Oil and Natural Gas Corporation (ONGC) recently announced a 135 per cent dividend of Rs 6.75 per share. Vedanta (VEDL) will consider paying a third interim dividend on November 22.

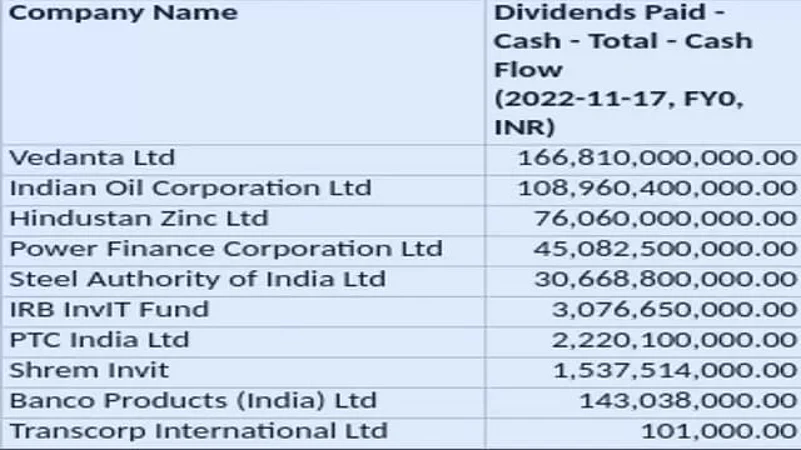

According to data from Refinitiv, a London Stock Exchange Group (LSEG) business which provides financial markets data and infrastructure globally, Vedanta (VEDL) is the highest dividend-paying Indian company thus far in 2022.

VEDL paid Rs 16,681 core as dividends till November 2022. Indian Oil Corporation (IOC) paid Rs 10,896 crore as dividends till November 2022 and holds the number two position in the list of top-10 dividend-paying companies.

What Is Dividend Yield And How Is Net Yield Calculated?

Dividend yield is the dividend percentage which a shareholder of a company gets from owning shares of the specific company. Suppose, a shareholder owns shares worth face value of Rs 10 lakh in a company, and the dividend yield percentage is 9 per cent. So, this shareholder would get Rs 90,000 as dividend.

Also, the face value of a share might not be equal to the market value of the share, due to various factors. For example: the face value of a Vedanta share is Re. 1, the market value is Rs 307.85 (November 21, 2022 on the Bombay Stock Exchange) and the book value is Rs 146.13.

Venil Shah, senior equity analyst, portfolio management service (PMS), Prabhudas Lilladher, a Mumbai-based stock broker, says that the dividend yield can be calculated by dividing the dividend per share by the current stock price.

“When a company declares a dividend of say 60 per cent, it means 60 per cent of face value of the stock, and not the current market price. The face value can be derived by dividing the equity share capital by the number of shares outstanding,” adds Shah.

For better understanding, let’s look at the dividend yield formula. It is calculated as the dividend in Rs per share divided by the current market price

For example: according to data from the BSE, Vedanta has so far, till November 2022, paid dividends in various quarters- Rs 13 (March), Rs 31.5 (April), Rs 19.5 (July). On a yearly basis Vedanta’s share price had corrected by 6.3 per cent and was Rs 328.35 on November 22, 2021. The current share price of Vedanta is Rs 307.85

So, the net effective dividend yield of Vedanta in 2022, till November 1, 2022 is Rs 13+31.5+19.5/Rs 307.85= 20.78 per cent. Now as per change in dividend payout amount and the current market price of Vedanta, the dividend yield percentage will vary.

Things To Note When Companies Declare Dividend

Dividend is always declared on the face value of a share, and not on the market value. One can calculate the net yield of the dividend paid by dividing the dividend with the market price.

When companies pay cash dividends, they decrease the equivalent amount of dividend from their liquid cash reserves, which in turn, reduces the book value of the share. Subsequently, the market value of the stock will also be corrected by the amount of dividend paid.

Dividends are taxed at slab rates for individuals, and the TDS is also applicable on dividend payments above Rs 5,000.