Sponsored Content

Highlights:

NFO opens on September 30, 2024, and closes on October 14, 2024

Offering cost-efficient access to value stocks within the Nifty 200 universe

Minimum Application Amount (During NFO) for ICICI Prudential Nifty200 Value 30 ETF and ICICI Prudential Nifty200 Value 30 Index Fund: ₹100 (plus in multiples of ₹1)

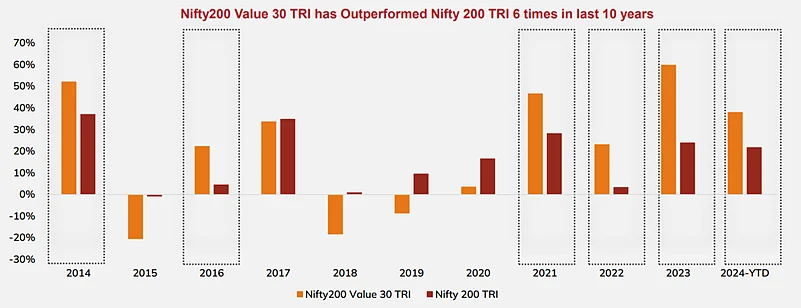

Nifty200 Value 30 TRI outperformed Nifty 200 TRI 6 out of 10 times till 2024

ICICI Prudential Mutual Fund announced the launch of ICICI Prudential Nifty200 Value 30 ETF, an open-ended Index Exchange-Traded Fund tracking the Nifty200 Value 30 Index. The fund house has also introduced ICICI Prudential Nifty200 Value 30 Index Fund, replicating the Nifty200 Value 30 Index. Both offerings fall under the smart beta category, focusing on a factor-based strategy to provide investors with a low-cost, value-driven investment approach.

The Nifty200 Value 30 Index consists of 30 stocks selected from the Nifty 200 Index, based on a 'Value Score.' This score is calculated using key valuation factors to help value-conscious investors easily identify opportunities. The index offers exposure to companies that demonstrate good potential for sustainable long-term growth.

Chintan Haria, Principal – Investment Strategy at ICICI Prudential AMC stated, "At a time when investors are seeking diversified strategies for long-term growth, value investing remains a crucial component of a well-rounded portfolio. We are excited to introduce the Nifty200 Value 30 ETF and Index Fund, offering investors a targeted approach to value-based investing, which is designed to provide growth over the long term."

The index is rebalanced semi-annually, so it could entirely align with market trends and valuation principles.

Why should investors invest?

Value-based investing: The schemes are based on the concept of value investment, which aims to target undervalued stocks

Diversification: Exposes the investors to 30 companies from diverse sectors, thus diversifying their share portfolio

Transparency and low cost: Both schemes aim to provide low-cost options for investors along with low portfolio turnover

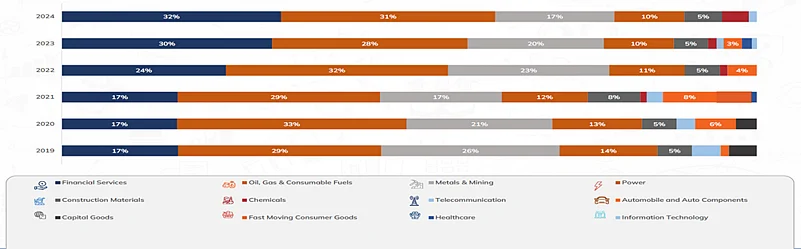

Sector Exposure:

The index Nifty200 Value 30 is exposed to Financial Services, Oil, Gas & Consumable Fuels, Metals & Mining, Power, Construction Materials, Chemicals and Telecommunication and is well-poised for capturing value opportunities therein. And this exposure changes based on the value score of the companies.

(source: https://niftyindices.com/Factsheet/Factsheet_Nifty200_Value30.pdf, Data as on August 30, 2024)

Disclaimer - The sector(s)/stock(s) mentioned do not constitute any recommendation of the same and ICICI Prudential Mutual Fund may or may not have any future positions in the sector(s)/stock(s)

Performance History:

The Nifty 200 Value 30 TRI outperformed the Nifty 200 TRI six times during the last ten years, indicating that value investing is a feasible strategy for an investor's portfolio under certain market conditions.

Data as on September 6th, 2024. Past performance may or may not be sustainable in the future. Data Source: Nifty Indices https://www.niftyindices.com/reports/historical-data . MFI Explorer. MFI Explorer is a tool provided by ICRA Online Ltd. MFI Explorer is a tool provided by ICRA Online Ltd. For their standard disclaimer please visit http://www.icraonline.com/legal/standard-disclaimer.html. CAGR stands for The compound annual growth rate (CAGR) is the rate of return (RoR) that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each period of the investment’s life span.

Capturing the changes in the market

The index compositions are aligned to the prevailing circumstances in the market. For example, it was overweight on the financial services in 2023 and 2024 in the index composition, since the value score of the sector's stocks was higher. This flexibility ensures that the exposure to various sectors is calibrated regularly in line with the value opportunities available on a quantitative basis.

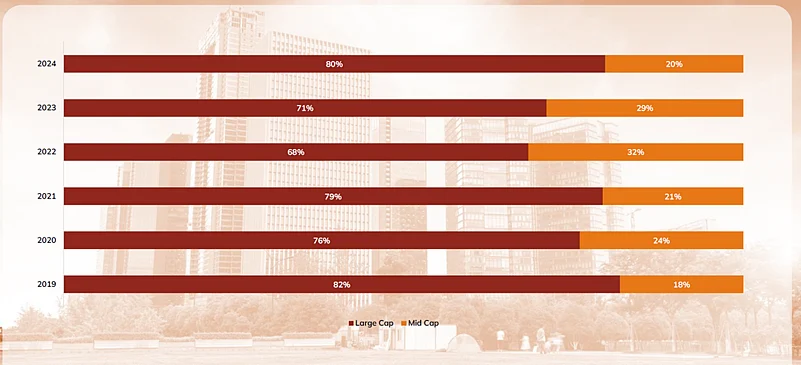

As the universe of stocks is NSE 200, the portfolio also has midcap stocks. Due to the use of value score, the exposure levels to the midcaps keep changing. For example, midcap stocks had more value in 2022, but in 2019, the exposure to midcap stocks was the least in the last five years.

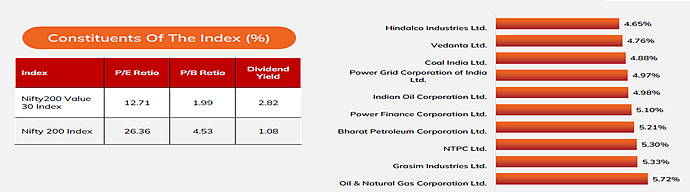

Portfolio Details

Performance of the index does not signify the returns of the scheme. Past performance may or may not be sustainable in the future. The stocks mentioned here are forming part of Nifty200 Value 30 Index as on 9th September 2024. The sector(s)/stock(s) mentioned in this document do not constitute any recommendation of the same and ICICI Prudential Mutual Fund may or may not have any future positions in the sector(s)/stock(s). The asset allocation and investment strategy will be as per SID Data as on September 9, 2024. Data Source : Nifty Indices https://www.niftyindices.com/reports/index-factsheet

For more information, please contact:

Adil Bakhshi

Principal PR & Corporate Communication

Email: adil_bakhshi@icicipruamc.com

Phone: 91-22-66470274

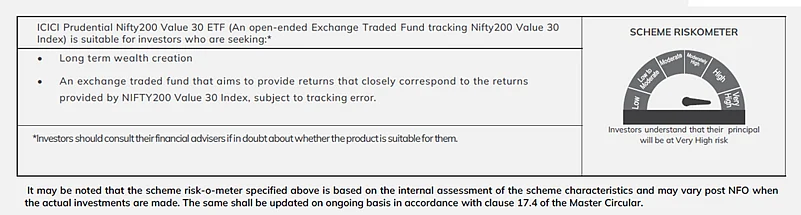

Riskometer & Disclaimers:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Disclaimer: All figures and other data given in this document are dated as of August 31, 2024 unless stated otherwise. The same may or may not be relevant at a future date. The information shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Prudential Asset Management Company Limited (the AMC). Prospective investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of ICICI Prudential Mutual Fund.

Disclaimer: In the preparation of the material contained in this document, the AMC has used information that is publicly available, including information developed in-house. Some of the material(s) used in the document may have been obtained from members/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. We have included statements / opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. ICICI Prudential Asset Management Company Limited (including its affiliates), the Mutual Fund, The Trust and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. Further, the information contained herein should not be construed as forecast or promise. The recipient alone shall be fully responsible/are liable for any decision taken on this material.

Disclaimer by the National Stock Exchange of India Limited: The Product(s) are not sponsored, endorsed, sold or promoted by NSE Indices Limited (" NSE Indices"). NSE Indices does not make any representation or warranty, express or implied, to the owners of the Product(s) or any member of the public regarding the advisability of investing in securities generally or in the Product(s) particularly or the ability of the Nifty200 Value 30 Index to track general stock market performance in India. The relationship of NSE Indices to the Issuer is only in respect of the licensing of certain trademarks and trade names of its Index which is determined, composed and calculated by NSE Indices without regard to the Issuer or the Product(s). NSE Indices does not have any obligation to take the needs of the Issuer or the owners of the Product(s) into consideration in determining, composing or calculating the Nifty200 Value 30 Index. NSE Indices is not responsible for or has participated in the determination of the timing of, prices at, or quantities of the Product(s) to be issued or in the determination or calculation of the equation by which the Product(s) is to be converted into cash. NSE Indices has no obligation or liability in connection with the administration, marketing or trading of the Product(s).

NSE Indices do not guarantee the accuracy and/or the completeness of the Nifty200 Value 30 Index or any data included therein and they shall have no liability for any errors, omissions, or interruptions therein. NSE Indices does not make any warranty, express or implied, as to results to be obtained by the Issuer, owners of the product(s), or any other person or entity from the use of the Nifty200 Value 30 Index or any data included therein. NSE Indices makes no express or implied warranties, and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the index or any data included therein. Without limiting any of the foregoing, NSE Indices expressly disclaim any and all liability for any damages or losses arising out of or related to the Products, including any and all direct, special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.

Any application by investors, other than Market Makers, must be for an amount exceeding INR 25 crores. However, the aforementioned threshold of INR 25 crores shall not apply to investors falling under the following categories (until such time as may be specified by SEBI/AMFI):

Schemes managed by Employee Provident Fund Organization, India;

Recognized Provident Funds, approved Gratuity funds and approved superannuation funds under Income Tax Act, 1961.

Disclaimer of BSE Limited: It is to be distinctly understood that the permission given by BSE Limited should now in any way be deemed or construed that the SID has been cleared or approved by BSE Limited nor does it certify the correctness or completeness of any of the contents of the SID. The investors are advised to refer to the SID for the full text of the disclaimer clause of the BSE Limited.

Disclaimer of National Stock Exchange of India Limited: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the 'Disclaimer Clause of NSE“

ICICI ETF is part of ICICI Prudential Mutual Fund and is used for exchange traded funds managed by ICICI Prudential Asset Management Company Limited.

Disclaimer by the National Stock Exchange of India Limited : It is to be distinctly understood that the permission given by National Stock Exchange of India Limited (NSE) should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the ‘Disclaimer Clause of NSE’.

Disclaimer by the BSE Limited: It is to be distinctly understood that the permission given by BSE Limited should not in any way be deemed or construed that the SID has been cleared or approved by BSE Limited nor does it certify the correctness or completeness of any of the contents of the SID. The investors are advised to refer to the SID for the full text of the Disclaimer Clause of the BSE Limited Disclaimer of NSE Indices Limited: The Products offered by “ICICI Prudential Mutual Fund/ICICI Prudential Asset Management Company Limited” or its affiliates is not sponsored, endorsed, sold or promoted by NSE Indices Limited (NSE Indices) and its affiliates. NSE Indices and its affiliates do not make any representation or warranty, express or implied (including warranties of merchantability or fitness for particular purpose or use) to the owners of these Products or any member of the public regarding the advisability of investing in securities generally or in the Products linked to their underlying indices to track general stock market performance in India. Please read the full Disclaimers in relation to the underlying indices in the respective Scheme Information Document.

Disclaimer: This is a sponsored article. It is not part of Outlook Money's editorial content and was not created by Outlook Money journalists.