The Nifty 50 index is touching an all-time high; in just 15 sessions, the index has risen nearly 900 points, fuelled by solid global market cues, and substantial influx of foreign investor funds. Here’s how to capitalise on the upward trend.

The Right Choice

- Capitalising on Growth Potential Different industries grow due to different conditions. For instance, technology companies might experience explosive growth due to technological advancements, while real estate companies may benefit from increasing property prices. Picking the right sectors is crucial.

- Diversification for Risk Mitigation By diversifying their portfolio across various sectors, investors can spread their risks. For example, technology stocks may perform well during a bull market, and healthcare or consumer goods might offer stability and act as a buffer in any downturns infecting the tech industry.

- Understanding Risk Appetite and Investment Horizon Each investor has a different tolerance for risk and time frame. Invest accordingly.

Small Caps and Mid Caps’ Historical Outperformance

Historically, small-caps and mid-caps proven to be star performers during bull runs. Smaller companies often have more room for growth and expansion, leading to significant capital appreciation during favourable market conditions.

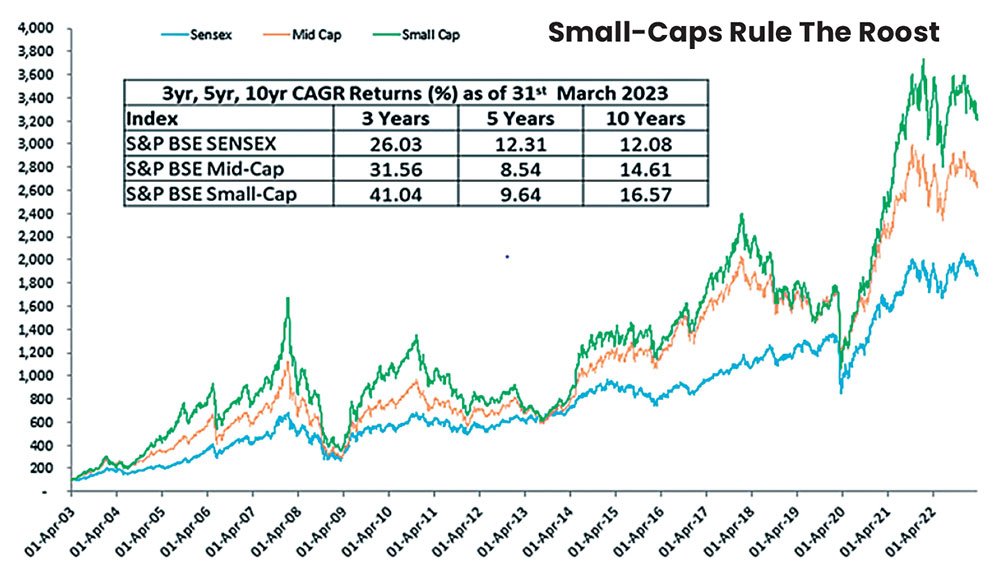

Out of eight bull runs, small-caps have been the best performers five times, mid-caps have been the best performers twice, and large-caps just once (see Small-Caps Rule The Roost). During the seven bear phases, large-caps have been the best performers five times, and small-caps and mid-caps were the best once each.

During bull runs, small caps have consistently outperformed mid-caps by an average of 30%, with a peak of 119% between 2004 and 2006. Conversely, small-caps’ underperformance in bear phases compared to mid-caps has stayed within 10%.

Ways to Invest

- Quality Small & Mid Cap Funds Professional fund managers curate the investments of mutual funds, diversifying the portfolio across various companies and sectors. Opting for funds with a proven track record of consistent performance and low expense ratios makes sense.

- Quality Stocks Experienced and confident investors can pick individual and small-cap stocks by conducting thorough fundamental and technical analysis of companies, and assessing their growth potential, financial health, and competitive advantages. However, they must exercise caution to minimise risk.

- Systematic Investment Plans (SIP) Opening an SIP in a small- and mid-cap fund allows regular investments and the benefit of rupee-cost averaging, reducing the impact of market volatility. A monthly SIP of Rs 5,000 opened in April 2003, would have given Rs 88,74,499 in BSE Sensex, Rs 1,08,84,080 in BSE Midcap, and Rs 1,28,09,561 in BSE Smallcap.

Conclusion!

During a bull run, selecting suitable investment avenues is crucial to capitalise on the positive sentiment. Small and mid-caps have historically outperformed during such market phases, making them attractive options.

Disclaimer

Equities can fluctuate and carry risk. A long-term approach and professional financial advice are recommended when considering investment strategies discussed in this article.

Sneha Jain, CEO and Founding Partner - WealthTrust Capital Services