Diwali is among the biggest of festivals that Indians celebrate, but it is actually the culmination of a series of festivals that starts with Onam, Raksha Bandhan, Janmashtami, the Navratras and Durga Puja. This year, the festive season started early when Chandrayaan-3 reached the moon on August 23, 2023, according to Prime Minister Narendra Modi.

When it comes to festivals, Indians go all out to add colour and zing to the celebrations. From shopping for new clothes and home décor to indulging in sumptuous feasts and exchanging gifts, the expenses can pile up rather quickly.

This year is expected to be no different. According to the India Consumer Sentiment Index (CSI) report by Axis My India, a consumer data intelligence company, 23 per cent of respondents plan to shop more during the festive period as compared to last year and 28 per cent intend to maintain their spending habits at the same level as before, indicating that the consumer sentiment will remain stable.

Like every year, Celine M. Dass, 72, who was a shipping coordinator for a consortium of shipping companies before she retired, and her husband, Hubert A. Dass, 73, who worked as a logistics and operations manager at a Dubai-based retail company previously, now both settled in Mumbai, are already planning to celebrate Diwali with sweets, décor and more. Despite being devout Catholics, they have always embraced Diwali with their neighbours and family friends.

To ensure they can fully enjoy and participate in the festivities, Celine and Hubert have set up some budgeting practices over the years.

Now retired, they consistently save and allocate a portion of their income from investments to spend on festive buying. They also go for Diwali offers to get the most out of discount sales during the period.

Festivities can always tempt you to spend more than what you had orginally planned for, but doing so can come back to bite you in the future if you overindulge and end up being a spendthrift.

So, here’s a guide to help you embark on a different kind of celebration—one that not only illuminates your surroundings, but also brightens your financial future. For that, you will have to strike the right balance between enjoying the festivities while safeguarding your financial well-being.

Spending Account

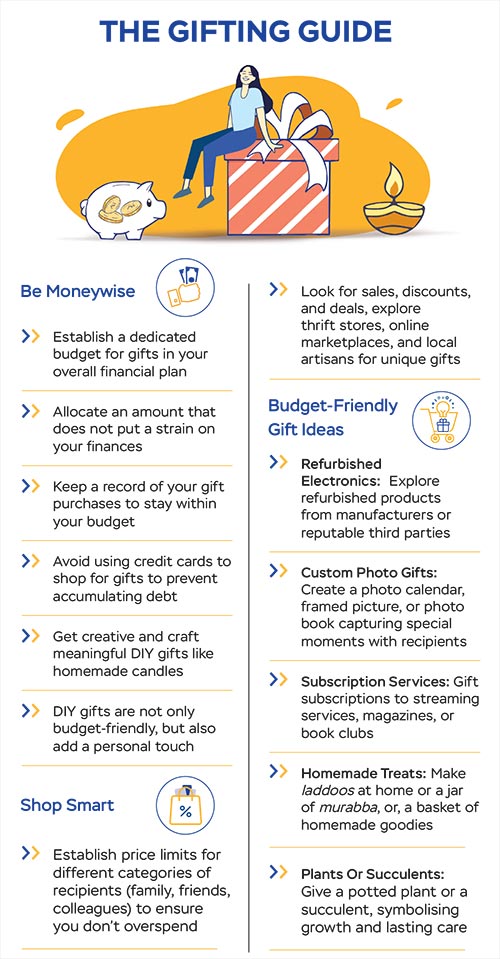

Budget: The first step is to make a list of the things you want to buy or spend on, and allocate a budget for each head. Says Nita Menezes, founder and CEO, Financially Smart, a financial planning firm: “Develop a budget that directs your finances to where they are needed, both for the present and the future. Having clear communication with your family about your budget will ensure that everyone is on the same page, thus averting disappointments during the festivities.”

Kamalika Mukhopadhyay, a 38-year-old businesswoman residing in Delhi, and her husband, Nitin Sharma, 38, and an entrepreneur, eagerly anticipate the arrival of the festive season every year. Besides allocating funds for the larger expenses, such as buying gifts for friends and family, and jewellery and clothing for themselves, she also allocates separately for expenses like deep-cleaning of their home and buying sweets. “In Delhi, Diwali holds great significance, and we allocate a substantial budget for this occasion,” says Mukhopadhyay.

Kamalika Mukhopadhyay, 38, Nitin Sharma, 38, Based out of Delhi. Photo: Suresh K Pandey

The couple earmarks separate funds towards buying gifts for friends and family, jewellery and clothes for themselves, and for deep cleaning of their house and for buying sweets. They also buy gifts in advance or take benefits of sale offers to save on expenses

***

As a safe practice, track your expenses regularly to ensure you stay within your budget.

Prioritise: It is essential that you assess your situation and spend accordingly. For instance, if you plan to spend on home improvement this season, you could cut down on extravagant gifts or expensive jewellery, or postpone replacing your air conditioner or refrigerator. Or, you may want to postpone the renovation if you don’t have enough money, and go for a repaint instead.

Says Kiran Telang, a Mumbai-based certified financial planner and author: “Festival spending can take various forms—shopping for clothes, jewellery, gifting, redecorating the home, travelling and other such things. One needs to figure out what is most important among the many such things.”

Track Expenses: Tracking your expenses diligently is paramount to ensure that there are no signs of extra burden on your current or future finances. “Categorise your spending, prioritise essentials, and trim discretionary expenses, if needed. Budgeting apps or a simple excel sheet can also help you track expenses,” says Menezes.

Saving Account

The festive season is considered auspicious for investing and buying assets, such as a house, gold and other assets. Incidentally, this is also the time when many employees recieve their Diwali bonus, which makes such investments possible.

Gold: You can invest physically in gold by buying coins, jewellery, or bars from trusted jewellers or dealers. Digitally, you can consider gold exchange-traded funds (ETFs), which track gold prices, or Sovereign Gold Bonds issued by the Reserve Bank of India (RBI) when they open for subscription. You can also explore gold monetisation schemes from banks which allow you to earn interest on your gold deposits with the bank.

Diversifying between physical and digital gold will allow you to balance tradition with modern financial instruments, thus providing you with security and returns over time while also allowing you to embrace the festive spirit. For a strategy on gold shopping, read Gold Shopping: Buy New Or Change Old?, Page X.

During her working years, Celine would use her bonus earnings to purchase gold jewellery on the auspicious occasion of Dhanteras.

Investments: According to Bhuvanaa Shreeram, co-founder and head of financial planning at House of Alpha, a financial planning firm, mutual funds, stocks, and other instruments can be good investment options, depending on your objective, time frame, need for returns and overall risk appetite. In fact, you can invest your bonus or extra funds to make investments that will help cement your future.

Home: If you are planning to buy a house, you could use your bonus to make the downpayment. Make a smart choice before settling on a property though (see Buying A House? Assess The Freebies, Page X)

If you are living in your own house, home improvement is a regular cost, but you may consider it an investment for your comfort in the coming years. It could range from a few thousand rupees for minor repairs to several lakhs or more for major renovations.

Utilising your Diwali bonus for home improvement purposes that cannot be postponed is a wise choice. Begin by identifying critical repairs or upgrades that enhance safety, such as fixing leaks or major electrical issues. Structural upgrades cost more money, but can be beneficial in the long run.

Striking A Balance

It’s easy to get swayed by the multitude of offers and discounts, but the prudent choice would be to strike a balance between short-term joy and long-term financial security.

To start with, you could split the available funds based on necessity—apportion some money for festival expenses and the rest towards long-term savings. “This approach ensures continual progress toward your financial objectives while you savour the festivities without financial concerns,” says Menezes.

Another aspect that can help maintain this balance is to assess debt. For instance, if you receive a substantial bonus and have unmanageable high-interest debt, the best strategy would be to use the bonus to get out of the debt trap instead of spending it elsewhere.

Prioritise debts with higher interest rates, then allocate a substantial portion of your bonus towards these debts while making minimum payments on others. This strategic approach will reduce the interest costs and accelerate debt reduction. Says Shreeram: “It is important to have a well-thought- out plan on how to use the bonus. Interest on such debts can quickly eat into any potential gains you’d make from investments.”

Every year it might be prudent to review and adjust this balance to align with your changing priorities.

Celine M. Dass (72) and Hubert A. Dass (73) shopping for the festive season at a mall in Mumbai. Photo: Dinesh Parab

In their working years, they diligently saved a portion of their income, to spend on Diwali festivities in the year. Now, retired, the septugenarian couple save from their investment income

***

Plan Ahead

Balancing short-term and long-term financial goals necessitates prudent planning. First, identify your immediate, short-term objectives, such as festive expenses, alongside your long-term financial aspirations, such as savings and investments.

Says Telang: “It is a good idea to keep a margin of 5-10 per cent in the monthly expenses to cover up such things as home improvement, gadget repair and/or replacement. You can also earmark a separate corpus depending on the quantum of expenses that you envisage. If you don’t put such measures into place on an ongoing basis, you may have to dip into your long-term investments to meet the needs.”

Festival Fund: Planning for festival spending should be integrated into your financial strategy at the start of the year. One effective way to do this is by treating festival expenses as a short-term financial goal.

To prepare for the increased costs as well as maintain a healthy cash flow, make an overall estimate of the expenses in your annual budget for gifts, decorations, special meals, and travel expenses. Once you have a clear picture of these costs, calculate how much surplus income you can set aside each month to meet these expenses comfortably.

Consider having a dedicated savings account specifically for your festival fund. Automate monthly transfers from your primary account to this fund. This will ensure that you accumulate the necessary funds throughout the year, thus making it easier for you to cover your festive expenses without causing financial strain during the celebrations.

Navigate A Shortfall

Should you find yourself facing a shortfall of funds, revisit your budget. Recalibrate your list and look for income sources that can come to your rescue. But stay away from debt that you will find difficult to repay. Adds Menezes: “Keep your Specific, Measurable, Achievable, Relevant, and Time-bound (S.M.A.R.T.) goals in mind, using them as your compass to make informed financial decisions. Avoid over-reliance on credit cards and the debt trap they may lead to.”

Trim unnecessary expenditures in the months leading up to the celebration to reallocate resources. Diwali is still at least a month away, so divvying up the budget over the period can help distribute the financial load that you may get burdened with later. Explore cost-effective alternatives for gifts and decorations and take advantage of discounts and special offers.

Says Kamalika: “We use various strategies to control our expenses, such as reusing decorations and procuring gifts in advance or during sales. We take advantage of the special offers and discounts available during the Diwali season.”

The idea is to keep things simple. Celebrations do not need to come at the expense of overspending and debt. Prioritise essential aspects of the festival, like quality time with loved ones, over extravagant gifts or parties. “We never planned strategically on how to spend in Diwali. But we always lived within our means, and so never had to grapple with any debt. We managed to strike a balance between spending and saving,” says Celine.

meghna@outlookindia.com