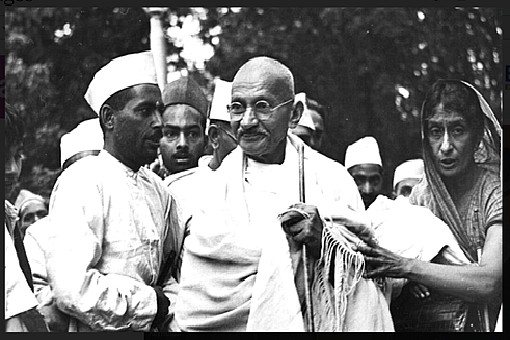

Mahatma Gandhi, revered for his philosophy of nonviolence and tireless efforts for India's independence, left behind not only a legacy of social and political change but also valuable financial wisdom. Though not a financial expert, his principles and life choices offer insightful lessons that are relevant in today’s world.

Let’s explore five financial lessons we can learn from the teachings and practices of Mahatma Gandhi.

Be Content With What You Have

Gandhi's life epitomised simplicity and minimalism. He chose to live with very few possessions and maintained a frugal lifestyle. This mindset can be applied to personal finances by focusing on needs over wants and avoiding unnecessary expenses.

We can save more, reduce debt, and attain financial security by embracing simplicity. In today's world, we often get carried away and spend money we do not need, like the latest phone, and sometimes even resort to debt to acquire certain items.

Ethical Investing

Mahatma Gandhi strongly advocated for ethical practices in all aspects of life. Today, ethical investing is gaining prominence, with individuals looking to support businesses prioritising environmental, social, and governance (ESG) factors.

Ethical investing aligns financial goals with values. Strategies include screening out harmful industries, impact investing for positive social and environmental effects, ESG integration for risk assessment, and shareholder voting to influence ethical behaviour, all aiming for both financial returns and a better world.

Debt Management

Gandhiji's staunch belief in debt avoidance is relevant to our finances. His core principle advocated living within our means and refraining from borrowing money unless essential. This lesson underscores the significance of managing debt judiciously.

Excessive debt can become a formidable financial burden, making it challenging to meet monthly expenses and compromising financial stability. High-interest rates on accumulated debt can also exacerbate the financial strain, hindering efforts to clear the outstanding amounts.

By embracing Mahatma Gandhi’s wisdom, we can aspire to lead financially responsible lives, free from the shackles of unmanageable debt and on a path toward long-term financial security.

Start Small, But Start Now

Gandhi led a successful protest called the Salt Satyagraha, vital for India’s freedom. Without his leadership, India might not have escaped the unfair salt tax imposed by the British.

Similarly, managing your money wisely is crucial. Some people spend all their money today without saving for tomorrow. But making smart financial choices now will lead to a better future. Just like Gandhi’s actions shaped India’s history, your financial decisions can shape a prosperous future.

Long-Term Vision

Gandhi’s struggle for India's independence was a testament to his unwavering commitment to a long-term vision. In personal finance, having a clear and long-term financial goal is essential.

Whether saving for retirement, buying a home, or funding your child’s education, setting achievable objectives and sticking to a disciplined savings and investment plan can lead to financial success. The final goal may seem far away, but it can be achieved if one is committed to the purpose and never wavers from it.

Mahatma Gandhi’s life and principles offer valuable insights into managing our finances. In a society often driven by materialism and consumerism, Gandhi’s financial wisdom reminds us of the importance of values and ethics in our financial pursuits.