Prodigy Finance expands its network to Australia. Ties up with universities to process education loans for international students

• Prodigy Finance is now offering loans to students who wish to pursue their post-graduation in Australia.

• The loan facility is available for 100+ courses at over 18 top-rated universities in Australia.

• Programs include fields like economics, engineering, IT, science, law, and more.

Prodigy Finance, a mission-driven organisation that has already funded $1.75 billion in student loans around the world, has now launched its offerings to students seeking financial help to pursue higher education in Australia.

The company is set to offer no-collateral and no-cosigner education loans to potential students who meet their eligibility and assessment criteria, for over 100 courses in 18 of the most sought-after universities in Australia. “We're currently able to fund students studying at Monash University and Queensland University of Technology in courses like Business and Economics, Engineering, Information Technology, Law, Science, and more,” said their Chief Financial Officer, Neha Sethi.

Some other Australian universities supported by Prodigy Finance include Australian National University, Griffith University, James Cook University, Macquarie University, University of Sydney, University of Tasmania, and University of Canberra. Students can seek loans for high-impact courses like Master of Biotechnology, Master of Data Science, Master of Economics, Master of Business Administration, at over 37 schools under these Australian universities.

This marks an important step in Prodigy’s expansion into new markets, giving students an opportunity to secure a loan for their higher education. All a student needs to do is fill out the online application form and hit submit, and if their application is successful, they can get a provisional loan offer within minutes.

The interest rate of the loan may vary according to the funded amount and chosen term period, but the average annual percentage rate of a loan secured from Prodigy Finance is competitive in the market.

With a steady year-on-year increase in enrollment rate in Australian universities, Australia continues to rise as a preferred destination among students willing to study abroad. Its universities consistently rank among the best globally. This attracts postgraduate students seeking top-notch qualifications and cutting-edge research opportunities. Prodigy Finance is proud to help students fulfil their dreams of higher education in Australia.

About Prodigy Finance

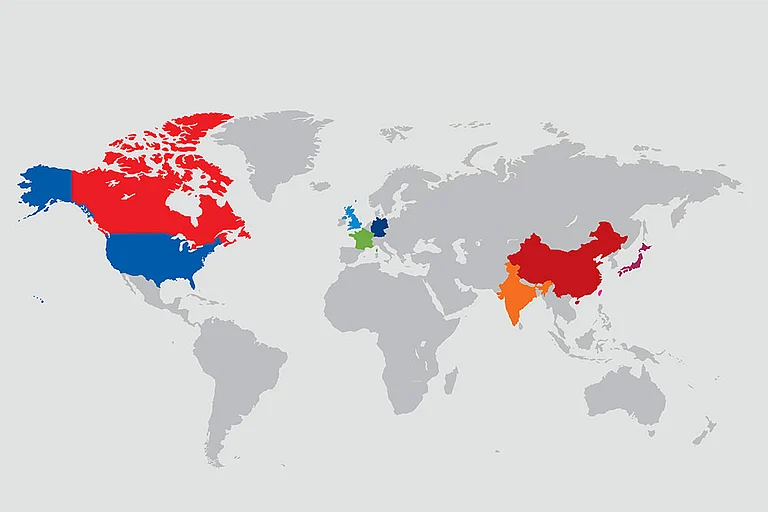

Founded in 2007, Prodigy Finance is an international student lender that has helped over 30,000 international masters students attend the world’s top universities. To date, Prodigy has disbursed over $1.75b in funding to students from more than 150 countries

Prodigy Finance is fuelled by impact investors and other private qualified entities who invest in tomorrow's leaders whilst earning a financial and social return. Prodigy’s borderless lending model enables students to apply for a loan based on their future earning potential and not just their current circumstances and credit history.