Real estate is always the favorite investment class for Indians, but the high ticket size made it out of reach for many. Investing in grade A commercial or prime residential real estate location is out of the question even for HNI as this will make their portfolio skewed to real estate. But REITs can provide an option to the retail investors to invest in high-end commercial real estate, as the minimum investment has been kept low. The minimum lot size has been reduced to 200 from 400.

When we buy physical real estate the average investor will need to identify a good location, book a property through a broker, make a big down payment, have to apply for a loan, engage lawyers in preparing and registering sale deed, maintenance, and upkeep of the property, but buying REITs (instead of directly a property) will eliminate all these steps. REIT is also regulated by a regulator which will further eliminate the chances of any “builder risk”. Properties developed by quality builders are expensive and are generally out of reach of retail investors. Investment in the real estate market through REITs will give the accessibility to the common, to invest in properties developed by the quality builders.

Currently, on average, returns of real estate investment in India can yield returns close to 9 per cent plus per annum average in residential properties including the rental yield of 2 to 3 per cent. When it comes to premium commercial properties, the rental yield will be 6 to 8 per cent per annum with capital gains of at least 7 per cent. Real Estate is a local asset class, which means city-wise economic factors influence the prices. Hence, in some pockets, the returns will be higher or lower than the above-mentioned rates

REITs have a negative correlation with stock markets. If we compare the performance of Embassy REITs with Nifty 50 for past one year then, Nifty 50 has given negative - 22.50 per cent returns and Embassy REIT’s has given negative - 2.50 per cent returns. If we take the closing price of the first day i.e, 1st April, 2019 then the dividend yield comes to an attractive 7.43 per cent on an annual basis. The closing price was Rs 315 and they have given a dividend of Rs 24.39 per unit.

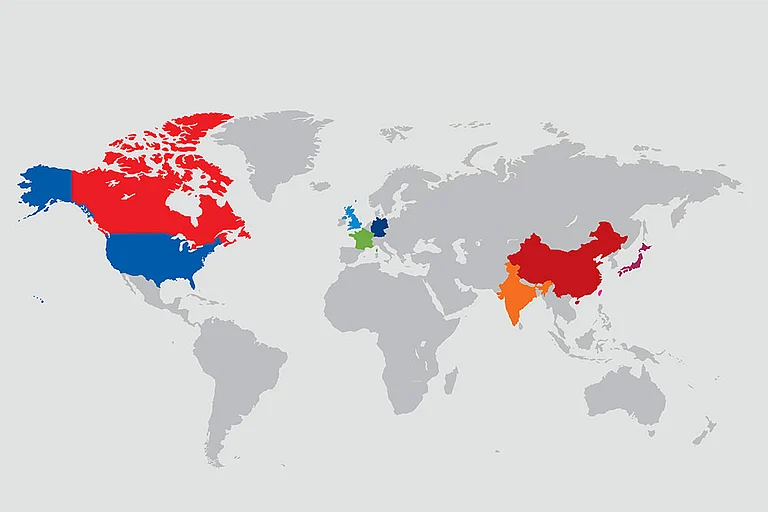

REIT is a globally recognized investment instrument. In international markets, we can invest in REITs of the US hospitals, commercial properties of Tokyo, warehouse REITs of Amazon or Walmart. In the Indian market we only have one REITs listed which is Embassy REITs and their underlying asset is office commercial buildings. Currently, we do not have much choice, also it is listed only for a year. But this is the emerging asset class for retail investors and gives a very efficient and transparent way to get exposure in real estate. In addition to fixed income and gold, this asset class can also be considered to create your own “all weather portfolio”

The author is Principal Founder – Paramasa Wealth Advisory