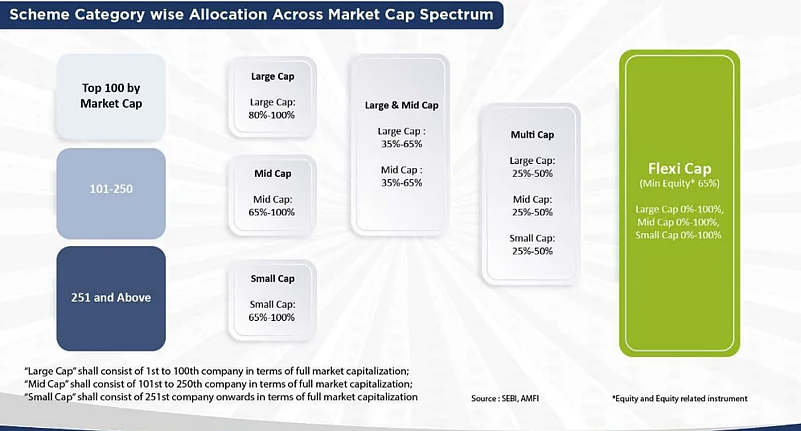

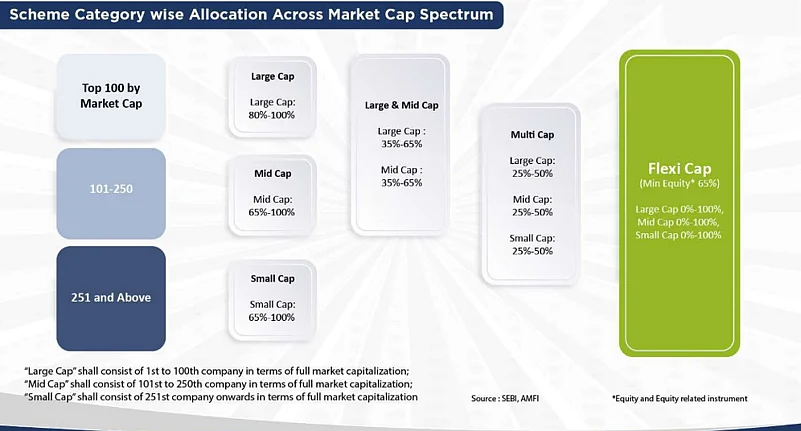

WhiteOak Capital Mutual Fund has launched its first equity new fund offer (NFO), named ‘Whiteoak Capital Flexi Cap Fund’. It is an open-ended dynamic equity scheme that invests across large-, mid-, and small-cap stocks.

The NFO opens on July 12 and closes on July 26, WhiteOak Capital MF announced at a press conference.

The NFO will have a balanced portfolio of both cyclical and counter-cyclical sectors, with the goal of outperforming market cycles. The minimum investment required is Rs 500, and subsequent investments are in multiples of Re 1. The exit load of 1 percent on the net asset value (NAV) is only applicable if the units are redeemed within one month from the date of allotment. Thereafter, the exit load is nil.

According to the asset management company (AMC), the scheme’s primary goal is to create long-term wealth for investors by investing across the market capitalisation spectrum.

“The fund’s goal is to build an active, well-diversified portfolio of companies from major industries, economic sectors, and market cap segments. Further, no market-cap bias along with style and sector-agnostic approach, diversification will help to mitigate concentration risks,” the AMC announced in a press statement.

Ramesh Mantri, CIO, WhiteOak Capital Mutual Fund said, “For the WhiteOak Capital Flexi Cap Fund, sector exposures will reflect our robust and rigorous bottom-up stock selection process. We will consciously seek to maintain a balanced portfolio reflecting our team’s stock selection capabilities rather than being driven by non-stock specific macro factors, such as market timing, sector, currency or other such factor exposures.”

The release further said that WhiteOak Capital MF has a strong performance-first culture, founded on a simple stock selection-based approach and robust risk management. The team also employs a proprietary, cash flow based ‘Opco-Finco’ analytical and valuation framework which provides unique insights in contrast to accounting earnings-based models.

Aashish Somaiyaa, CEO, WhiteOak Capital Mutual Fund, said: “WhiteOak Capital Mutual Fund intends to fill a vacuum of actively managed funds in India. Our company has instituted a performance-first culture, earning the confidence of investors in India as well as overseas. India continues to be among the most favourable investment destinations in the world, with a high alpha potential embedded on the canvas of a high growth economy. We believe there is a huge scope of differentiation in the industry, and we will leave no stone unturned to provide best-in-class investment products to retail investors.”