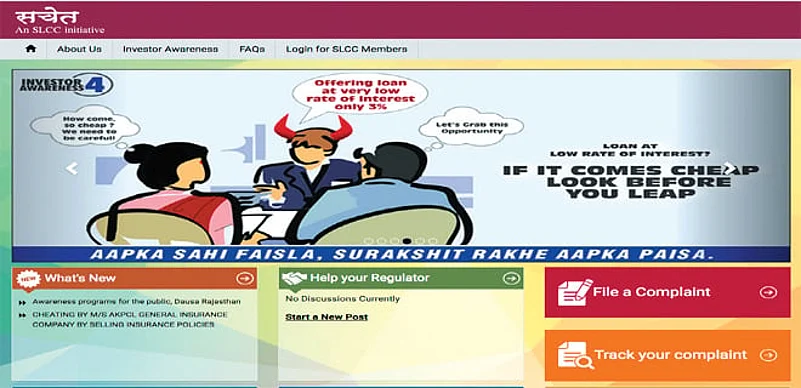

In a first, the RBI, SEBI, IRDAI, National Housing Bank, Registrar of Companies, State governments and the Economic Offences Wing came together to start www.sachet.rbi.org.in, a one-stop-shop to know about any investment company. Launched on August 4, the website will help curb illegal and unauthorised pooling of funds by unscrupulous firms. The site will help facilitate filing, tracking of complaints, besides providing information about whether any particular entity is registered with any regulator or is permitted to accept deposits.

The website would also help enhance coordination among regulators and state government agencies and thus be useful in curbing instances of unauthorised acceptance of deposits by unscrupulous entities, according to the RBI. The site allows people to check through the website if an entity seeking deposits is registered with any regulator or is allowed to accept public money.

“Members of public can file and track a complaint on this website if any entity has illegally accepted money from them and/or defaulted in repayment of deposits. They can also share information regarding any such entity on this portal,” according to S S Mundra, deputy governor, RBI. The website also has a section for closed user group for State Level Coordination Committee (SLCCs) wherein they could share market intelligence and other information about their activities as well as agenda and minutes of meetings across the country on a real time basis.

For years, the SEBI has been vocally advocating against collective investment ponzi schemes that go unchecked and unregulated, duping scores of gullible people. Scams involving the Saradha group of West Bengal and PACL of the Punjab-based Pearl Group have duped public to the tune of Rs. 50,000 crore in all. The move to have a website which will check the proliferation of such ponzi schemes will go a long way in protecting people. However, this alone cannot be the solution. There is a need to reach out to people in smaller unbanked parts of the country and spread financial awareness at such places to make the impact of such facilities more meaningful.