Retirement planning works in your favour if you start early. The monthly investment required to build the desired corpus will be much smaller because a longer term will allow the money to compound

Life expectancy in India is likely to rise from the current 70 to 75 by 2050 and 82 by the end of this century, according to UN estimates in 2022. This means that most people would have to provide for at least 15-20 years after they retire, given that the retirement age is around 60 in most professions.

This shows that delaying retirement planning is not an option. Even so, fewer people take retirement planning seriously, especially when they are younger. Goals like going on a holiday, children’s education and others take precedence as retirement seems to be too far into the future.

“Often, individuals plan retirement later in life because they prioritise their family and children’s financial security over their own retirement. They may start building the corpus in their 40s, but they may be caught up in daily responsibilities with lower surplus income. The inflection point is usually around 50 years, but by this time it is already a bit late,” says Vikas Sharma, head of wealth management and private banking at IDFC FIRST Bank.

But did you know that the earlier you start planning, the bigger would be the corpus that you will be able to accumulate? Also, if you start early, the monthly investment required to build the desired corpus will be much smaller, because a longer term will give more time for the money to compound. Let’s delve deeper to understand how this works.

Why You Should Start Early

First and foremost, an early start will help you enjoy the benefit of compounding. People usually start planning for retirement in their mid or late career when earnings go up, or goals like buying a house, children’s education, etc., are met and they have money to spare. However, this robs them of the opportunities they could have had with an early start.

Abhijit Talukdar, a Securities and Exchange Board of India registered investment adviser (Sebi RIA) and founder of Attainix Consulting, says, “Planning as early as possible is crucial because it gives more time to your corpus to compound. It is a process in which the earnings from the invested money are reinvested to generate additional income. The earlier you start saving for retirement, the more time your money has to grow through compounding.”

Talukdar explains with an example: “Assume you need Rs 50,000 per month during retirement, your existing savings are nil, your planned retirement age is 60, life expectancy is 85, inflation is 5 per cent, pre-retirement return is 12 per cent, and the post-retirement return is 6 per cent. With these assumptions, the money you will need to save every month for retirement, if your age is 25 will be Rs 10,776; if you are 35, Rs 22,726; if 45, then Rs 57,969; and if it is 55, you will need Rs 197,612.”

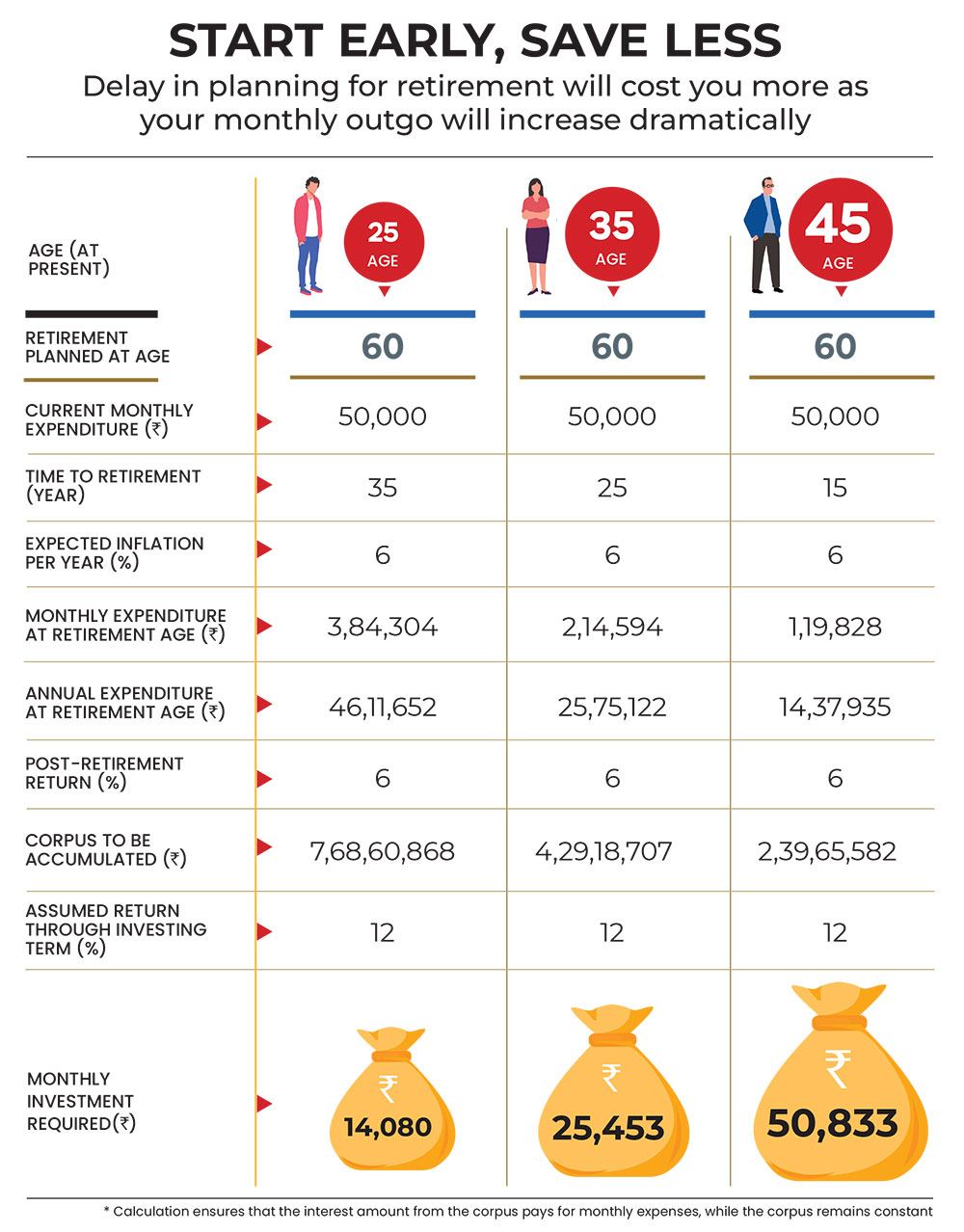

We did a back-of-the-envelope calculation for a corpus that doesn’t get used up but the interest from it pays for your monthly cash flow post-retirement. Sample the results: If you start investing for retirement at the age of 25 years, you will require a monthly investment of Rs 14,080 to meet the monthly expenditure equivalent to your current monthly expenditure of Rs 50,000 and assuming a growth rate of 12 per cent in the pre-retirement phase and 6 per cent post-retirement on the balance corpus (see Start Early, Save Less).

However, keeping everything else constant, if you were to start investing at 35 years of age, the monthly investment required would almost double to Rs 25,453. Similarly, if you start at 45 years of age, your monthly investment towards retirement will again double to Rs 50,833. Note that the corpus required at the time of retirement for the youngest person in the example is the largest, factoring in inflation, and yet the monthly investment sum required is lower.

“With timely planning, you can align your financial resources with your retirement goals and make informed decisions about when to retire, ensuring a comfortable and secure future,” says Sharma.

Second, if you catch the investment bus early on, you will be able to take an aggressive strategy. Plus, you will be able to benefit from tactical allocation through different market cycles. A longer period will reduce the perils of inflation as it provides the chance to earn higher returns. It will also help you access long-term instruments with tax benefits, such as Public Provident Fund (PPF), National Pension System (NPS), etc. On the other hand, a late starter will have limited scope to take advantage of the market cycles or products.

Third, it will give you time to streamline your finances. This means you will have enough time to deviate from the plan temporarily for any goal or emergency on the way to retirement. For instance, during a medical emergency or job loss, you would have a ready corpus to dip into, with the idea of replenishing it as soon as the crisis blows off. However, this is advisable only if you have no other source of income. When you deviate in this manner, your monthly investment may need to be increased for a short period of time. An advisor could help you calculate that.

What You Should Do

Before you start your journey, you will need to decide the corpus size, withdrawals you want to make every year, expected inflation and returns, unplanned expenses, and retirement and non-retirement goals, etc.

“The ideal retirement plans are expected to deliver financial security, stable returns along with capital preservation, all of which can be achieved through diversification across assets,” says Sharma.

An early start can also help those who aspire for Financial Independence Retire Early (FIRE). Talking about how to prepare for the FIRE strategy, Dev Ashish, Sebi RIA and founder of StableInvestor, a financial planning firm, says: “Preparing for early retirement is like an advanced preparation for normal retirement. It fast-forwards your retirement savings. This front-loading of retirement savings creates an insurmountable advantage due to compounding. Even if you fail to reach the right corpus, you will still be better off than if you didn’t attempt to pursue it at all.”

The more you save during your service years, the easier your retired life will be. Says Sharma: “Retirement should be stress-free with independence and financial security. It should not be an adjustment to circumstances but a relatively relaxed phase of life. Retirement planning is a multi-year and, in most cases, even a multi-decade exercise. That is why it is important to start saving early.”

An early start to retirement planning will help you unlock the compounding benefits and ensure a corpus that not just beats inflation but outlasts your lifespan. How you manage your finances during your active life will decide how well you will lead your golden years.

sanjeeb@outlookindia.com