Indian citizens who pay income tax will not be eligible to join the Atal Pension Yojana (APY) from October 1, 2022. In addition, if any person who is a taxpayer or has been a taxpayer, opens an APY account post October 1, it will be closed, and the balance will be refunded.

Adhil Shetty, CEO of Bankbazaar.com, a financial services provider, says taxpayers can enroll for APY by the cut-off date of September 30, but accounts opened on October 1 or later shall be closed, and the balance amount, if any, would be returned.

The government’s APY annuity scheme is targeted at the unorganised sector or those who don’t fall in the taxable bracket and need a guaranteed pension. However, Shetty added that the National Pension Scheme (NPS) would be a better option for those in the taxable bracket.

So, if you are eligible for the APY scheme, the following is the step-by-step guideline to open an APY account online.

What Is APY and How To Open An E-APY Account?

APY is a monthly pension scheme guaranteed by the government of India. You can choose the pension amount between Rs 1,000 and Rs 5000 after 60 years of age. Also, you can open an APY account between 18 and 40 years of age.

One can open an APY account in two ways; through a bank branch, a post office, or the National Securities Depository Limited (NSDL) website.

You must find the banks through which you can open an APY account. According to the NSDL’s E-NPS APY registration website, 18 banks presently support APY account opening, including Canara Bank, ICICI Bank, RBL Bank, Indian Bank, City Union Bank, etc. Do check the full list on the NSDL website.

Here’s a step-by-step guide for APY account opening online.

Step 1 : Go here - https://enps.nsdl.com/eNPS/ApySubRegistration.html

Step 2: Fill out the details like bank account number, email ID, Aadhaar number and your authentication method—offline Aadhaar KYC (know your customer) mode, online Aadhaar KYC, and virtual ID KYC.

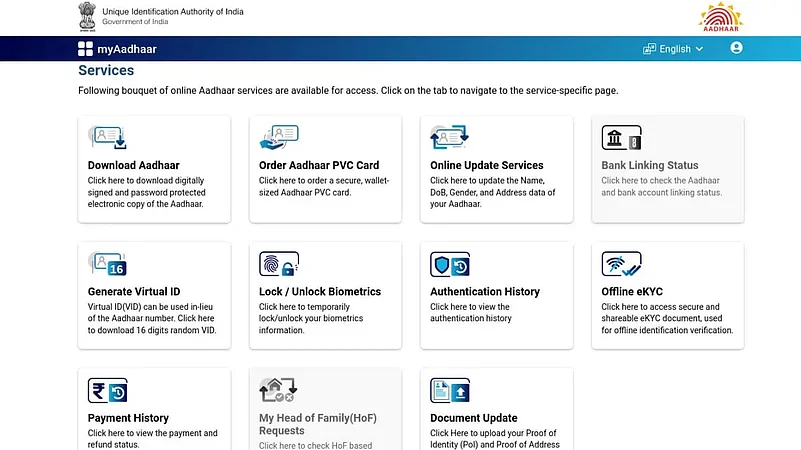

If you choose the offline Aadhaar KYC option, you must upload the Aadhar XML file in the checkbox. The Unique Identification Authority of India (UIDAI) has a dedicated website for all Aadhaar services, it can be accessed here-resident.uidai.gov.in. Go here and then, log in with your Aadhaar number and authenticate it using the OTP sent to your mobile number. If you do not have the mobile number linked with your Aadhaar, you must do it first at your nearest Aadhaar enrolment centre.

After log in, navigate to the ‘Offline e-KYC’ button in the second last row and click that. You must enter a four-digit code or the ZIP offline eKYC XML file password. So, remember this code for reference later.

“The details will contain name, address, photo, gender, DoB (date of birth), the hash of registered mobile number and email address and the reference ID, containing the last four digits of Aadhaar number followed by a timestamp in the digitally signed XML,” said UIDAI in a support article.

In the same dashboard, click on the offline eKYC button; there, you will find another button titled ‘Generate Virtual ID’. If you wish to enroll in APY using the virtual ID method, this is required.

Step 3: After you authenticate the details using Aadhaar OTP, a new page will open, asking for your father/mother/guardian’s name and details, desired pension amount, choice of payments (monthly/quarterly/half yearly), etc.

Things to note after registration:

Keep Bank Account Funded

The APY contribution will not be immediately deducted. The bank will verify the details given by you with the bank KYC. If the verification process is successful, a portable permanent retirement account number (PRAN) will be given to you. After that, the money will be debited from your bank account as an initial contribution towards eAPY. So, keep it sufficiently funded.

Note Acknowledgement Number

After you finish the registration process, you will get an email with the subject line– ‘Acknowledgement number for registration under APY’. You must save this email and note your acknowledgement number for future reference.

Download Android App To Track Transactions

You can check five recent contributions towards APY, generate a transaction statement, and download the e-PRAN card for free on the APY Android app—APY and NPS Lite by Protean.