Amitesh Kumar Das (32) lives with his homemaker wife Tulika (28) and parents in Bengaluru and works for a private firm. At the outset it is clear that he is looking way too ahead. Agreed one should plan for events in life but planning is a step by step process and should focus on goals which are nearer.

He first needs to get his foundation right by paying off the personal loans, creating an emergency fund, and taking a life and health insurance.

Securing the cash flow

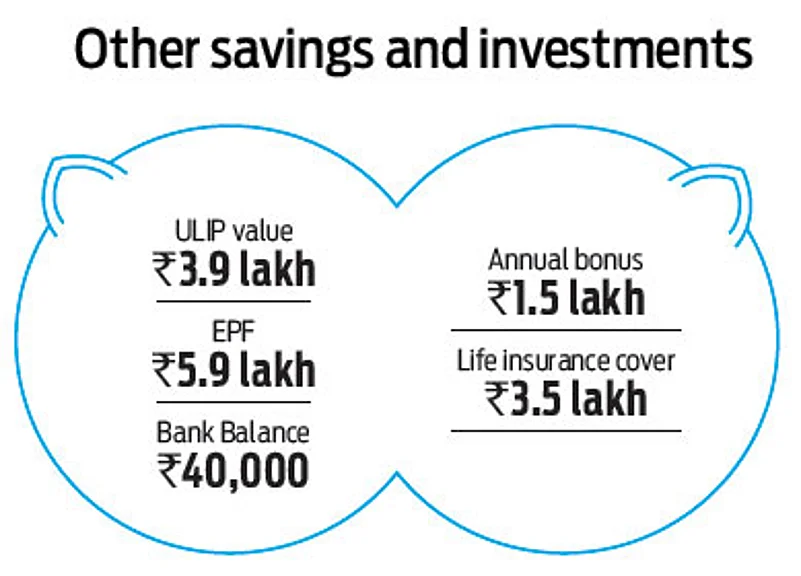

Amitesh is the only earning member and has three dependents. Therefore it is very important that he considers enhancing his life insurance cover from Rs 3.5 lakh to Rs 1.5 crore. The best and cheapest way would be to go for a term cover. In the same vein, Amitesh and his wife should buy a separate health cover for themselves even though they are covered by his employer and should include a maternity cover. Since his parents are not covered by his employer, he should consider a comprehensive health policy for them.

He should also consider a critical illness policy of Rs 10 lakh for himself and his wife as a standard health insurance policy typically covers only hospitalisation expenses.

Bolstering the balance sheet

With just Rs 40,000 in bank account, Amitesh is staring at a debt trap which will be difficult to come out of. We see this already with some of the personal loans that he has taken.

Pay off personal loans: Amitesh should pay off the loans by withdrawing money from his ULIP policies, as he would be earning far lesser than the cost he is incuring.

Emergency fund: The additional cash should be straight away transferred into a RD or a liquid mutual fund. This should be used to create a corpus of around Rs 2.5 lakh.

Cut expenses: Keeping his goals in mind, he should consider cutting his non-essential expenses. To get into the discipline, his savings could be made towards liquid mutual funds.

Increase earnings: In order to meet his current goals, his earnings should go up by at least 20-30 per cent in the next 1-1.5 years. This is extremely critical, otherwise some of his near-term goals of buying a house and a car will be pushed even further.

Portfolio reorientation

Recommended allocation: Given that Amitesh has so far not experienced any market linked instruments, barring the exposure through ULIPs, it is important that he starts building some exposure to equities.

Short-term: Large part of his current savings should go into debt mutual funds and liquid mutual funds given that he has big goals like buying a house and a car coming up in the next few years.

Also given the age of his parents, it is of paramount importance that he builds up a decent fund to meet contingencies. Therefore, he should be more focused right now in building liquidity and cash around the portfolio.

Medium- to long-term: Once some of the shorter term goals are met, it is important that Amitesh’s equity exposure goes up. He should at least have around 40-50 per cent of his assets in equities or equity linked funds. This will ensure that he generates long term inflation beating returns.

It is important to revisit the goals after one year, after the short-term actions on insurance, liquidity management and emergency funds have been dealt with.

The next one year is critical to get on the right path; reduction of goal values is not necessarily a permanent action. Once Amitesh gets on the path of disciplined savings, belt tightening in the near term, avoiding unnecessary debt and taking appropriate life cover, he should look at revising his goals upwards and getting back to his original plan.