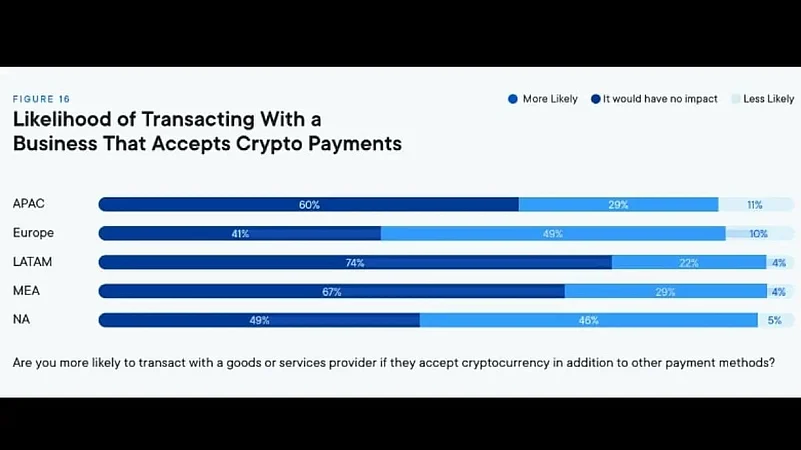

Fifty-six per cent of consumers globally are more likely to transact with a merchant that accepts cryptocurrency, finds an international survey conducted by Ripple.

The report titled ‘New Value Crypto Trends in Business and Beyond-2022 also showed that 33 per cent of consumers surveyed would consider using cryptos for purchases.

Also, 25 per cent of the participants said they would consider sending money to family or friends using the crypto platforms.

“Nearly one-third of respondents say they would consider using crypto to make a domestic or international purchase, and one quarter say they would consider using it to send money to a domestic or international friend or family member,” the report said.

The study covered more than 800 people across 22 countries in Asia Pacific (APAC), Latin America (LATAM), North America, Europe, and the Middle East and Africa (MEA) regions.

The respondents from LATAM, APAC and MEA regions were more positive about blockchain and cryptocurrency use than their peers in North America and Europe.

According to Navin Gupta, Managing Director of South Asia and MENA at Ripple, "With over half of global consumers stating that they are more likely to transact with a merchant that accepts crypto, I expect that we will see more businesses use crypto payments as a way to stand out from the competition. But it’s not just about using crypto to purchase goods or services. Crypto is also making a mark in the cross-border payments space, where transactions are known to be costly, full of friction, and slow."

"Clearly, crypto has real potential to transform the payments landscape as we know it. As consumer acceptance for crypto-enabled payments grows, I am looking forward to seeing the industry expand and mature, bringing about a more dynamic and inclusive global financial system," Gupta further added.

According to Dileep Seinberg, founder and CEO of crypto fintech MuffinPay, “At the current stage, Bitcoin and Ethereum have become a store of value instead of using them as currency for payments. Although BTC and ETH differ from other investment products, these crypto assets are liquid in nature. He however believes cryptos’ payment functions would be widely adopted in the future."

Consumers’ Preference For Cryptos

Convenience and Safety: The respondents said that crypto transactions offer ease, speed, safety that make them a preferred payment choice.

However, the consumers ranked low transaction fees, as in the case of banks, near the bottom of benefits that would motivate them to use cryptocurrency.

It may be because “domestic payments are free or low cost and most payments are domestic as opposed to cross-border,” the report noted.

Punit Agarwal, founder of crypto taxation firm KoinX, believes that cryptocurrencies are yet to enter the mainstream because the future of cryptos itself is uncertain.

Reduce Risk In Fiat Currency: In emerging markets, which face currency devaluation, “cryptocurrencies are highly valued for their ability to make remittance payments and business transactions more affordable. Hence, the report notes that as the crypto usage grows so will its “reputation as a payments cost saver”.

Sense Of Exclusivity: Crypto payments provided a feeling of exclusivity to consumers. The report finds that it gave consumers an ‘exclusive experience’ while buying items.

About 40 per cent of respondents who paid with cryptos were first-time users, suggesting “crypto acceptance is a desirable value proposition that attracts new customers,” it said.

Obstacles To Crypto Use

The report notes that while “the adoption curve is still rising, there is plenty of opportunity for financial institutions” and leverage new payment methods “to deliver a better experience, new revenue streams, and lower operational cost”.

Agarwal of KoinX says the lack of regulations has made it hard for consumers to fully trust a crypto economy. Although countries are building crypto infrastructure and legal frameworks, “we don’t know when that would be possible”.

Also, cryptocurrency prices can be highly volatile. On April 1, 2022, Bitcoin price was $46,281, but it fell to around $21,254 by August 22, 2022, Coinmarketcap data shows.

“The crypto markets move fast and change every minute. This is a major concern for investors that seek stability with their investments,” adds Agarwal.