in question. “While I’m uncertain about the committee’s ability to achieve major outcomes within the next six months, it’s clear that the government is already making progress in the area of tax reforms. We’re certainly ahead in many aspects, but the timeline for these new reforms may be overly ambitious. If, however, the government has already decided on a course of action, then it’s a positive step,” says a senior government tax official, on the condition of anonymity.

We spoke to tax experts to understand what kind of changes are on the anvil and what is it that taxpayers actually want changed.

Why Are Reforms Needed?

The Income-tax Act, 1961 currently has 23 chapters and about 298 Sections, according to an income tax department document. The voluminous Act has several laws that are no longer applicable or measures that no longer hold relevance, and being a decades-old document it’s not the easiest to understand and interpret either. Plus, the legalese in the document is not easy to understand given the complicated structure and language.

The primary objective of the reforms is to make the Act simple and easy to understand. Experts say that simpler laws will enhance voluntary compliance by taxpayers, provide stability, and also eliminate uncertainty. Moreover, it may do away with the need for making frequent amendments to the tax law.

As per our understanding, the government proposes to undertake a comprehensive review of the existing Income-tax Act, 1961, in terms of simplification. But a complete overhaul of the Act seems unlikely as a part of this exercise

According to a Parliamentary Standing Committee report dated March 2023, simpler language will minimise potential disputes which can lock significant amounts in litigation for both the taxpayer and the government. For instance, as of FY 2021-22, `20.8 trillion is locked in income tax disputes, amounting to about 8.9 per cent of India’s gross domestic product (GDP) for the year.

The Income-tax Act, 1961 has undergone numerous amendments over the years. Over its more than decade-old regime, the present Bharatiya Janata Party (BJP)-led National Democratic Alliance (NDA) government has introduced many changes, such as introduction of the new tax regime, abolition of wealth tax and introduction of surcharges. Even earlier governments have made several changes during Budget announcements.

Says Sudhakar Sethuraman, partner, Deloitte India, “With each Budget, the government has been endeavouring to bring in measures to simplify and rationalise the income tax law. One needs to keep in mind that the legislation is decades old and has been trying to keep pace with the changing business models, economic scenarios, global tax developments, and so on.”

The changes over the years have only increased the size and complexity of the legislation. Gupta gives some facts in this regard: “More than 90 Sections of the Act have lost their relevance. The redundant Sections are in the areas of exemptions and deductions such as special economic zones, telecommunications, capital gains, etc. where exemptions/deductions have ended due to a sunset clause or otherwise, but the Sections still form a part of the law, making it more complicated,” says Gupta.

“The government has simplified the tax structure for businesses and corporates. However, as we look ahead to the DTC, I hope to see further simplification of the demand and assessment provisions. Reassessment rules must become more objective. Additionally, DTC should offer clear guidance on areas with diverse viewpoints. Transfer pricing, for instance, is a significant source of litigation.”

Some were introduced to give a fillip to certain investments or spending but were later rolled back. “These provisions have either been abolished or been replaced by other Sections. A classic example would be Section 88 which covered deductions such as contributions to provident funds (PF), life insurance premium payments, etc. which are now part of Section 80C. Likewise, there are other Sections, such as 80HHC, 80HHE, 80HHF, 10B, 10BA, etc. which relate to deductions or exemptions in respect of export businesses,” says Sethuraman. These deductions/exemptions were available for a few years in the past (from 2004-05 to 2010-11), but they remain a part of the Act. Others include Sections 10, 35 and 80 (see Outdated Exemptions and Deductions for details).

"The Income-tax Act, 1961 has undergone numerous amendments over the years and the changes have only increased the size and complexity of the legislation"

Then, there are certain aspects where monetary limits could be revisited considering the rise in inflation. “A few examples are child education allowance (Rs 100 per child per month, capped to a maximum of two children), perquisite value of driver salary (Rs 900 per month) and so on,” says Sethuraman. It may be noted that in several metro cities, children’s tuition fees and driver’s salary has multiplied by at least 10 times, depending on the institution and the area.

The senior government tax official quoted earlier said that the system currently suffers from too many outdated limits. “One of the key areas needing attention is the decriminalisation of tax violations. Forums, such as the dispute resolution panel (DRP), with three commissioners, have become ineffective,” the official added.

Additionally, the appellate process is cumbersome and often just creates more work for tax practitioners rather than resolving issues efficiently. A similar review of the appeals process is overdue.

“The fear of taking risks within the system also stifles progress, and while the idea of simplifying the tax regime is appealing, it often comes at the cost of concessions. Moving to a flat rate may not be as practical as it sounds,” says the government official.

The new tax regime, which is now the default one, makes way for flat rates of taxation and doesn’t allow most deductions and exemptions, including those under the popular Section 80C, which are available under the old tax regime. It, however, offers a standard deduction of Rs 75,000, up from Rs 50,000, as proposed in Budget 2024.

The official adds: “On the procedural front, the new tax regime introduced by the government has gained in popularity, and they are actively addressing these processes. However, aggressive tax laws have led to aggressive tax positions, which in turn have increased tax litigation. The dispute resolution mechanism and, most importantly, the decriminalisation of tax issues, need urgent reforms.”

“With rising prices for food, accommodation, and other necessities, we hope for relief in income tax. Today’s tax slabs are more advantageous for individuals with lower incomes. However, there should be incentives for those in the 30 per cent plus tax slab. I have also observed that the tax filing process is very confusing. It should be simplified and made more user-friendly.”

Earlier Proposals

DTC was first proposed in 2009 to simplify, rationalise, and modernise the tax framework. The proposed reforms were subject to revisions and did not come into effect as initially planned. It is possible that some of those provisions may be considered now.

Recently, Sanjay Malhotra, revenue secretary, Ministry of Finance, Government of India, said that the Centre is working on a comprehensive review of the Direct Tax Code, which will be prepared by the internal committee and then shared for stakeholder consultation within the next six months.

Here are some of the key reforms and changes it proposed.

Simplification Of Tax Structure: The DTC proposed the rationalisation of income tax rates for individuals, companies, and other entities aiming to make the tax regime progressive and simple, to align it with international standards.

“This included reducing the number of tax slabs with a lower tax rate for income up to a certain threshold and higher rates for higher income levels. Further, the DTC aimed to simplify the tax structure by reducing the number of exemptions and deductions, thereby broadening the tax base. This was intended to make the tax system easier to understand and comply with,” says Suresh Surana, a Mumbai-based chartered accountant. The new tax regime may be aligned to this proposal.

Almost three-fourths of individual taxpayers chose to file their return in the new tax regime. One would now have to wait and watch to determine whether the old tax regime would be scrapped altogether or launched in a revamped version

Streamlining Compliance And Reporting: The DTC proposed changes to the process of filing tax returns, including simplified procedures for taxpayers and enhanced electronic filing options. Enhanced reporting requirements were suggested to improve transparency and reduce tax evasion. This, too, has been incorporated to a large extent.

Tax Administration Reforms: “The DTC aimed to simplify the dispute resolution process and enhance taxpayer rights and protections. Changes were proposed to the tax appeals process to streamline and expedite the resolution of disputes,” says Surana.

The DTC 2009 was introduced for public discussion and feedback but faced significant opposition and concerns from various stakeholders who perceived them as complex and something that would have a negative impact on certain sectors.

What to Expect?

We spoke to tax experts to understand what can be reasonably expected from the proposed tax reforms.

“It’s a good initiative. I believe many pensioners like me would benefit from the proposed reforms. I am much thankful to the government that from the day of my retirement in 2012 till date, I haven’t faced any issues regarding my pension and allowances. I hope the government continues with its efforts for the welfare and betterment of all the pensioners across India.”

Less Deductions: In 2014-15, then finance minister Arun Jaitley, riding high on BJP’s victory in the general elections, perhaps felt generous and increased the Section 80C deduction limit from Rs 1 lakh to Rs 1.5 lakh. However, it has remained unchanged ever since.

In 2020, they became irrelevant for many as Sitharaman introduced the new tax regime, which does not allow common deductions under Sections 80C, 80D, 24B and so on. Though the new regime didn’t find many takers initially, as the government added to the incentives in subsequent Budgets, the numbers have increased.

“With household expenses and the cost of education of children rising, every coin counts. I hope the Budget will provide higher tax deductions for essentials, such as education and healthcare, and also simplified processes that do not take so much of our time or money to figure out. A simple and family-friendly structure of taxation will go a long way in helping us manage our finances better.”

“Out of the total income tax returns (ITRs) of 72.8 million filed for Assessment Year 2024-25, 52.7 million have been filed in the new tax regime compared to 20.1 million ITRs filed in the old tax regime,” the Central Board of Direct Taxes (CBDT) said a few days after the deadline for filing ITRs closed on July 31, 2024.

"Lesser deductions may dash the hopes of some people. Though the new tax regime aims to simplify taxpayers' life, some of them feel they have been adversely affected"

Says Gaurav Mehndiratta, partner and national head, corporate and international tax, KPMG in India: “As per data released by the Central Board of Direct Taxes (CBDT), almost three-fourths of the individual taxpayer population chose to file their tax return in the new tax regime, making it undisputedly more attractive than the old tax regime. One would have to wait and watch to determine whether the old tax regime would be scrapped or launched in a revamped version.”

Lesser deductions, however, may dash the hopes of some people. Jorhat-based Dibya Jyoti Bora, 32, junior engineer, public works department (PWD), Government of Assam, says that the almost blanket exclusion of deductions in the new tax regime has adversely affected genuine taxpayers. The exclusion of tax saving instruments like Public Provident Fund (PPF), life insurance and health insurance has disincentivised investments in these schemes. He said he would prefer the new tax regime to continue with some dynamic reforms.

Easier Compliance And ITR Filing: Says Surana: “One significant area for simplification is the tax structure, as the Act includes numerous exemptions, deductions, and tax credits that often complicate the filing process. A simpler tax regime might involve fewer deductions, but higher exemptions, or a more streamlined approach to these allowances. This would reduce the need for extensive documentation and calculations by taxpayers and would make the tax filing process more straightforward.”

With each Budget, the government has tried to bring in measures to simplify and rationalise the income tax law. The legislation is decades old and has been trying to keep pace with the changing business models, and so on.”

This would also mean simplifying the provisions related to tax compliance and reporting. Often, taxpayers find the existing procedures for filing tax returns, maintaining records, and reporting income, somewhat taxing. In the last few years, many steps have been taken by the government to digitise and simplify the tax filing experience, and it is expected that there will be further fine-tuning and simplification of the procedural aspects to make it more user-friendly.

Many taxpayers still find ITR filing challenging. This is especially true for Delhi-based 26-year-old Chanchal Goel, a freelance communication manager. “Filing ITR can be quite a challenge, especially for freelancers like me. Managing irregular payments, varied client contracts, and unpredictable cash flows adds to the complexity,” says Goel.

A simpler and more streamlined income tax filing process would be highly beneficial and will also reduce the administrative burden, says Chanchal.

Rationalisation Of TDS Provisions: “Currently, there are 33 Sections dealing with different types of payments to residents where the TDS rates vary from 0.1 per cent to 30 per cent. The wide variety of TDS rates creates confusion for the taxpayers, increases compliance burden, and gives rise to disputes,” says Gupta.

The recent Budget made a beginning by reducing the TDS rates for many transactions. “The government may now consider only two or three Sections under the law (instead of the current 33) for various categories of payments requiring TDS,” says Gupta.

"Salaried taxpayers are complaining that they are expected to pay maximum taxes, while businesses and professionals have it easier. The removal of deductions is also a bone of contention"

He adds that only 2-3 categories of TDS rates for clearly defined payments may be maintained, with a small “negative list” of payments that will not be liable to TDS. The negative list is for avoiding any ambiguity or litigation on whether these payment heads are liable to TDS or not.

Change In Computation Of Business Income: “Th e current mechanism of computing business income is very complex, involving compliance with Income Computation and Disclosure Standards (ICDS), interplay with Indian Accounting Standard (IndAS), and so on. Th is computation could be simplifi ed,” says Gupta.

One of the biggest challenges Chanchal faces is the lack of clarity around tax-saving investments and exemptions for business-related expenses. “For instance, tools like communication software, travel for client meetings, and courses for professional development are essential for running a PR business. However, there’s ambiguity around how these can be claimed,” she says.

Simpler Capital Gains Provisions: The law may be further cleaned out given the changes announced in the recent Budget. “There are many other areas under capital gains taxation that may be reviewed for simplification,” adds Gupta. For instance, the difference in durations for different assets for the gains to be considered long- or short-term may be looked into.

Stronger Alternative Dispute Resolution (ADR) Mechanism: Given the large number of tax litigations pending in the tribunals, experts believe the new changes could focus on a stronger dispute resolution mechanism.

“India has a large number of tax cases pending in disputes. The lifecycle of tax litigation from assessments to the first appeal to the tribunal and then the courts can take 15-20 years or even more. For improving the ease of doing business, dispute minimisation needs to be accorded priority,” says Gupta.

“The exclusion of rebates and deductions in the new tax regime has adversely affected taxpayers. In particular, the exclusion of tax-saving instruments, such as PPF, life and health insurance premiums, infrastructure bonds, and small savings schemes has disincentivised investments in these. As such, almost our entire salary falls within the tax ambit. Therefore, we would prefer the new tax regime to continue with reforms.”

The Tax Conundrum

A look at social media posts will make it clear that several salaried taxpayers are complaining that they are expected to pay maximum taxes, while businesses and professionals have it easier. The removal of deductions and exemptions from the new tax regime and no changes in their limits under the old tax regime (Section 80C limit was last revised in 2014-15) in the last 10 years or so is also a bone of contention. These reliefs allow taxpayers to reduce their taxable income.

“Salaried taxpayers feel the pinch of taxes due to limited deductions/ exemptions as against individuals earning income from business/ profession. However, compliance has been eased considerably. For example, timelines for tax refunds have reduced substantially over the years,” says Sethuraman.

“The government should do a fine balancing act and one possible approach could be to review and rationalise the various deductions and exemptions available now,” adds Mehndiratta.

Taxpayers should, nevertheless, realise that the government is unlikely to increase deduction limits under the old tax regime going ahead. Tax reliefs announced in Budget 2024 are all meant just for the new tax regime. For all we know, the old tax regime may get scrapped.

In a simplified tax system without deductions, one should focus on increasing income through investments and additional earnings. Also, it gives you a chance to plan your investments better instead of just focusing on tax-saving investments. Understanding tax brackets and seeking professional advice can help you minimise your tax liability.

While India’s tax reform proposals hold promise, challenges remain. Taxpayers hope for clearer guidance, reduced complexity, and fairer treatment. Eventually, the success of these reforms will hinge on effective implementation and continuous engagement with stakeholders.

Outdated Exemptions And Deductions

The Income-tax Act, 1961 has undergone numerous amendments over the years, and some sections on exemptions and deductions have now become redundant. A few are listed here

Section 10A, 10B, 10BA

These Sections aren’t relevant now. Section 10A constitutes a special provision for newly-established undertakings in a free trade zone. Section 10B deals with special provisions in respect of newly-established 100% export-oriented undertakings. Section 10BA refers to special provisions in respect of the export of certain articles.

Section 35AC

The benefit under this Section in relation to certain eligible projects or schemes is no longer available after AY2018-19.

Section 35B, 35C, 35CC, etc.

These deductions with respect to export markets development, agricultural development, rural development, etc. are abolished, but still hold a place in the Act.

Section 80-IA, 80-IB

These offered deductions for profits from infrastructure projects/specific industries. Changes in tax laws and the introduction of new schemes have affected their relevance. Tax holiday under Section 80-IA is available to the assessees who are engaged in providing infrastructure development facility. Under this Section, eligible assessee get tax deduction on profits under business head for a specified period of time. Section 80-IB provides for deduction in respect of profits and gains from certain industrial undertakings other than infrastructure development.

Source: KPMG

10 Wishlist Items: What Indian Taxpayers Want From Tax Reforms

Simplified Tax Brackets: A reduction in the number of tax brackets to make tax calculations easier and more understandable.

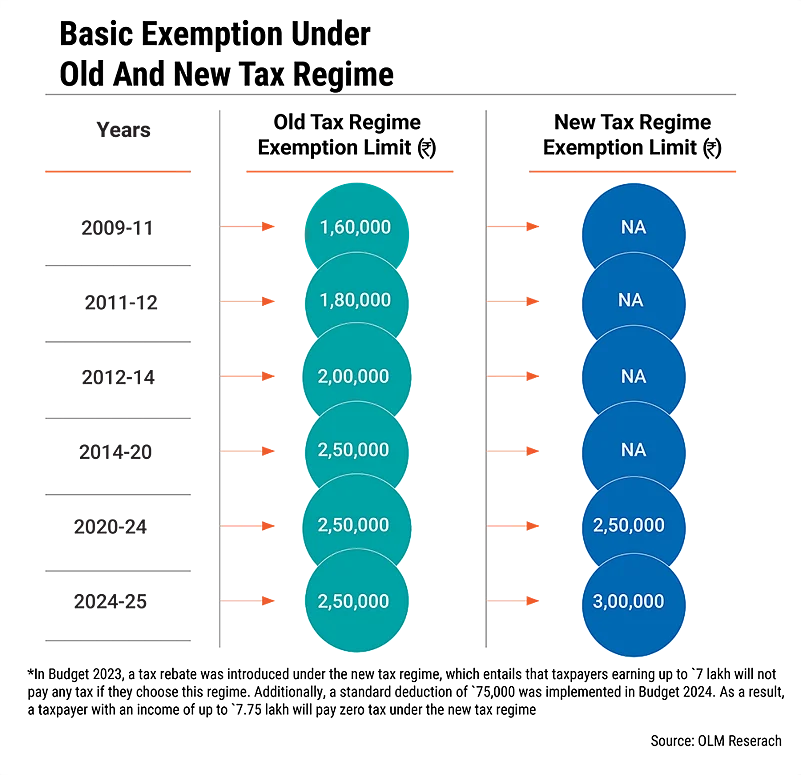

Increased Threshold Limit: Increase in threshold limit (till which income is tax-free) from the current `2.5 lakh, to decrease tax outgo.

Increased Deductions: Higher deductions for essential expenses, such as education, healthcare, and home loan interest to provide relief to middle-class taxpayers.

Lower Tax Rates: Decrease in income tax rates for individuals and businesses, especially for small and medium-sized enterprises (SMEs).

Simplified Tax Filing: A more user-friendly and digitised process for filing tax returns, thus reducing the burden on taxpayers.

Reduced Litigation: Streamlined dispute resolution mechanisms to minimise the time and cost involved in tax-related legal battles.

Fair Taxation Of Digital Economy: Clear guidelines and regulations for taxing income generated from digital transactions.

Enhanced Transparency: Increased transparency in tax policies and procedures to improve taxpayer confidence and compliance.

Reduced Penalties: Lower penalties for minor tax errors or omissions to encourage compliance.

Effective Tax Administration: Improved efficiency and responsiveness of tax authorities.

Source: OLM Research

Meghna Maiti with inputs from Anuradha Mishra, Aaron Varghese Charly, Manas Malhotra, Priyanka Debnath and Sanjeeb Baruah