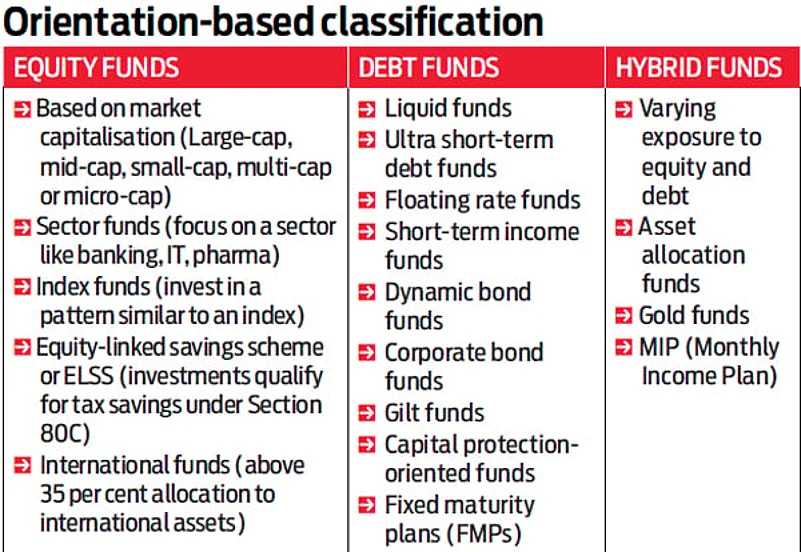

The universe of mutual funds has a lot more funds than what an investor is ever likely to invest in. That, however, should not intimidate an investor as funds can be classified under different categories, which is the starting point of understanding the various funds available. An easy way to approach different fund types is to approach them based on their orientation, assets they invest in, and their management style.

Funds can also be classified based on their asset class such as equity, debt or gold, and whether they are equity, debt or gold funds. There are also funds that have a judicious mix of all these asset classes to form the hybrid category of mutual funds. A debt mutual fund scheme invests in debt papers like government and corporate bonds, money market instruments, and other approved fixed-income securities. In case of equities, the investments are in stocks of varying market capitalisation and sectors.

A special type of fund within equities is the equity-linked savings scheme (ELSS), in which investments qualify for tax deduction under Section 80C of the Income Tax Act. Then there are closed-end funds that have a defined investment time period. In closed-end funds, one can invest only at the time of launch of these funds and withdraw only when the fund is finally closed.In contrast, open-ended schemes are open for investment and redemption on a continuous basis till the scheme is wound up—investors can invest their money at any point of time. Investors can also redeem their money at any point of time subject to applicable exit load, if any, applicable to a scheme. Likewise, there are also funds that are actively managed and those that are passive as they track the constituents of a popular index. Once you know which fund falls under which category, it would help you choose a scheme based on your risk profile and investment needs.