To make the gold bond scheme more attractive, the government has included sops in the sixth tranche. While the yearly interest rate on this tranche is 2.5 per cent, which is 0.25 lower than the previous tranches, there is a discount in the form of per gram gold being Rs 50 lower than the nominal value, compared to the earlier trend of issuing the bond at the nominal closing value of pure gold.

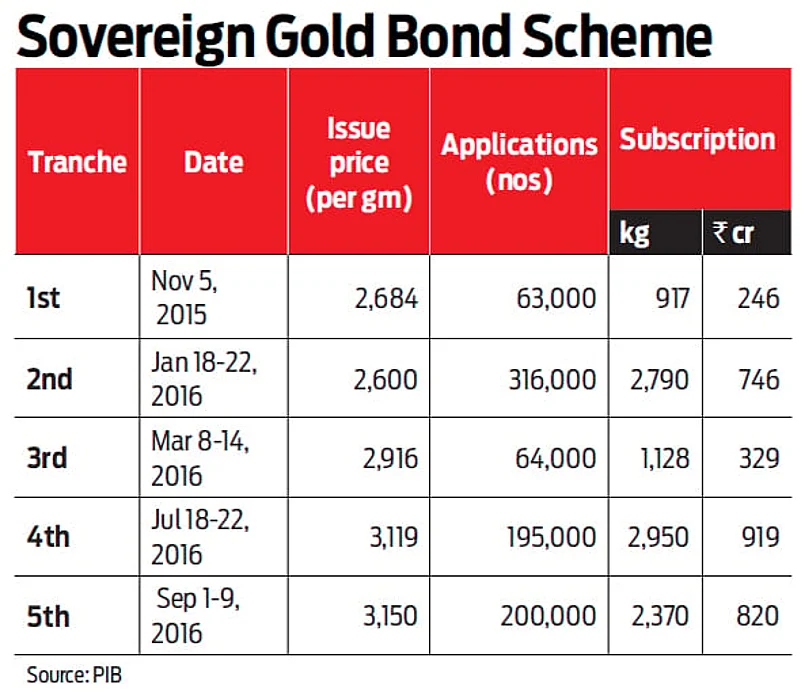

The bonds have found takers, which is visible from the number of subscriptions for each tranche. Equally, the bond has witnessed progressive modification with each instalment. For instance, in the fifth tranche, the minimum investment quantity was made a minimum of one gram and its multiples, which resulted in an increase in the number of applications, though the weight of gold was less. Further, the demat form of the bonds makes it very safe and convenient for people who may otherwise fear losing the bond certificate or damaging it. Although these bonds are listed on the exchange, trading in them is thin.

The benefit of having the bond in a demat account is the liquidity it offers for one looking to sell the bond as selling it on the exchange is possible only if the bond is in the demat form. Another aspect that finds inclusion is the details of the applicants being sought in the application form, which may be eased to get in more investors into this successful scheme. There may also be push to sell this bond through banks and post offices, to make the utmost use of reach of these institutions.