Money matters. Or does it really? Outlook Money brings to you this series through which we explored the under 35's take on money matters. Every generation has its share of distinct events that later gets recounted. Those from the early 1990s India had consumer durables as their object of desire. By the end of that decade and turn of the millennium, fancy cars had taken that place. Gen Z has grown up in a time of rapid change, giving them a set of priorities and expectations sharply different from previous generations. Demographically speaking, those under 25 comprise 50 million of India’s population. This is more than that of the total population of Brazil, Russia, Germany and Canada combined. Being personal finance specialists, it was only natural that we at Outlook Money got curious to investigate what Gen Z thinks about money.

Contrary to popular notion, today’s youth are money-savvy

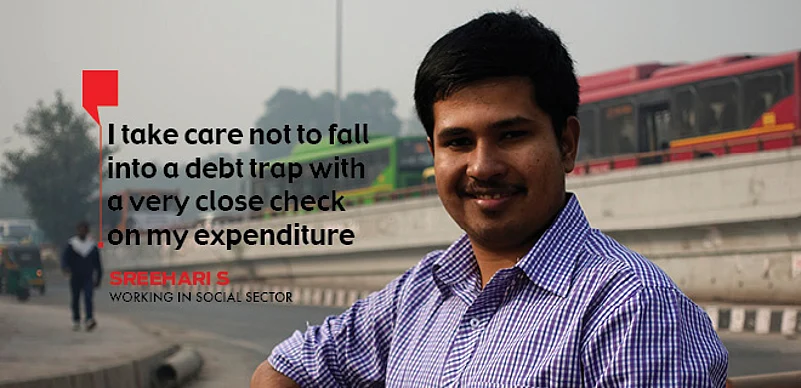

After completing a course in Engineering, he went on to fulfill his passion of working with the social sector and pursued an MBA from Institute of Rural Management, Anand (IRMA).

Today, he works for a social enterprise that is dedicated to poverty alleviation through rural entrepreneurship. “The idea is to create village-level entrepreneurs and sell socially relevant products through them. Products include solar lights, sewing machines, basic mobiles, smokeless chulas, induction cook-tops, sanitary napkins, health supplements and so on,” says Sreehari.

Sreehari has no dependents and is the only child to his parents, both of whom have retired from government service. He has no burden to send money home; however, he is intent to pay off his student loan as early as possible and pays more than what his EMI demands every month. He is planning to go for higher studies abroad and is preparing to take a huge loan for the same. Sreehari is yet to buy a house for him or for that matter, even a vehicle. He tries to save at least 10 per cent of his salary every month and takes no less than 2 long trips yearly. He had gone to Bhutan with his friends last year in March and did a pan-south India trip in October with his family, for which he paid.

He saves using a recurring deposit account and says that he does not want to lock in his money for 3 years even through investments like SIP or FP as he plans on studying further. He aims to pursue his dream of studying abroad within the next two years. When asked about what funda does he lives his financial life by, he says, “Plan for the future, but not at the cost of the present”. He adds that he takes care to not fall into any debt, even on his credit card.