Hurdles seem to keep on increasing for crypto exchanges in India. Most recently, e-wallet provider Mobikwik seems to have disabled its services in India for crypto exchanges since April 1, four senior executives from different crypto exchanges told Outlook Money, on the condition of anonymity.

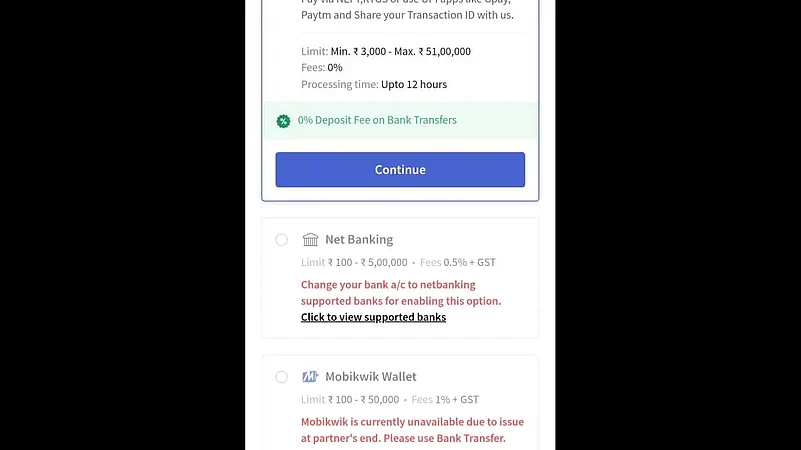

The MobiKwik option continues to appear on some crypto exchange apps, but the services are not functioning.

When contacted over WhatsApp, the company representative said the founders were not available for comments.

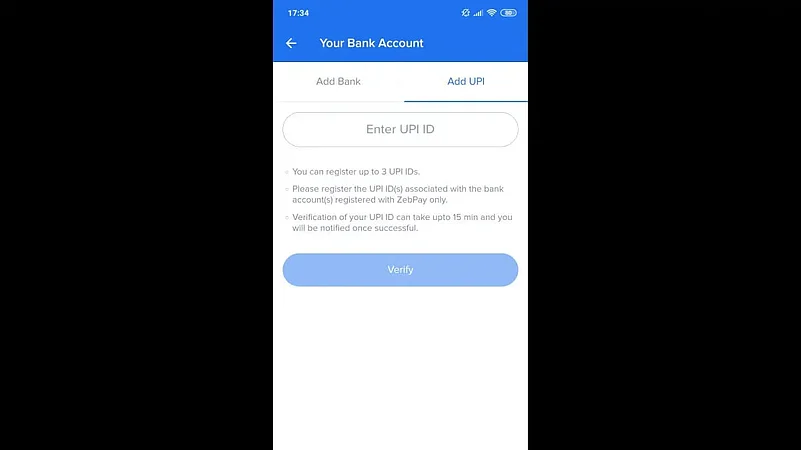

MobiKwik’s withdrawal follows a statement published by Unified Payments Interface (UPI) parent, the National Payments Corporation of India (NPCI). On April 7, NPCI put out a statement saying they were not aware of any virtual digital asset exchange using UPI for transactions. “With reference to some recent media reports around the purchase of cryptocurrencies using UPI, National Payments Corporation of India would like to clarify that we are not aware of any crypto exchange using UPI,” the statement read.

MobiKwik e-wallet was one of the ways that investors could use to transfer money to a crypto exchange. The other major options were via Unified Payments Interface (UPI), Netbanking or bank transfer. At least six major crypto exchanges in India were offering the MobiKwik e-wallet option.

NPCI’s statement came after the US-based crypto exchange Coinbase launched its services in India on April 7. During the launch, it was announced that the crypto exchange, which is one of the largest in the world, would use UPI to enable rupee deposits on the platform. Coinbase co-founder and chief executive Brian Armstrong said, “We know it’s not going to be a straight shot to bring this technology (blockchain; in the region). We don’t know exactly how it’s going to evolve but we’re committed to working with bank partners, regulators, most importantly, the Indian people because they showed a real spark of interest in cryptocurrency and there’s a real desire to get access to some of these services and products… India has shown a great willingness with UPI.”

When Outlook Money contacted NPCI for its comments, the spokesperson said, “Whatever we have said in our statement is what we have to say. But maybe when we get more clarity on this, we will be able to say something (further).”

The crypto exchanges have been left in a lurch with two of the transaction options for investors suddenly not available. As of now, both the UPI and MobiKwik options continue to appear on some crypto exchange apps, but the services are not functioning.

Responding to the situation, the CEO of a crypto exchange, on the condition of anonymity, said, “I don't know what NPCI’s intention is behind this. I also don’t want any interruption in services.”

In reply to NPCI’s public statement, on April 9, Coinbase stated: “We are aware of the recent statement published by NPCI regarding the use of UPI by cryptocurrency exchanges. We are committed to working with NPCI and other relevant authorities to ensure we are aligned with local expectations and industry norms.” The company further noted, “India has a rich tradition of innovation and the burgeoning crypto ecosystem and adoption of the technology is a great example of this. As we enter the Indian market, we are actively experimenting with a number of payment methods and partners to enable our customers to seamlessly make their crypto purchases.”

What Is The Legal Position?

Purushottam Anand, an advocate and founder of Crypto Legal, a crypto law firm, says, “We should be clear that the NPCI has not taken an official decision to disallow crypto exchanges from using the UPI infrastructure. Its statement that it is ‘not aware’ of this phenomenon can, at best, be interpreted as a withholding gesture.” The existing systems (such as MobiKwik) have no legal reason to discontinue services on the basis of this (NPCI’s) statement, he adds.

The Payment and Settlement Systems Act, 2007 states that the designated authority for regulation and supervision of payment systems is the Reserve Bank of India (RBI). “Which means that the Supreme Court’s 2020 judgment striking down its (cryptocurrencies) ban is still the law of the land. Since blockchain services are presently not illegal in India, it is necessary that the RBI and NPCI further clarify their explicit stance on this issue,” Anand adds.