Type 1 Investors

Investors wearing short-sighted lens are those whose actions are mostly based on the latest market environment, what are the stock prices are right now or where is it expected to head in the near future and the likes. These participants track index minute to minute, day to day, month to month, and quarter to quarter, and their obvious question always is “market kya lagta hai” to which there is never a correct answer. But the reality is if one were to track the stock market behavior – it varies across short, medium, and long term.

Short Term: Anywhere within a year to 3 years, you can and should expect the stock market to behave not just irrationally but extremely so - in response to the fear or fad of the moment. I call it, “The Bumpy Road between Market’s Long-Term Returns”. The compounded return of the Nifty Index since the year 2000 has been 11% annually. But it is only in 2 out of the last 22 years that the return has been anywhere between 10 - 12%! In all the other years, the market was either much more or much less optimistic than the long-term figure.

My observation for the short term is - the stock market always overreacts, be it on the downside or upside, and nobody can predict where the movement will be. John Kenneth Galbraith quoted, “The only function of economic forecasting is to make astrology look respectable”

Medium Term (4 to 7 years): The market mood swings moderate somewhat, but it can still overreact. That is, somewhere along here you can reasonably expect the stock market to be edging toward some objectively verifiable economic and/or financial reality. In India, during the global financial crisis, the index fell from that time peak of 6,200 (Jan 11, 2008) to 2,620 (March 06, 2009). It took just 18 months to recover from the lows and now it has grown six times from there. The market reacts in the medium term as well, but the probability of getting a negative return has been NIL on a rolling 7-year window.

Type 2 Investors

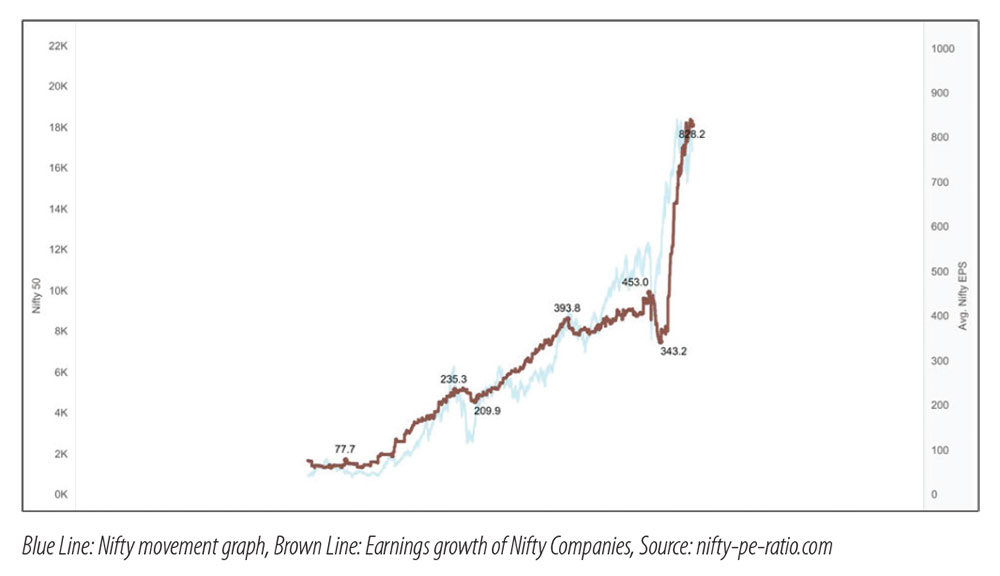

Now, coming to the investors wearing far-sighted lens. Such investors tend to reflect the behavior of the market over long term. Both earnings and Nifty levels are approximately up by 12 times since the year 2000, and this is not at all coincidental. The blended values of the Nifty companies always mirror their earnings. Don’t make the mistake of reading past this too quickly, because you have just discovered why stocks have gone up so much over the last two decades. In the long run, it is the corporate earnings that have always driven the market. See the below image which depicts the market movement and earnings.

This brings us to another interesting aspect as to how the Indian demographic has favored long-term investments in the equity market.

India consumes what it produces. The 141 crores consumer population has always been bliss. Today, more than 50% of our population is below 25 years, 47% is in the age bracket 25-69 years, and only 3% of the population is old. This statistic has a huge impact on our economy. The younger the population, more is the earning potential, ability to spend and contribute to the Indian economy. This growth fueled by the Indian demographic benefits the top Indian companies. You not only recognize the names of these companies, but you and your family use their products and services regularly - some as often as daily. As these companies make more and more profit, their shareholders find their investments not just growing but compounding in value over time.

To conclude, the investor who looks at the stock market through the second lens is the one who will see their money growing and compounding like a dream.

Happy Investing!

The views are personal and are not part of the Outlook Money editorial Feature

Abhishek Mohta, CFP Founder & Partner, Trustedarms Wealth