Real estate is the most valuable asset in the world. And buying a house is perhaps the biggest financial decision for most people. It is also a highly emotional one. Hence, when it comes to such decisions, you cannot rely totally on the numbers. Nothing will drive my point home better than some real instances.

I know a young couple who live in Bandra West, Mumbai. From a real estate point of view, this is an expensive location, and they spend a fair amount of money on rent. What’s interesting is that they own a house in Navi Mumbai, which they have leased. The rent they earn (from the Navi Mumbai house) is way, way below the rent that they pay (for the Bandra house).

If we look at pure financial considerations, the clichéd “rent is money down the drain” argument comes into play. Logically, they should be living in their own house and investing all the money that they spend on rent. But investing is not all about logic and numbers. Their decision is not based purely on the financial aspect. They have family and friends living in and around Bandra. They find it more central when it comes to travelling to work. They like the social aspects of living there, as well as the convenience. Staying there gives them fulfilment and a sense of contentment. They can afford it. Both are earning. They have zero debt, and no children.

They don’t even plan on retiring in Mumbai. So, building a community in Navi Mumbai is not on their radar.

Now, let me narrate another example of a lady who works in a salon in Mumbai. Her husband is an electrician. This is what she told me: They were staying in a one-room house and paying `6,000 as rent. They decided to buy a small one-bedroom, but it would be a monthly outdoing—equated monthly instalment (EMI) of `15,000 for 15 years. A difference of `9,000 per month, which was a significant amount for them. But they also realised that `6,000 was a lot to “give away” every month. So, they decided to buy their own home.

They worked hard, cut down on extra expenses, and put all “extra earnings” into prepayment of their loan. She said once they decided the route they were going to take, they made it their focus. No whining, no crying, no comparing, no unnecessary spending, and no feeling ashamed asking for odd jobs to help prepayment. They never lost track of their goal. They paid off the entire loan within 10 years.

She explained to me that the security she got from owning her own home was precious. During the pandemic, when they struggled to make ends meet, it was the mortgage-free home that she owned that made her feel secure. For someone who is financially insecure, a home is the best safety to buy.

Morningstar’s director of personal finance and retirement, Christine Benz, once related a very interesting situation. A newly-divorced friend in Chicago asked her for advice on whether she should buy a home. Benz replied by asking her another question: “Do you like owning a home?”

The friend wanted financial advice. But Christine responded by encouraging her friend to dig deeper into the emotional aspects of home ownership at that point in time. Do you mind having to deal with repairs when they come up? Do you feel like you would get to know your neighbours better if you were a homeowner? Are you certain you want to live in this area for many years?

Can you afford to buy a house at a locality where you have a community? What is it you like about owning a home right now? What is ownership going to give you that rental does not?

Look Beyond The Numbers

Those who advocate rent to the exclusion or owning a property, or vice-versa, are deeply undervaluing the emotional aspect of owning a home. The decision of whether to buy or rent is not purely a financial one.

One of the biggest misconceptions is that money is all about math. There are numerous intangible factors that come into play. And you cannot put a number to it. For some, it is quite primal to have roots somewhere, a place called home. For others, the freedom and flexibility offered by way of rent is much more valuable.

Yes, there will always be the financial aspect. But there are also social and emotional considerations. That is why these decisions are very personal. There are no cookie cutter solutions or one-size-fits-all answers.

Renting isn’t inherently “throwing money away”. It can often be the right call when you take into account non-financial considerations. If an individual only plans to live in the city for a few years, why should she purchase a home there? Or, if she wants to live in a specific locality, but cannot afford to buy a house there, renting gives her the option to live where she wants to. Or, if she eventually plans to retire in her ancestral home in her hometown, she would prefer renting in the city she is employed in.

No one should buy a home purely for financial reasons, as some ‘quality-of-life’ considerations are central to the thought process.

***

All Assets Are Not Equal

- No portfolio is an island. A portfolio must be diversified, so that various asset classes complement and balance each other

- Each asset class serves a purpose, and neither is superior to the other. You must figure out what works best for your specific situation

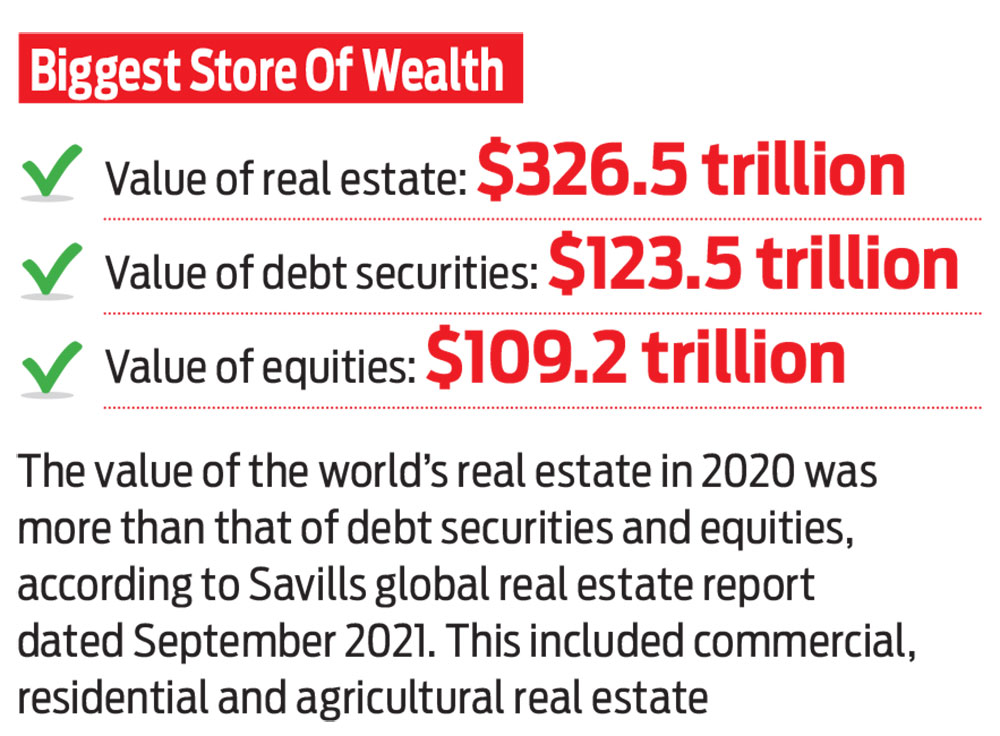

- Equity, debt, gold, art and real estate are the most popular asset classes

- Returns are not the only factor to consider. Liquidity is an important factor, too. For instance, large-cap stocks are extremely liquid, while art and real estate are illiquid assets

- As with any asset class, be aware of your holding period, and look at taxation on short- and long-term capital gains, and whether indexation can be applied when paying taxes on the profit. Other costs are fees, brokerage, insurance, and maintenance

- It is a bad idea to take a loan to invest in equity. But real estate is one asset where it makes sense to take a loan, or else, the asset is mostly unattainable. Moreover, you get tax benefits on your home loan. So, it is a great idea to buy when interest rates are low, and you can lock in the loan at that rate

- Real estate is not a simple buy. It depends on many factors, namely, location, the amount you qualify to get as a loan, the amount you can afford as downpayment, the number of people who will reside in the house, and the reason for buying the house. The reasons for buying a house can also vary: save tax (reinvest the amount from the sale of another property), to eventually live in, to currently live in, to lease commercially, to leave for the next generation, or just an investment for capital appreciation

- Since all assets are viewed differently in the owner’s mind, the subjective element cannot be ignored. Art, for instance, is a passion asset, while real estate can be an emotional asset. Think about the emotions invoked when an ancestral property that has been in the family for many generations has to be sold. Gold bars will not invoke as much emotion as gold jewellery passed down by grandmother.

The author is an Investment Specialist at Morningstar India