One of the largest and oldest ETF offerings of ICICI Prudential Mutual Fund based on the S&P BSE Sensex Index – ICICI Prudential S&P BSE Sensex ETF - has completed 21 years.

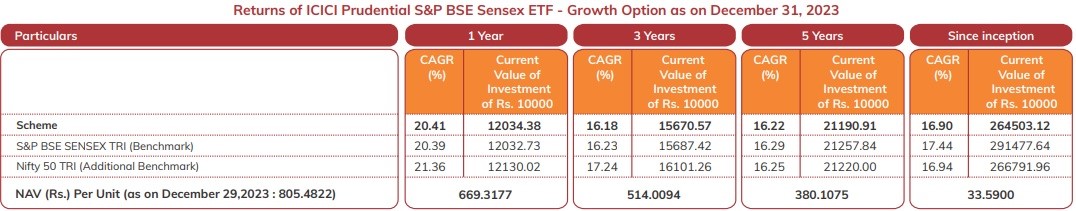

This scheme with an AUM of Rs. 4,560.71 crs (December 31, 2023) has a tracking error of 0.04% (1-Year) and an expense ratio of 0.03%. Tracking error represents how closely the scheme has been successful in replicating its underlying index. Lower tracking error, can help make the investment a balanced one can be.

Speaking on the occasion of 21 years’ completion, Chintan Haria, Principal- Investment Strategy, ICICI Prudential AMC says, “The journey of ICICI Prudential Sensex ETF is a story of the growth of the Indian equity market over the past two decades. We are pleased that investors who remained invested had a pleasant investment experience.”

Over the past few years, the fund house has launched a variety of offerings encompassing both strategic and tactical investment products spanning across market capitalizations, sectors, asset classes and smart beta offerings. Today, with 29 ETF schemes catering to the various investment needs of an investor. Across various product categories, several of the ICICI Prudential ETF offerings have a relatively lower tracking error and expense ratios.

Haria further added, “Over the past few years, with the rise in the number of demat accounts and market participants, the interest in ETFs have significantly improved, especially, when it comes to taking exposure to benchmark indices. This has been the result of improving investor awareness among the masses and increasing comfort around including passive strategies as a part of one’s portfolio. We believe this trend will continue in the times ahead.”

A lump sum investment of Rs. 1 lakh at the time of inception (January 10, 2003), as of December 31, 2023, would be approximately worth Rs. 26.4 lakhs i.e. a CAGR of 16.9%. In the same timeframe, the benchmark S&P BSE SENSEX TRI delivered a CAGR of 17.4%. Given that ETFs replicate the underlying index, the difference between the benchmark index returns and the scheme return is attributed to tracking error.