Sponsored Content

The largest value fund in terms of assets, ICICI Prudential Value Discovery Fund,has successfully completed 18 years. The Scheme has an AUM of Rs. 24,694 crs which accounts for nearly 30% of the total AUM in the value category.This indicates significant investor trust of value investors in the scheme. Data as of July 31, 2022. (Source: Value Research).

The scheme follows a value investment style by investing in diversified portfolio of stocks that have attractive valuations but are quoting at a discount to their intrinsic value.

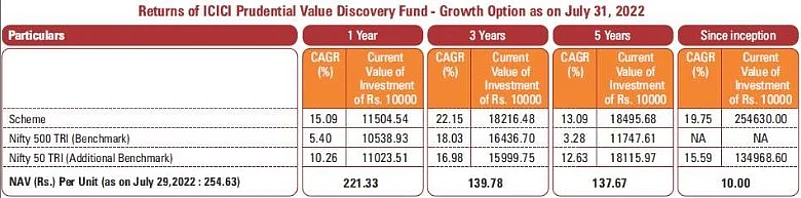

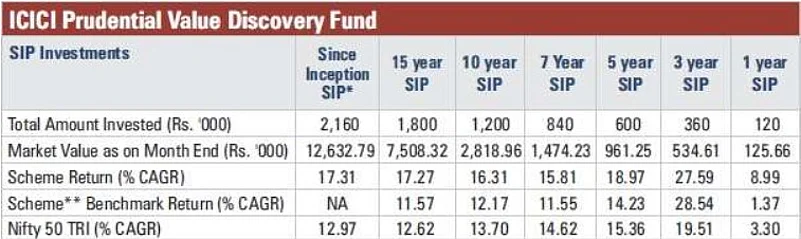

A lump sum investment of Rs. 10 lakhs at the time of inception (August 16, 2004), as of July 31, 2022, would be worth Rs. 2.5 crore i.e. a CAGR of 19.7%. A similar investment in Nifty 50 would have yielded a CAGR of 15.6% at Rs. 1.3 crore. With value investing being suited for long-term investing, SIP emerges as a good investment pathway. In terms of SIP performance, a monthly investment of Rs 10,000 via SIP since the inception, which would amount to a total investment of Rs 21.6 lakhs, would have grown to Rs 1.2cr as of July 31, 2022 i.e. a CAGR of 17.3%.

Past performance may or may not be sustained in future. *Inception date is 16 Aug 2004. **Scheme benchmark is Nifty 500 TRI.The performance of the scheme is benchmarked to the Total Return variant of the Index.