The India Post Payments Bank (IPPB), which comes under the Department of Post, has slashed the interest rates on all its savings accounts by 25 basis points.

It announced this in an official notification that the new rates will be effective from June 1, 2022.

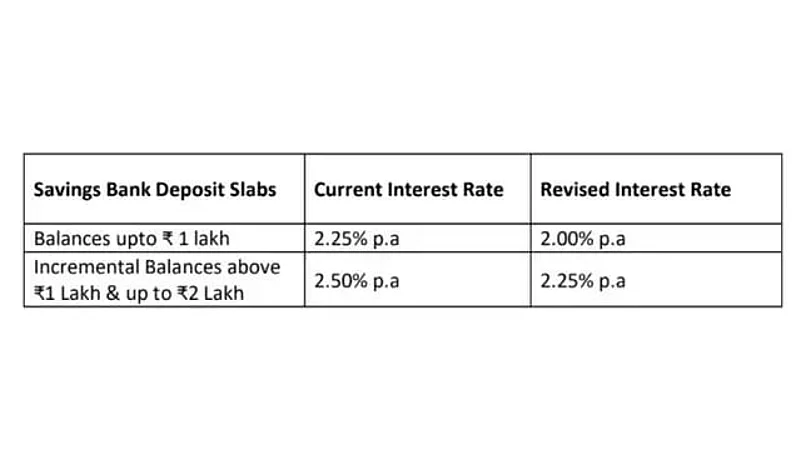

“This is to inform all the concerned that India Post Payments Bank has revised its interest rate on all the customer variants of Savings Accounts as per the Asset Liability Committee approved policy effective from 01st June 2022 as per below table.”

According to the notification, for balances up to Rs 1 lakh, the revised interest rate will be 2 per cent per annum. Previously, this was 2.25 per cent per annum. For incremental balances above Rs 1 lakh and up to Rs 2 lakh, the revised rate will be 2.25 per cent, down from 2.50 per cent per annum.

The notification further said that the interest will be paid to the customers quarterly, and it will be using the daily end of the day (EOD) balance.

Post Office Savings Accounts are among the most popular and accessible savings accounts in India. One can open an account by making a deposit of just Rs 500. The prevailing rate of interest offered to depositors is 4 per cent per annum.

The account can be opened by a single adult, two adults, a guardian on behalf of a minor, a guardian on behalf of person of unsound mind, and a minor above 10 years in his own name.

That said, there are certain exceptions. Only one account can be opened by an individual as a single account. Only one account can be opened in the name of minor or for one above 10 years of age (self), or for a person of unsound mind. In case of death of a joint holder, the surviving holder will be the sole holder, and if the surviving holder already has a single account in his/her name, the joint account will have to be closed. Lastly, conversion of a single account to joint account or vice versa is not allowed.

Post office savings accounts also offer additional facilities of cheque book, ATM Card, e-banking/mobile banking, Aadhaar Seeding, Atal Pension Yojana (APY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), and Pradhan Mantri Jeevan Jeevan Jyoti Bima Yojana (PMJJBY) to the depositors.