Around this time last year, a comparison between Bitcoin and gold arose, with returns from the former beating those from the yellow metal for a few consecutive years. But this year, gold returns have beaten Bitcoin hands down, according to data from Augmont goldtech pvt ltd.

Among other factors, some experts consider both assets a store of value. Amanjot Malhotra, country head, Bitay, a global fintech company focused on crypto assets, blockchain, artificial intelligence, IoT, etc., said one of the most common reasons to buy both gold and Bitcoin is that they are a store of value during economic uncertainties.

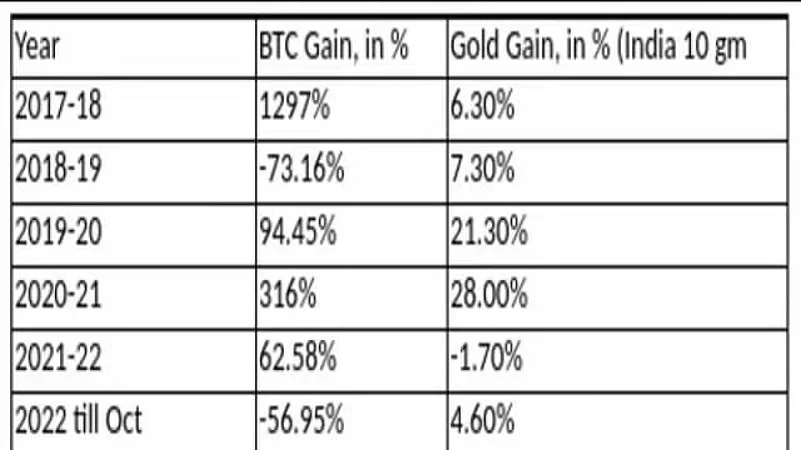

Gold Vs Bitcoin: Overall Returns

While Bitcoin jumped nearly 1,300 per cent in 2017-18, gold saw returns of around 6.3-7.3 per cent. In 2019-20, 2020-21, and 2021-22 too, Bitcoin gained significantly more than gold (see table). However, year to date, Bitcoin fell almost 57 per cent against over 4 per cent positive return by gold.

Gold demand was healthy this festive season. The India Bullion and Jewellers Association (IBJA) estimates that about 39 tonnes of gold, worth Rs 19,500 crore, were sold during the two-day festival.

What Experts Say

Unlike the gold industry, the cryptocurrency market lacks stability. “It (gold) has been there with us for ages; it is among the most liquid forms of assets and investments and has always given positive returns over long periods,” says Aditya Modak, co-founder of Gargi by PN Gadgil & Sons, a jewellery group.

Also, digital assets carry high risk due to volatility, say experts. "Investors have already seen it (Bitcoin) skyrocketing and plunging to record lows in a short time. So, looking at this, conservative investors are inclined towards low-risk traditional assets," says Nidhi Manchanda, certified financial planner, and head of training, research & development at Fintoo.

But Bitcoin supporters believe its fundamentals are positive, although they are disconnected from its current price. "Looking at a few metrics like the Bitcoin network’s hash rate, Bitcoin’s adoption, and the adoption of Lightning Network, it is clear that most fundamentals of Bitcoin are on an upward trajectory," says Mohammed Roshan, CEO and co-founder of GoSats, a Bitcoin rewards app.

They also believe that the crypto winter is short-term. "I do not expect the price to stay deflated in the long term. We mustn't also forget that compared to other assets, the Bitcoin market is nascent and is currently affected by macroeconomic headwinds," says Roshan.

Malhotra says Bitcoin has never taken more than three to four years for its price to regain. “This suggests that in the long term, BTC could be a store of value," he says.

To state one, there is still a lot of uncertainty surrounding Bitcoin and other digital currencies. Regulations are still being developed, and there is much speculation about these currencies’ future. "This uncertainty can lead to price swings as investors try to predict the market’s direction," says Shrikant Bhalerao, cofounder Seracle, a blockchain firm.