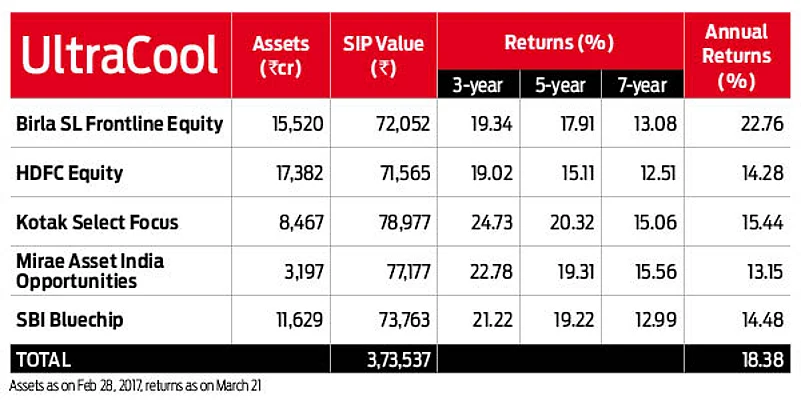

Investors with over five year investment time frame expect growth, and are fine with some risk, as long as the risk can be absolved over the long run. The funds selected here ensure all these aspects are met and their performance has been tested over several years including different market cycles, making them well placed to handle any change in stock market conditions. The sizeable assets managed by each of the funds here stands testimony to its ability and investor confidence in them, which you too should take a cue from when investing.

Birla SL Frontline Equity

In its 15-year history, the fund has demonstrated consistent performance which is due to a steady fund management team. The fund scores high on its ability to contain falls during the downmarket phases of the stock markets. Moreover, the buy and hold strategy with its core holdings has paid off over the years.

HDFC Equity

This fund has seen it all in its more than two decade history, which has resulted in it being one of the biggest funds by assets managed. The fund predominantly follows a long-term approach, has a good record of delivering healthy returns over different market cycles and skilfully manages stock market volatility.

Kotak Select Focus

This fund has created a fan following for itself. Its investment principal that focuses on select sectors before diversifying investments across stocks has played well. The flexibility to invest across market capitalisation with exposure to small and mid-cap stocks, which is mostly maintained at 30 per cent, has worked well, as indicated in its superior performance.

Mirae Asset India Opportunities

This nearly ten year old fund has been a consistent performer. From the beginning, this fund’s investment strategy has focused on selecting quality businesses that meet high return on capital. The fund’s performance in times of market falls has really not been tested, which is the only concern that one should have with it.

SBI Bluechip

For over a decade this fund has managed to fare well and find its footing with investments in the 100 companies by market capitalisation. A very clearly defined investment approach has resulted in its superior performance when the markets rise and fall, making it an all weather investment.