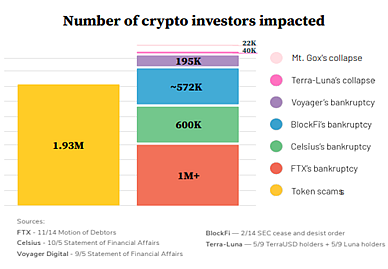

Some two million people fell prey to 200,000 crypto scams globally between September 2020 and December 1, 2022, reveals a report by New York-based crypto trade surveillance firm Solidus Labs.

The report, titled “The Rug Pull Report 2022”, notes that “rug pulls are one of the most common scams in crypto.” But until recently regulators had no access to either forensic or compliance tools that could identify and address the threat.

According to Srikant Bhalerao, co-founder of Seracle, a Maharashtra based blockchain company, it is important for investors to be aware of the risks of investing in crypto.

“The best way to protect oneself is to do their own research on any crypto project before investing. Make sure that the project is legitimate and also look into who is behind the project. If the team is anonymous, then it is best to avoid investing in the project. Additionally, investors should be wary of projects with unrealistic returns or excessive hype,” Bhalerao further added.

How Do Rug Pull Fraudsters Work?

Fraudsters issue fake crypto tokens to lure potential victims.

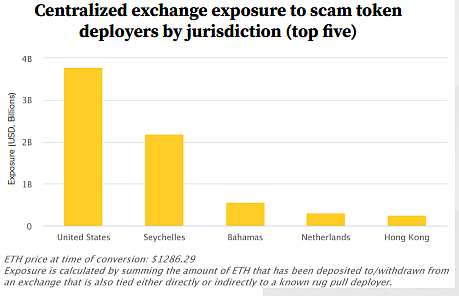

The report said that between September 2020 and December 1, 2022, scamsters used 153 centralised crypto exchanges to withdraw about $11 billion worth of Ethereum (ETH).

The US, Seychelles, the Bahamas, the Netherlands, and Hong Kong saw the highest exposure to such scams.

Source: Solidus lab

How People Were Directly Impacted By Rug Pull Scams

Some two million people globally have lost their investments due to rug pull scams, many of whom had invested through crypto lenders like Celsius, FTX, etc.

“This demonstrates that rug pulls have harmed more investors than any single collapse in crypto to date,” the report noted.

Source: Solidus

The report also claimed that 8 per cent of all ETH tokens are programmed to execute rug pull scams while 12 per cent of

Binance smart chain (BNB) tokens are a scam, the highest number of scam tokens in any single blockchain.

Techniques Used By Scammers To Lure People

At 98,442 crypto scams, the honeypot technique was most widely used to lure victims. As the name suggests, fraudsters lure investors into buying a crypto by highlighting the crypto’s attractive features, but discourage them from selling their assets to permanently lock their money in the scam.

The report said the scam prevents the buyers from reselling their tokens. Thus, it causes the token price to increase as long as the scammer wants, creating the appearance of a “mooning” token, and thereby tricking more users into buying it.

“This is why honeypots are by far the most popular rug pull because they allow their deployers to both manipulate their users and the token’s price,” the report added.

At 60,985 scams, ‘hidden mints’ is the second-most widely used technique that fraudsters use. As the name suggests, it lets the developer create unlimited crypto tokens and sell them to gullible investors.

“A hidden mint allows one or more externally owned accounts (EOAs), in this context, the personal addresses of the token’s deployers to mint new tokens using a hidden function within the token’s contract. After calling this function, the scammer can dump these extra tokens on the market, devaluing the tokens held by others,” the report said.

Role Of Centralised Exchanges In Rug Pull Scams

The report noted that five centralised crypto exchanges had more than $1 billion worth of exposure to these scams. Seventeen crypto exchanges had exposures of more than $100 million and about 93 exchanges had an exposure of $1 million to these scams.

“Almost every major crypto exchange is impacted. These exchanges are required to prevent money laundering under the regulatory regimes in every jurisdiction in which they operate. Further, they face additional regulatory requirements in many jurisdictions regarding investor protection and market abuse prevention,” the report noted.