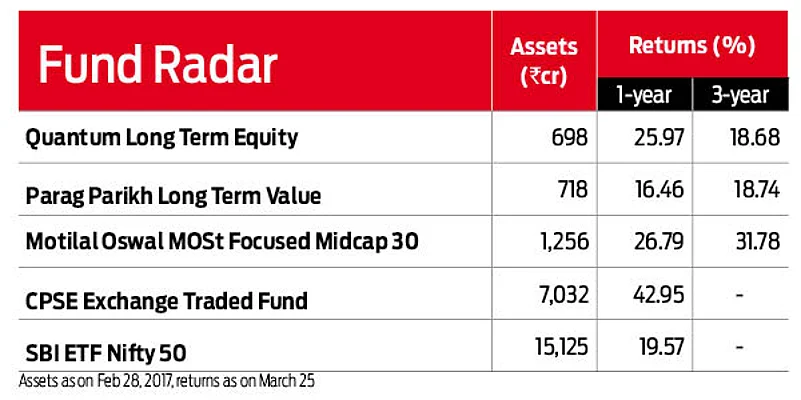

There are many mutual funds that have something interesting about them, either by way of their investment objective or just because of their performance. This is not exactly a category, but the performance of some select funds because of their unique traits. One could invest in them, if they like the idea or the philosophy.

Quantum Long Term Equity

Much before direct plans came into existence, Quantum AMC started offering funds only through the direct route. The experiment paid off because the AMC managed to keep the fund’s expense ratio to the minimum. This fund has consistently done well since its launch in 2006.

Parag Parikh Long Term Value

Value investing is something that this fund house espouses. Here is a fund, which is meant for investors who are looking to invest for more than five years. It is also unique, for it invests in both Indian and foreign companies. Alphabet Inc, parent of Google, makes for a chunk of its holdings.

Motilal Oswal MOSt Focused Midcap 30

This fund invests in emerging wealth creators by investing in a maximum of 30 mid cap companies having long-term competitive advantages and potential for growth. It further follows a buy and hold strategy in quality companies with growth prospects, longevity and at a reasonable price.

CPSE Exchange Traded Fund

The scheme seeks to provide returns that, before expenses, closely correspond to the total returns of the securities as represented by the CPSE Index. Basically it invests in 10 PSUs - ONGC, Coal India, Indian Oil, GAIL, REC, PFC, Container Corp, Bharat Electronics, Oil India and Engineers India.

SBI ETF Nifty 50

The investment objective of the scheme is to provide returns that closely correspond to the total returns of the securities as represented by the underlying index, subject to tracking error. That the EPFO’s investments are in this fund, only adds to its lustre and rising assets.