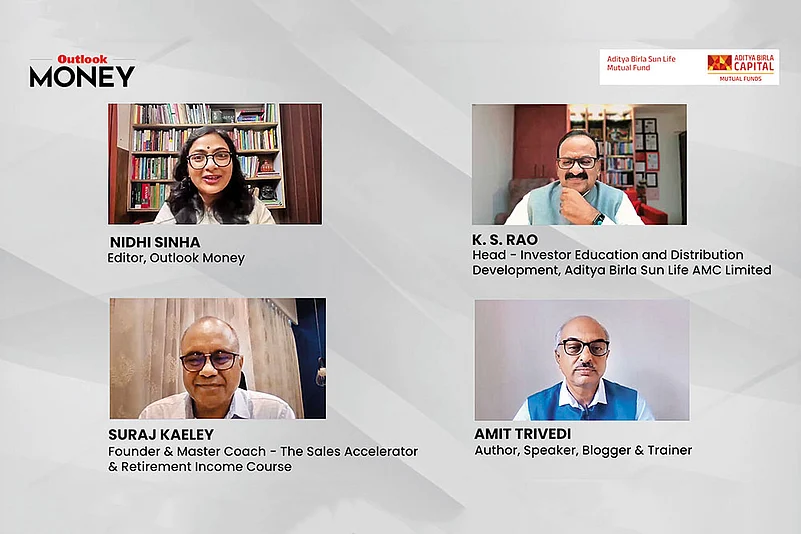

The latest webinar, hosted by Outlook Money in collaboration with Aditya Birla Sun Life Mutual Fund as part of their investor education initiative, explored the essence of smart investing. The panel featured three experts: K.S. Rao, Head of Investor Education and Distribution at Aditya Birla Sun Life AMC; Amit Trivedi, co-founder of OSAT Knowledge; and Suraj Kaeley, founder of the Sales Accelerator Program at Reflect and Grow. The webinar was moderated by Nidhi Sinha, Editor, Outlook Money. The experts shared practical insights into what makes an investor “smart,” especially in today’s dynamic financial landscape.

Rao reflected on how financial education aligns with the spirit of celebration, from Navaratri to Diwali. He laid out five principles every smart investor should follow: “Informed investment decisions, managing volatility, proper asset allocation, understanding risk versus returns, and consistent investing through SIPs.” Drawing on his decades of experience, he emphasized, “The key is to stay educated, navigate market volatility, and always invest with a long-term goal in mind.”

Building on this, Trivedi delved into the basics of investing, noting that the purpose of investing should guide all decisions. He humorously shared, “When I ask young investors why they invest, many say, ‘To save tax!’ I joke that quitting your job would bring your tax liability to zero—but that’s obviously not the goal.” He stressed that defining financial goals and aligning investments accordingly is crucial. “For short-term goals, protect your capital; for long-term goals, protect your purchasing power.”

"Digital platforms make investing easier, but they also expose investors to unsolicited advice and cyber frauds, so one needs to be cautious"

The discussion also touched on the role of technology in investing. Rao highlighted both the benefits and risks: “Digital platforms make investing easier, but they also expose investors to unsolicited advice and cyber frauds.” Kaeley added practical tips: “If you receive suspicious messages or calls, don’t engage. The moment you engage, scamsters gain leverage.”

Wrapping up the conversation, each expert shared the single quality they believe defines a smart investor. Rao underscored the importance of planning, Trivedi advocated reading diverse perspectives, and Kaeley emphasized the value of teamwork. “Successful investing is not a solo journey; collaboration helps overcome biases and leads to better decisions,” he said.

As the session concluded, the experts reminded participants to stay vigilant, stay informed, and continuously learn, with Trivedi emphasizing, “Read, read, and read more—contrasting views will help you stay grounded.”

This engaging session provided valuable insights for both novice and experienced investors, reiterating that financial literacy, discipline, and collaboration are the cornerstones of smart investing.