It’s been four days since the Life Insurance Corporation (LIC) of India came out with its initial public offering (IPO).

It opened for subscription on May 4, and by the afternoon of May 7, it was fully subscribed by retail investors as well as non-institutional buyers. The issue continues to see strong interest from all investor categories.

The price band for the share sale has been fixed at Rs 902-949 per share. Retail investors and LIC employees have been offered a discount of Rs 45 per share, while policyholders got a discount of Rs 60 per share.

Who Has Subscribed To The IPO?

The LIC IPO is entirely through an offer-for-sale (OFS) of up to 221,374,920 equity shares of face value of Rs 10 each. This means that the entire proceeds of the share sale will go towards the seller (government), and not LIC. The government aims to generate about Rs 21,000 crore by diluting its 3.5 per cent stake in LIC.

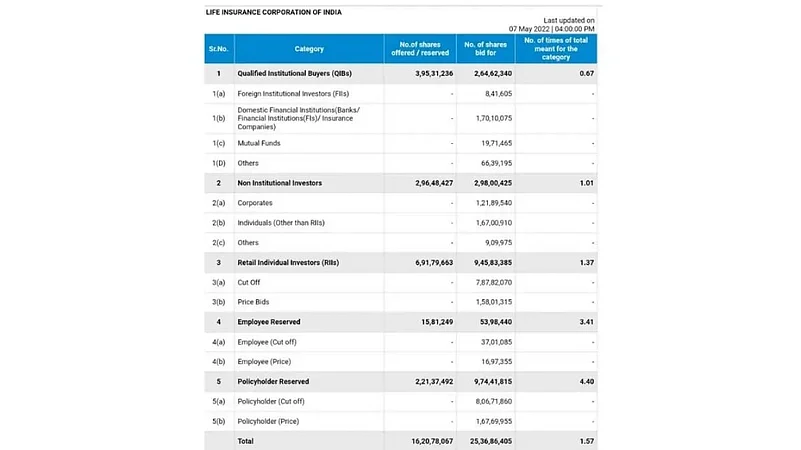

The portion reserved for eligible policyholders was subscribed by 4.40 times. The number of shares reserved for policyholders was 22,137,492 (22.1 million), and bids were received for 97,441,815 (97.4 million) shares.

The portion reserved for eligible employees was subscribed 3.41 times. The number of shares reserved for policyholders was 1,581,249 (1.581 million) and bids were received for 5,398,440 (5.398 million) shares.

The portion reserved for retail individual investors was subscribed 1.37 times. The number of shares reserved was 69,179,663 (69.1 million) and bids were received for 94,583,385 (94.5 million) shares.

The portion reserved for non-institutional buyers was subscribed 1.01 times. The number of shares reserved was 29,648,427 (29.6 million) and bids were received for 29,800,425 (29.8 million) shares.

The portion reserved for qualified institutional buyers was subscribed 0.67 times. The number of shares reserved was 39,531,236 (39.5 million) and bids were received for 26,462,340 (26.4 million) shares.

Check the table below for a better visual representation of the shares reserved and shared bid for in the respective category:

Table1

Data at May 7, 4:00 pm

How Many Total Bids Were Received?

The offer received bids for 223,698,915 (223.6 million) shares against the offered 162,078,067 (162 million) equity shares (excluding shares offered to anchor investors), as per the 7:00 pm data available on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) on May 6. This means that the issue has been oversubscribed by 1.38 times.