Get acclimatised, investors!

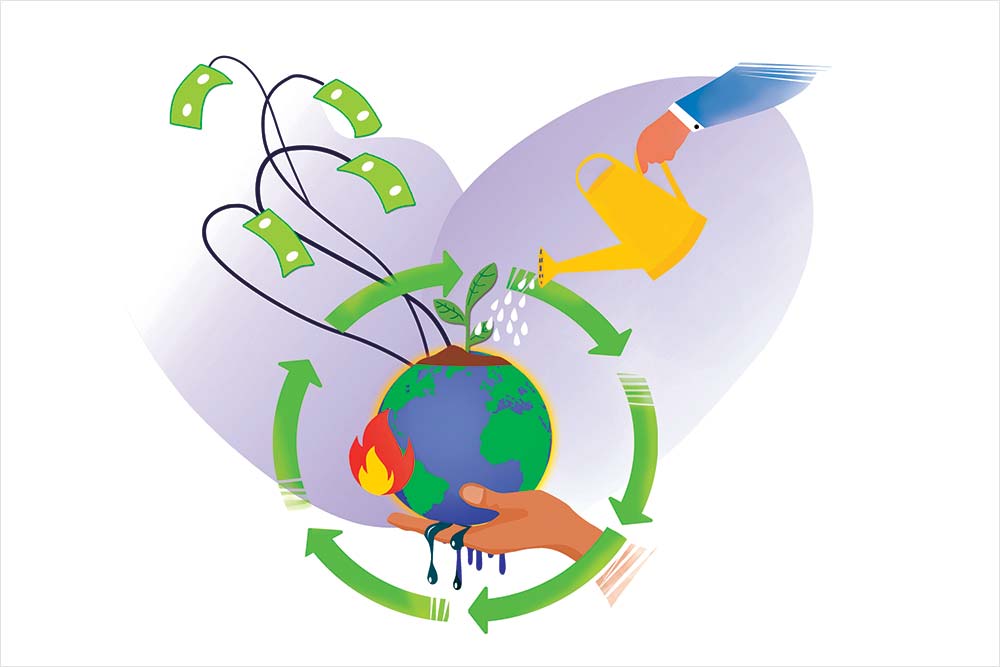

Show me a global crisis, and I will show you a business opportunity. And what could be more sinister and imminent than climate change, the crise extraordinaire that threatens the very essence of civilisation as we know it?

Climate change, which is already spawning businesses that many think will ultimately overshadow plenty of others, has far-reaching ramifications for individual investors too. A moveable feast of investment products awaits them, if you could pardon the risqué analogy. The very first of these has just made an appearance in India, courtesy a fund aimed at allocation to climate-sensitive sectors that will gain traction with the passage of time.

HSBC Mutual Fund’s Global Equity Climate Change Fund of Funds will devise for its unit holders a platform to invest in a variety of emerging climate-related segments collectively covering quite a range of themes. A ‘Fund of Funds’ or FoF does not own securities directly, instead, it invests in another fund (or in a group of funds).

The fund, which has identified climate change as the ‘ultimate megatrend’, will cotton on to the need for large-scale transformations in the use of energy and other critical resources. Such transformations will provide sustainable solutions for the complications associated with the climate challenge, as the fund house has outlined it for the benefit of the local investor community. MSCI AC World TRI index will serve as its benchmark.

HSBC’s Global Equity Climate Change Fund has been chosen as the target fund (the underlying). The latter, incorporated in the Grand Duchy of Luxembourg, seeks to deliver long-term total return by allocating chiefly to companies deemed to gain from climate change adaptation processes. Transition to low-carbon usage is among the foremost considerations for such companies. Their themes will inter alia include renewable energy, clean transportation, waste management and green buildings.

“For banks to deliver on their commitment and targets to align their portfolios with global climate goals and support the low-carbon transition of the real economy, they must work closely with their clients. Tailored green financial products and services are key instruments which banks can use to support clients’ transition to new technologies, business models and lifestyles,” says a recent UNEP report, Principles of Responsible Banking.

Watch the melting iceberg

The point I wish to make is simple, and it concerns the domestic investor who (from the point of view of sheer asset allocation) is not really accustomed to an idea as engaging as climate change. However, the market for managed investment products is undergoing sweeping metamorphosis, and a whole set of new themes is expected to be rolled out in keeping with contemporary international trends.

This is evident in the emergence of exchange traded funds – the preferred route for a larger number of local participants than ever before. Further, a modern concept like ESG (environment, social and governance) has also made its initial mark in India. In fact, ESG has emerged lately as an international rallying point for a section of the market.

The climate change rationale needs to be viewed from this angle. A new fund based exclusively on it will help discerning investors trace a novel path. It is likely to pave the way for similar experiments by local asset managers, but it remains to be seen whether the maiden rollout is quickly trailed by others of its kind.

Clearly for the rapidly enlarging Indian market for funds (aggregate assets stood at more than Rs 30 lakh crore, the last time I checked), such innovations are a crying need. This seems especially true considering the environmental timebomb we are sitting on. I can think of quite a few sectors – solar energy, for instance – that deserve to get plenty of support from the investor community.

Well, for every Harry Potter, there is a Lord Voldemort. The dark side – the probable exclusions from the dashboard, in a manner of speaking – appears as a separate (but not entirely unrelated) story to tell as well. Will the market really adopt, for example, a fresh stance on some of our highly polluting businesses? Do we have a truly ecologically-friendly and exclusionist policy on the extraction industries? Will a whole generation of reform-minded investors shun the tobacco sector in favour of a benign one, say, a sector dedicated to clean potable water? I leave you, reader, to ponder over these concerns.

Where to, traveller?

The Indian investor, who has seen in the past a raft of thematic alternatives being introduced by asset managers, has by and large restricted himself to simpler market-oriented concepts like ‘market capitalisation’. Individual participants, mostly creatures of habit, are well aware of identifiable products based on, say, large-cap. After all, the latter is fairly straightforward and quite easily understood.

A professionally managed alternative based on climate change will not be so convenient to appreciate, mind you. In other words, the market will need plenty of time to get convinced. And that will happen only when all the three ‘I’s’ converge at a common meeting ground – the issuer, the intermediary and the investor. That is not in any particular order. The presence of the one in the middle is absolutely critical in this context, despite certain recent attempts to de-escalate intermediation. Further, what one ideally needs is a decent-sized universe of investible stocks.

I can right now think of several other contemporary themes – democratic dividend, zero tolerance or even Thunberg Society – and I wish to find out whether these will ever emerge as investment-worthy themes. Will there be, at some point in future, a global fund with “towards an egalitarian society” as its central rationale? Will it provide a specific investment window for Indian investors? Oh my, that should be the subject matter of a column I will want to write someday!

***

MSCI World Climate Change Index

The MSCI World Climate Change Index (based on the parent benchmark, MSCI World Index) includes large and mid-cap securities across 23 developed markets. It aims to represent the performance of an investment strategy that re-weights securities based upon the opportunities and risks associated with the transition to a lower carbon economy, while seeking to minimise exclusions from the parent index.

The author is Director, Wishlist Capital Advisors