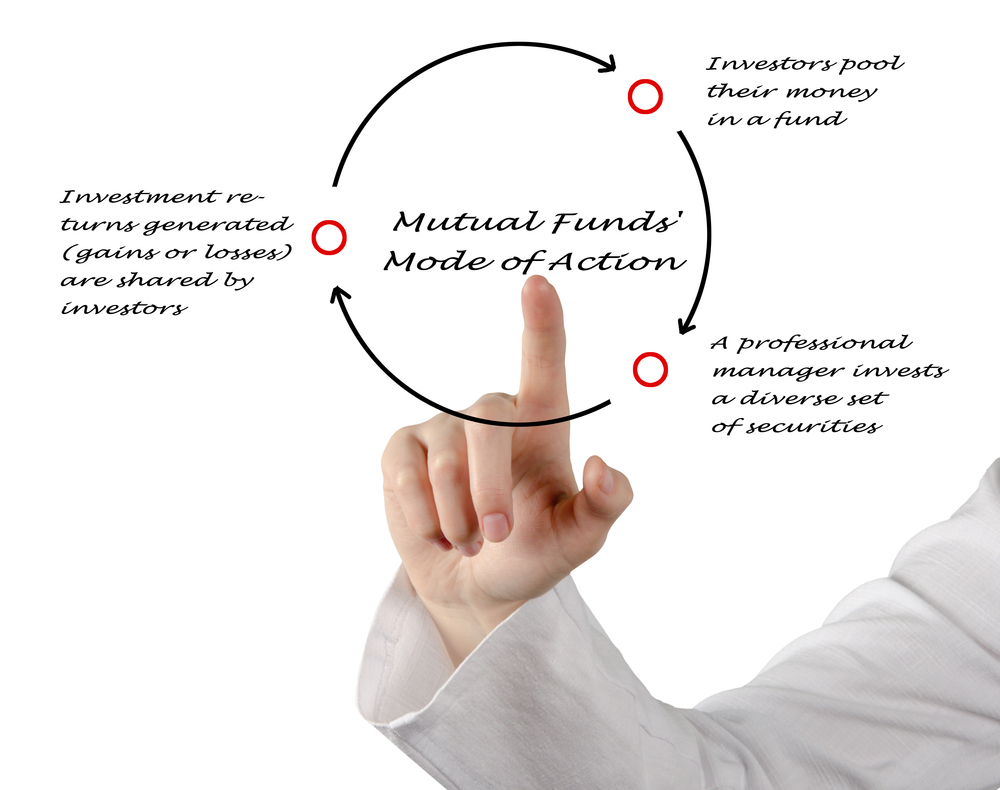

Mutual funds are an excellent option for retail investors to park their savings. There are many advantages of investing through mutual funds:

Professional fund managers managing the money

This means the funds are heavily regulated by the Securities and Exchange Board of India (Sebi), which means the negligible probability of fraud. Most mutual fund schemes are open-ended funds, which means one can withdraw money in case of need.

Mutual funds also offer facility to invest through systematic investment plans (SIPs), which brings discipline to investing, and one can build a significant corpus over the long run. Different types of assets are available within mutual funds like equity, debt, gold. So, investors can achieve desired asset allocation within mutual funds.

However, investing through mutual funds is not as simple as it sounds. There are various things for a first-time investor to understand while taking the initial steps:

Do’s for the first-time investor

Define the financial goals for which you are investing through mutual funds. This will help you understand the amount to be invested and the expected time horizon. Understanding of time horizon of investment is important to select the right asset class.

Try to understand your risk preferences and tolerance levels. Choose the appropriate category of funds according to your expected time horizon and risk preferences.

Also, try to understand the characteristics of the funds that you're investing in. You can either ask your distributor/advisor about it or read various information portals. In case of equity funds, don’t invest a substantial amount as a lump-sum. The investment must be made systematically over a long period. It helps in ‘rupee cost averaging’, bringing down your average cost of holding due to market volatility.

Keep long-term in mind while investing through mutual funds. Due to compounding, a longer time horizon yields maximum growth in your investments. Track your investments and external environment, which could have an impact on your investments. For example, a rising interest rate scenario is not good for investing in longer maturity debt funds (like Gilt Funds). This will help avoid costly mistakes.

Keep taxation in mind while investing. Post-tax returns are important compared to pre-tax returns.

Don’ts for the first-time investor

Don’t think of mutual funds as some miracle that will create wealth for you. It requires patience and discipline to continue the investing journey for the long term. Trying to time the markets will most certainly be futile. No one has ever been able to predict the behaviour of markets, and it is futile to spend your energy on this.

As far as possible, avoid investing in closed-ended funds (except ELSS, which is required for tax saving). Liquidity has its value. Don’t look at just past returns and invest. Past returns are not a guarantee of returns in future periods.

Avoid herd mentality and just don’t go after what everyone is talking about. Instead, analyse the situation objectively and then decide. Don’t blindly trust anyone or any information, particularly the ones circulating in social media. Do your research, ask relevant questions, and then make a decision.

Don't panic during adverse market conditions and stop or withdraw your investments. Systematic investment plans (SIPs) in equity mutual funds are tailor-made to take advantage of market corrections, and it is important to persist with your investments during volatile markets.

Following the above points will go a long way in ensuring that you have a successful investment journey that helps you throughout your life with the achievement of your financial goals!

The author is Founder and CEO, Nivesh.com

DISCLAIMER: Views expressed are the author's own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.