Highlights:

- The offering provides investors with an opportunity to gain exposure to the metal sector which is diverse and dynamic in nature

- The ETF will invest in a range of companies involved in both ferrous and non-ferrous metals, reflecting the behaviour and performance of the companies forming a part of the metal sector

- The NFO period is from August 1, 2024, to August 12, 2024

ICICI Prudential Mutual Fund has announced the launch of the ICICI Prudential Nifty Metal ETF. The offering aims to provide returns before expenses that correspond to the returns provided by the Nifty Metal Index, subject to tracking errors. The Nifty Metal Index includes companies from the metal sector, including both ferrous and non-ferrous metals.

The Nifty Metal Index is designed to reflect the behaviour and performance of the Metals sector (including mining). The Nifty Metal Index comprises of maximum 15 stocks that are listed on the National Stock Exchange. These companies are selected from the Nifty 500 based on their market value, ensuring a broad representation of the sector. The index composition ensures that no single company has more than 33% weight, and the top three companies cumulatively do not exceed 62% of the index.

Speaking on the launch of the product, Chintan Haria, Principal - Investment Strategy at ICICI Prudential AMC, said, “ICICI Prudential Nifty Metal ETF is designed to provide investors with access to one of the critical sector that forms the backbone of industrial growth. The metal sector, encompassing crucial industries like steel, aluminium, and copper, is integral to infrastructure and economic development. With increasing demand and consumption, especially in a rapidly growing economy like India, this sector presents a compelling long-term investment opportunity. Our Metal ETF aims to allow investors to benefit from the uptick in metals due to expected higher global inflation amidst lower interest rates."

Why invest in ICICI Prudential Nifty Metal ETF?

The Nifty Metal TRI has outperformed the Nifty 500 TRI five times in the last decade, demonstrating its potential for delivering good returns. Investing in the ICICI Prudential Nifty Metal ETF provides:

- Exposure to a key sector essential for economic growth.

- Access to well-established companies experiencing renewed global interest.

- A relatively low valuation compared to broader market indices, coupled with increasing demand and consumption.

- A convenient entry with a minimum investment of just one unit.

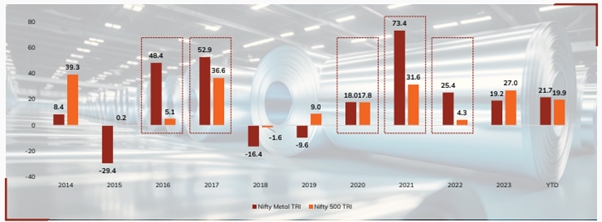

Performance of the Index: Calendar Year Returns (%)

Nifty Metal TRI has Outperformed the Nifty 500 TRI five times in the last 10 years.

Data as on June 28, 2024. Data Source: Nifty Indices https://www.niftyindices.com/indices/equity/sectoral-indices/nifty-metal , MFI Explorer. MFI Explorer is a tool provided by ICRA Online Ltd. MFI Explorer is a tool provided by ICRA Online Ltd. For their standard disclaimer please visit h ttp://www.icraonline.com/ legal/standard-disclaimer.html. Performance of the index does not signify the returns of the scheme. Past performance may or may not be sustainable in the future.

Data as on July 23, 2024. Data Source : Nifty Indices https://www.niftyindices.com/indices/equity/sectoral-indices/nifty-metal . MFI Explorer. MFI Explorer is a tool provided by ICRA Online Ltd. MFI Explorer is a tool provided by ICRA Online Ltd. For their standard disclaimer please visit http://www.icraonline.com/legal/standard-disclaimer.html. CAGR stands for The compound annual growth rate (CAGR) is the rate of return (RoR) that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each period of the investment’s life span. Returns rebased to Rs. 100 as of 12th July 2013. Performance of the index does not signify the returns of the scheme. Past performance may or may not be sustained in the future.

Index Portfolio Snapshot:

Top 10 constituents by weightage | Weightage (%) |

Tata Steel Ltd. | 20.97 |

Hindalco Industries Ltd. | 14.82 |

JSW Steel Ltd. | 12.99 |

Adani Enterprises Ltd. | 12.18 |

Vedanta Ltd. | 9.38 |

Jindal Steel & Power Ltd. | 5.61 |

NMDC Ltd. | 4.11 |

APL Apollo Tubes Ltd. | 4.04 |

Jindal Stainless Ltd. | 3.86 |

Steel Authority of India Ltd. | 3.14 |

Source: Nifty Metal Factsheet. As of June 28, 2024. https://www.niftyindices.com/Factsheet/ind_nifty_metal.pdf. The sector(s)/stock(s) mentioned in this document do not constitute any recommendation of the same and ICICI Prudential Mutual Fund may or may not have any future positions in the sector(s)/stock(s).

The Nifty Metal Index is updated twice a year to reflect the sector's performance accurately and has outperformed broader market indices since inception, as shown in above graph, demonstrating its potential for delivering good returns.

The minimum application amount during the NFO is Rs. 1000 (plus in multiple of Re. 1).

This ETF's benchmark is the Nifty Metal TRI, and Mr. Nishit Patel and Ms. Priya Sridhar are the fund managers of the ETF.

For more information, please contact:

Adil Bakhshi

Principal PR & Corporate Communication

Email: adil_bakhshi@icicipruamc.com

Phone: 91-22-66470274

Riskometer & Disclaimers:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Disclaimer: All figures and other data given in this document are dated as of June 30, 2024 unless stated otherwise. The same may or may not be relevant at a future date. The information shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Prudential Asset Management Company Limited (the AMC). Prospective investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of ICICI Prudential Mutual Fund.

Disclaimer: In the preparation of the material contained in this document, the AMC has used information that is publicly available, including information developed in-house. Some of the material(s) used in the document may have been obtained from members/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. We have included statements / opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. ICICI Prudential Asset Management Company Limited (including its affiliates), the Mutual Fund, The Trust and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. Further, the information contained herein should not be construed as forecast or promise. The recipient alone shall be fully responsible/are liable for any decision taken on this material.

Disclaimer by the National Stock Exchange of India Limited : The Product(s) are not sponsored, endorsed, sold or promoted by NSE Indices Limited (" NSE Indices"). NSE Indices does not make any representation or warranty, express or implied, to the owners of the Product(s) or any member of the public regarding the advisability of investing in securities generally or in the Product(s) particularly or the ability of the Nifty Metal Index to track general stock market performance in India. The relationship of NSE Indices to the Issuer is only in respect of the licensing of certain trademarks and trade names of its Index which is determined, composed and calculated by NSE Indices without regard to the Issuer or the Product(s). NSE Indices does not have any obligation to take the needs of the Issuer or the owners of the Product(s) into consideration in determining, composing or calculating the Nifty Metal Index. NSE Indices is not responsible for or has participated in the determination of the timing of, prices at, or quantities of the Product(s) to be issued or in the determination or calculation of the equation by which the Product(s) is to be converted into cash. NSE Indices has no obligation or liability in connection with the administration, marketing or trading of the Product(s).

NSE Indices do not guarantee the accuracy and/or the completeness of the Nifty Metal Index or any data included therein and they shall have no liability for any errors, omissions, or interruptions therein. NSE Indices does not make any warranty, express or implied, as to results to be obtained by the Issuer, owners of the product(s), or any other person or entity from the use of the Nifty Metal Index or any data included therein. NSE Indices makes no express or implied warranties, and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the index or any data included therein. Without limiting any of the foregoing, NSE Indices expressly disclaim any and all liability for any damages or losses arising out of or related to the Products, including any and all direct, special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.

Any application by investors, other than Market Makers, must be for an amount exceeding INR 25 crores. However, the aforementioned threshold of INR 25 crores shall not apply to investors falling under the following categories (until such time as may be specified by SEBI/AMFI):

- Schemes managed by Employee Provident Fund Organization, India;

- Recognized Provident Funds, approved Gratuity funds and approved superannuation funds under Income Tax Act, 1961.

Disclaimer of BSE Limited: It is to be distinctly understood that the permission given by BSE Limited should now in any way be deemed or construed that the SID has been cleared or approved by BSE Limited nor does it certify the correctness or completeness of any of the contents of the SID. The investors are advised to refer to the SID for the full text of the disclaimer clause of the BSE Limited.

Disclaimer of National Stock Exchange of India Limited: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the 'Disclaimer Clause of NSE“

ICICI ETF is part of ICICI Prudential Mutual Fund and is used for exchange traded funds managed by ICICI Prudential Asset Management Company Limited.