Some startling stats were stated by the finance minister in his budget speech. The one about 24 lakh people showing income above Rs 10 lakh in 2016 was an eye openers as was the detail about 1.7 crore people filing income tax returns out of 4.2 crore salaried people.

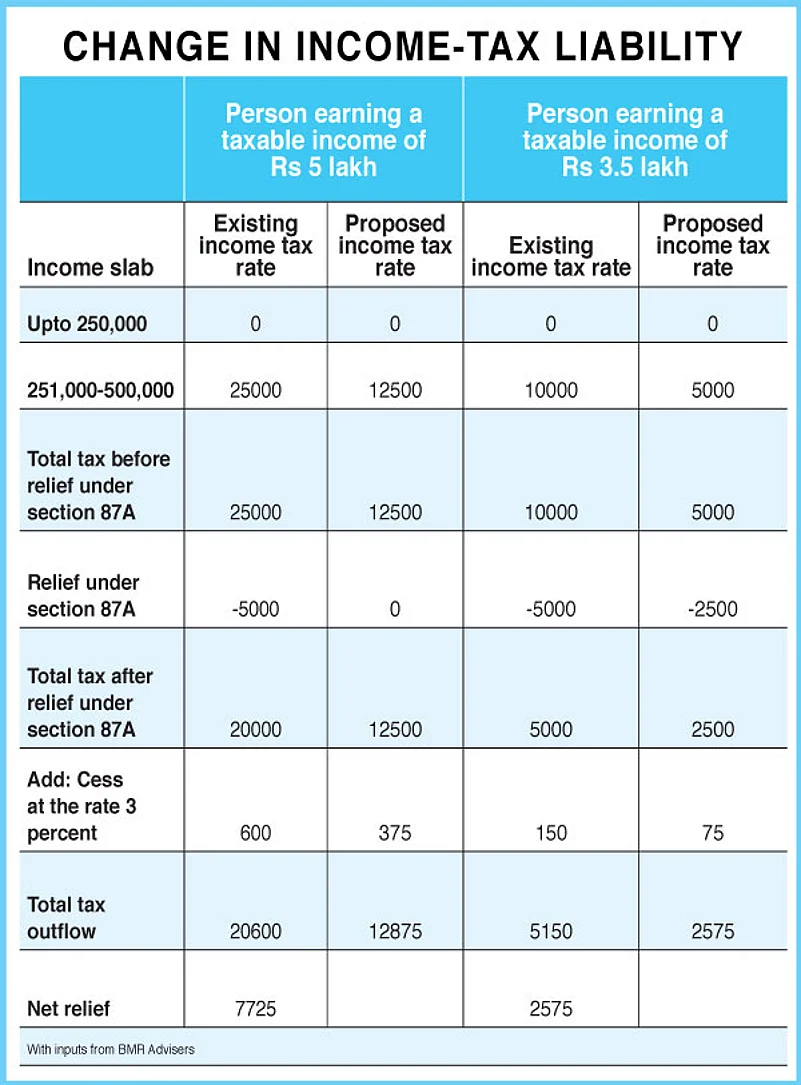

Perhaps to encourage more taxpayers into the system, the minister has reduced the tax liability for those with annual income between Rs 2.5 and 5 lakh at 5 per cent instead of the existing 10 per cent. However, for those earning an annual income is Rs 50 lakh and Rs 1 crore, the surcharge of 10 per cent will stay. And, the surcharge on individual annual income of Rs 1 crore or more remains unchanged at 15 per cent. The icing on the cake however, is the proposal for a single-page income tax return filing form for taxable income under Rs 5 lakh.