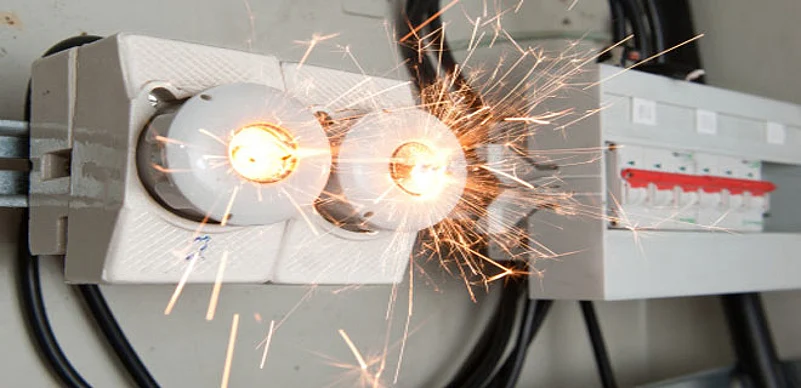

A short circuit in the meter board caused a fire in my house. The insurer settled for the contents and the damages, but did not pay for the expenses incurred for replacement of the meter board. Why?

Suresh Rathod

There are broadly two kinds of risks that are covered under a home insurance policy. The basic policy protects the building against fire and allied perils such as earthquakes and floods. The second type of risk coverage protects the contents of your house from burglary, natural and man-made calamities. Your claim falls under the head of fire and allied perils, which is subject to a few exclusions, including the one on that says that the point of origination of fire is excluded from the scope of coverage of the claim. Therefore, if the fire at your home originated due to short circuiting in the meter board, then the expenses incurred in the repair or replacement of the meter board would be excluded. From your question, it seems that the insurers had applied this condition only and that is why, the meter board has been excluded while settling your claim.