There has been significant improvement in credit awareness among Indian citizens, especially Gen Z consumers and those living in the non-metro areas, says a report by credit information company TransUnion CIBIL.

The report titled “CIBIL for Every Indian” said the number of consumers self-monitoring their credit profile increased by 83 per cent between October 2021 and September 2022.

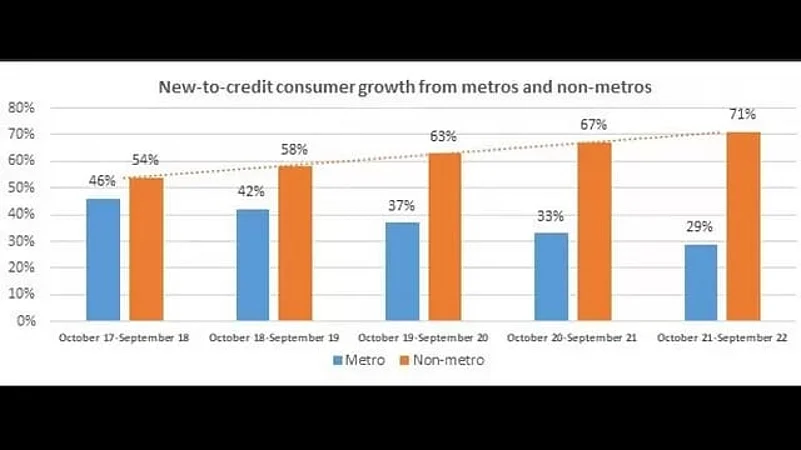

Also, 23.8 million consumers registered for self-monitoring for the first time, of which 71 per cent or 16.8 million were from non-metro locations. The company also said 61.1 million consumers had self-monitored their credit profiles since it started its direct-to-consumer service in 2009.

Data provided by TransUnion CIBIL showed that new self-monitoring consumers rose from 13 million in the October 2022-September 2021 period to 23.8 million between October 2021 and September 2022.

In addition, there has been a nearly three-fold increase in Gen Z consumers (born between 1997 to 2012) monitoring their credit profiles in the October 2021-September 2022 period versus the same period a year ago. It shows more Indians now start credit management at a younger age or understand it better, it noted.

Commenting on the findings, Rajesh Kumar, managing director and CEO of TransUnion CIBIL, said that Indians are beginning to take a more active role in monitoring their credit profile. “Digitization, smartphones, and internet penetration into semi-urban and rural areas have improved access to credit exponentially.”

He said that “the end consumer is the largest beneficiary as they can now access multiple financial opportunities across the financial ecosystem at competitive terms.”

Improved consumer awareness “catalyzes competitive pricing of credit products and services by lenders, access to affordable credit opportunities, and financial inclusion in the economy,” Kumar added.

The report finds that Indians are more credit conscious now, with nearly 47 per cent of consumers having improved their credit profiles within six months of checking their CIBIL scores.

Also, 35 per cent of self-monitoring consumers have opened a new credit line within three months of monitoring, compared to just 6.2 per cent of non-monitoring consumers, the study finds.

Other trends include 46 per cent of self-monitoring consumers applying for a new credit and 36 percent opening a new credit line within three months of checking their score, suggesting a correlation between consumers monitoring credit profiles and intent to purchase, it said.

More consumers are using their scores to avail of lower interest rates, better offers, and even higher credit amounts. Of the new accounts opened, 49 per cent were personal loans, 14 per cent were consumer loans, 9 per cent were gold Loans, and 9 per cent were credit cards, the survey finds.

Non-Metros Sees Strong Credit Growth

The report highlights that 69 per cent of the new self-monitoring consumers with a CIBIL score of over 730 were from the non-metro areas between October 2021 and September 2022.

In addition, most new-to-credit consumers (vintage up to 6 months) came from non-metros over the last four years, comprising more than 76 per cent of the newly registered self-monitoring consumers in the same period.

Non-Metros Also See Higher Women Borrowers

The survey shows that the number of self-monitoring women consumers grew by 88 per cent between October 2021 and September 2022 compared to the previous 12 months. Also, there has been a 2.2-fold increase in self-monitoring women consumers with a CIBIL score of over 730.

Young Indians Are Cautious Borrowers

While Gen Z consumers represented 29 per cent of new self-monitoring consumers between October 2021 and September 2022, millennials (born between 1981 and 1996) represented 83 per cent, or nearly 23.8 million, who began monitoring their credit profiles in the same period compared to the previous year.

Gen Z and millennials comprised 94 per cent of new-to-credit consumers between October 2021 and September 2022, the TransUnion CIBIL survey said. In conclusion, TransUnion highlighted that youth and women consumers from non-metro areas demonstrated increased credit consciousness.