The largest value fund in India by assets under management (AUM), ICICI Prudential Value Discovery Fund, has successfully completed 19 years. The Scheme has an AUM of Rs. 32,659.44 crs which accounts for nearly 30% of the total AUM in the value category. This indicates significant investor trust of value investors in the scheme. Data as of July 31, 2023. (Source: Value Research).

The scheme follows a value investment style by investing in diversified portfolio of stocks that have attractive valuations but are quoting at a discount to their intrinsic value.

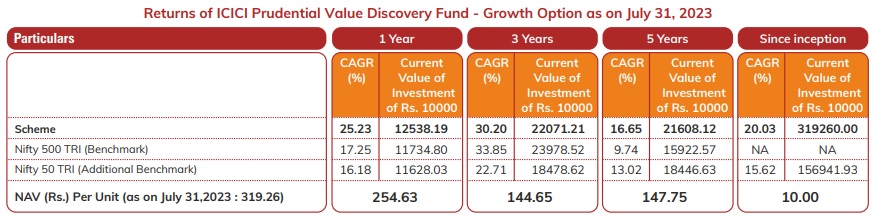

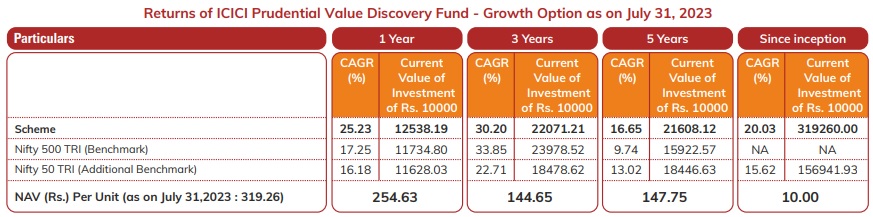

A lump sum investment of Rs. 10 lakh at the time of inception (August 16, 2004), as of July 31, 2023, would be worth approximately Rs. 3.1 crore i.e. a CAGR of 20%. A similar investment in Nifty 50 would have yielded a CAGR of 15.6% at approximately Rs. 1.5 crore.

Speaking on the occasion of 19 years’ completion, Nimesh Shah, MD & CEO of ICICI Prudential AMC says, “The greatest of the investing gurus be it Warren Buffett, Seth Klarman, Joel Greenblatt etc. are all proponents of value investing as the way to build long term wealth. We at ICICI Prudential AMC Ltd believe value as an investment style is here to stay as investors are increasingly becoming aware of what constitutes value and why it must be followed diligently. But the caveat here is that value can test one’s patience at times. We may have to wait for a long time for value to deliver on its promise. Through the journey of ICICI Prudential Value Discovery Fund, we have endeavoured to prove that value as a style works well in India as well. We are happy to note that the Scheme over the years has helped patient investors create long-term wealth.”

“Globally as well as in the scheme, there have been patches of time when value investing has not done well. However, if an investor is ready to be patient, then value investing will deliver sizeable returns over the long term. This is because the thesis of value investing is about buying stocks that have attractive valuations but are quoting at a discount to their intrinsic value,” says S Naren, ED & CIO, ICICI Prudential AMC Ltd.

He further adds, “Given the approach, it is advisable that investors should consider investing through the SIP route for the long term, especially during times when the past return is very good. On the other hand, when the past returns are low, we recommend investors to consider lump sum investing.”

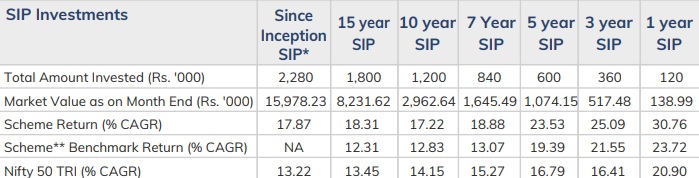

With value investing being suited for long-term investing, SIP emerges as a good investment pathway. In terms of SIP performance, a monthly investment of Rs 10,000 via SIP since the inception, which would amount to a total investment of Rs 22.8 lakh, would have grown to Rs 1.59 cr as of July 31, 2023 i.e. a CAGR of 17.87%. A similar investment in Nifty 50 TRI would have yielded a CAGR of 13.22%.

Data as on July 31, 2023.The returns are calculated by XIRR approach assuming investment of Rs 10,000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial and final value and a series of cash inflows and outflows with the correct allowance for the time impact of the transactions. Past performance may or may not be sustained in future. *Inception date is 16 Aug 2004. **Scheme benchmark is Nifty 500 TRI. The performance of the scheme is benchmarked to the Total Return variant of the Index. The investment value shown above would have varied based on the amount of SIP, the investment period of the investors and continuity of SIP. The returns shown are not indicating/assuring in any manner and is not an indicator of future returns. ICICI Prudential Mutual Fund does not provide guaranteed returns. Past performance may or may not sustain in the future.

-x-

For further information, please contact:

Adil Bakhshi, Head PR & Corporate Communication

Email: adil_bakhshi@icicipruamc.com

Mobile: +91- 9920010203

Disclaimer & Riskometer

Notes:

1. Different plans shall have different expense structure. The performance details provided herein are of ICICI Prudential Value Discovery Fund.

2. The scheme is currently managed by Sankaran Naren and Dharmesh Kakkad. Mr. Sankaran Naren has been managing this fund since Jan 2021. Total Schemes managed by the Fund Manager is 13 (13 are jointly managed). Mr. Dharmesh Kakkad has been managing this fund since Jan 2021. Total Schemes managed by the Fund Manager is 10 (8 are jointly managed). Refer factsheet annexure from page no. 108 for performance of other schemes currently managed by Sankaran Naren and Dharmesh Kakkad.

3. Date of inception:16-Aug-04.

4. Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investment.

5. Load is not considered for computation of returns.

6. In case, the start/end date of the concerned period is a non-business date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period

7. The benchmark of this scheme has been revised from Nifty 500 Value 50 TRI to Nifty 500 TRI w.e.f. January 01, 2022.

8. As the scheme was launched before the launch of the benchmark index, benchmark index figures since inception or the required period are not available.

9. For benchmark performance, values of earlier benchmark (Nifty 500 Value 50 TRI) has been used till 31st Dec 2021 and revised benchmark (Nifty 500 TRI) values have been considered thereafter.

Please refer to Page no. 108 to 112 of the factsheet (https://www.icicipruamc.com/docs/default-source/documents/factsheet-and-portfolio/fund-factsheet-for-july-2023.pdf?sfvrsn=1340321d_4) to view performance of other schemes managed by fund managers of the scheme.

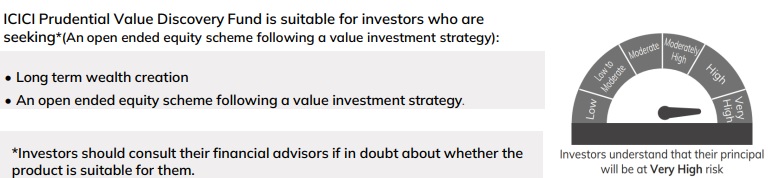

ICICI Prudential Value Discovery Fund - An open ended equity scheme following a value investment strategy

Please note that the Risk-o-meter(s) specified above will be evaluated and updated on a monthly basis. The above riskometers are as on July 31, 2023. Please refer to https://www.icicipruamc.com/news-and-updates/all-news for more details.

The portfolio of the scheme is subject to changes within the provisions of the Scheme Information Document of the scheme. Please refer to the SID for investment pattern, strategy and risk factors.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.