Around 49 per cent of India’s senior citizens have not fully used their 80C limit, and only about 7 per cent exhausted their 80D ceiling provided under the Income Tax Act of 1961 for Income Tax Returns (ITR) this year, reveals a survey by Clear (formerly ClearTax), an e-filing ITR services company.

Here we explore how the Act defines a senior citizen and what benefits it offers them.

Who Is A Senior Citizen Under The Income Tax Act?

Under the Act, a senior citizen is someone who has completed 60 years but less than 80, while a super senior citizen is someone who crossed 80 years of age.

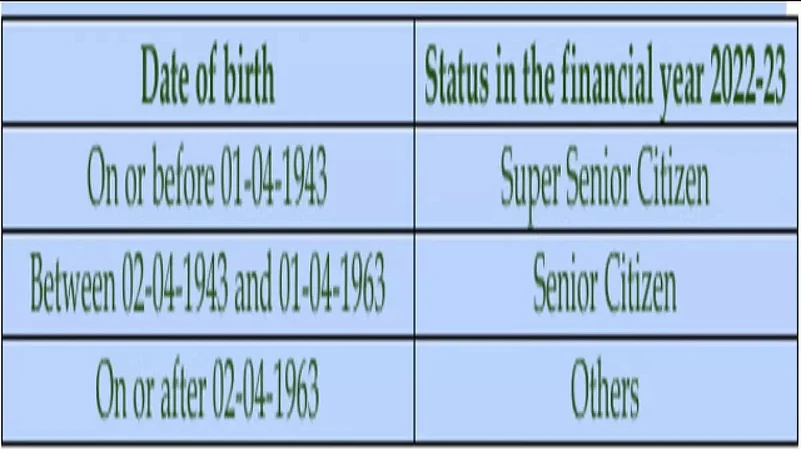

The following table shows the status of senior or super senior citizens according to their date of birth.

Tax deductions and other benefits for senior citizens:

Deductions Under Section 80DDB

Naveen Wadhwa, deputy general manager (DGM) of Taxmann, a Delhi-based book publishing company, said the Income Tax Act provides an enhanced deduction limit for certain medical treatments for self, dependent relatives, or dependent senior citizens.

Under Section 80DDB, a deduction for expenses incurred for such medical treatment is allowed.

The maximum deduction amount for self and dependent relatives is Rs 40,000; for dependent senior citizens, the total amount is Rs 1,00,000.

Deductions Under Section 80D

Divya Baweja, a partner at Deloitte India, said senior citizens could take 80D benefits of the Income Tax Act for medical expenses and health insurance premiums.

The deduction limit for individuals other than senior citizens is Rs 25,000, including Rs 5,000 for a preventive health checkup. For senior citizens, it is Rs 50,000 for medical insurance premiums.

Also, if the persons are senior citizens and their parents are also senior citizens or super senior citizens, Rs 50,000 for themselves and Rs 50,000 for parents can be claimed towards premiums.

But if the person does not have medical insurance but is incurring medical expenses, Section 80D offers a deduction of up to Rs 50,000.

According to Ajay Chandiramani, a finance professional and senior guide of GetSetUp, a platform for older adults to learn and share new skills, this specific deduction (Rs 50,000) provided for medical expenses of a senior citizen is exclusive to them, meaning “this benefit is not available in respect of a non-senior citizen. Also, total deduction under section 80D cannot exceed Rs 1,00,000.”

Section 80DDB offers a deduction for medical expenses of a specified disease, subject to certain conditions. The payments must be incurred for the treatment of self, dependent spouse, children, parents, and brothers and sisters.

Baweja pointed out that the deduction is limited to a maximum of Rs 1,00,000 for senior citizens and a maximum of Rs 40,000 if incurred for a non-senior person.

Deductions Under Section 80 TTB

Section 80 TTB allows a deduction of interest income earned from a bank, post office, and cooperative banks by senior citizens. It offers a deduction of up to Rs 50,000 during a financial year for savings and time deposits like recurring and fixed deposits.

Baweja added that non-senior citizens could get a deduction under 80 TTB “only for interest in a savings account” up to Rs 10,000 in a financial year.

Other Tax Benefits For Senior Citizens

Advance Tax Payment is not required if there is no business or professional income.

Every citizen whose income tax liability for the year is Rs 10,000 or more is liable to pay advance tax. But senior citizens are not required to pay advance tax if they have no income under the head profits and gains from business or profession (PGBP).

Higher Limit of TDS On Interest Payment From Bank/Post-Office

Section 194A of the Income Tax Act gives a higher limit on TDS deduction from interest paid by a bank or post office, including cooperative banks. For senior citizens, the limit is Rs 50,000, and for others, it is Rs 40,000. Payment of interest beyond this limit is subject to TDS deduction.

E-filling of ITR In Paper Mode For Super Senior Citizens

Super senior citizens (age 80 or above) can file their ITR in paper mode, besides the online facility. They can file through ITR 1 (Sahaj) and ITR 4 (Sugam) in paper mode.

ITR Return Filing Exemption For Specified Senior Citizens

According to Section 194P of the Act, a senior citizen whose age is 75 years or more in the previous year, he will get an exemption when he files ITR, subject to certain conditions, which include submitting a specific form and having only a pension and interest income, receiving in the same bank.

“His pension income and interest income should be received in the same bank, and such senior citizens furnish a declaration to the bank in Form No. 12BBA. If all the above conditions are satisfied, the bank shall be liable to deduct tax under Section 194P as per the slab rate applicable,” Wadhwa added.

Higher Tax Slab Exemption Limit

For ordinary individual taxpayers, it is Rs 2,50,000. Senior citizens, however, get a higher exemption of Rs 3,00,000, and in the case of super senior citizens, the exemption is Rs 5,00,000.