Investor, fund manager and a best-selling author, all rolled into one—that’s Peter Lynch. His books provide nuggets of practical approach to stock investing. We demystify his investing style to help you implement it when picking stocks. We also have some picks based on his strategy that you may consider

Rrandom search on Google on “Who is Peter Lynch” will throw up two pieces of information about him, among others: his outperformance as a fund manager at Fidelity Investments and his status as a best-selling author. His investment philosophy in picking stocks has been widely acclaimed. During his tenure, the Fidelity Magellan Fund clocked 29.09 per cent annual returns compared to 14.47 per cent of the S&P 500 index.

However, few talk about how he underperformed in 1984, 1987, and 1990 versus the S&P 500, albeit by a small margin. Also, no one points out that because he didn’t manage funds directly for about 25 years, it is difficult to ascertain how his funds would have done if factors, such as value and momentum, were in vogue.

Nevertheless, there are learnings from him that can benefit investors. Let’s explore.

Learning From Lynch

Gems In Writing: His books—One Up On Wall Street, Beating The Street and Learn To Earn—provide a practical approach to investing rather than delving into complex theories. This puts retail investors at ease. His strategy of observing the world around him to discover potential stocks is a method that anyone can apply, making his investment philosophy accessible and empowering for amateur investors. What stands out is his ability to give a perspective on investing by looking at the investor’s consumption pattern.

Learn To Earn gives investors a brief understanding of economics and investing. Highlighting the importance of patience, Lynch says in this book, “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” Beating The Street and One Up On Wall Street should be read together as they expand on and truly lay out the foundation of shortlisting stocks, evaluating and investing in them. Says Nitin Shanbhag, head of investment products at Motilal Oswal Private Wealth, “Everyone in the investment field should read One Up On Wall Street at least once. It helps form an investing framework.”

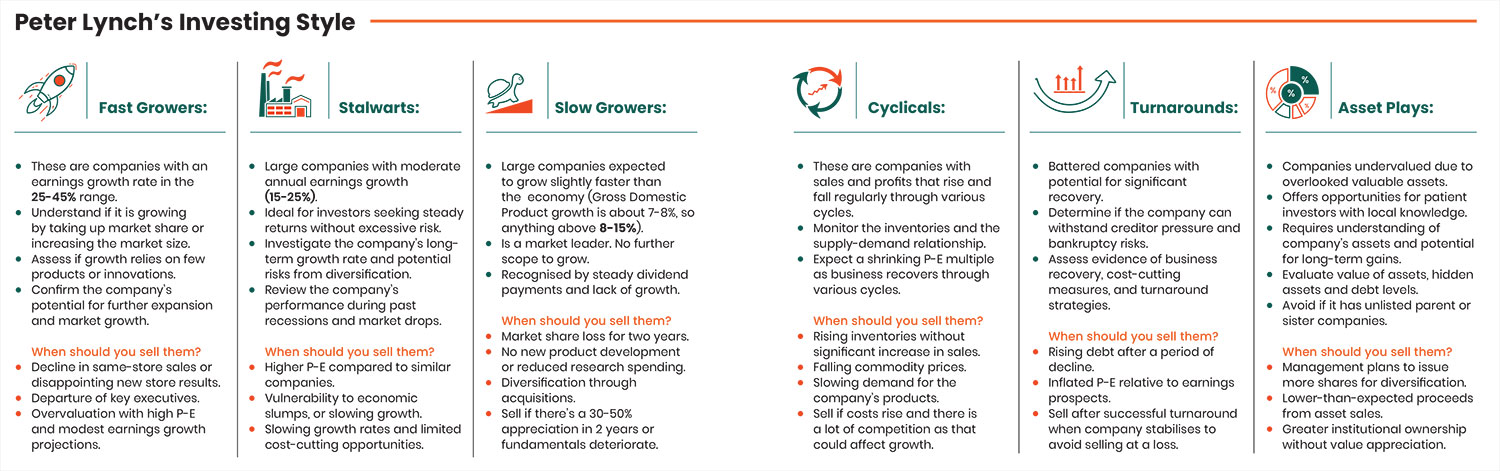

Investing Strategy: Though he is often recognised for articulating the investing philosophy of GARP (growth at a reasonable price), his strategy also involves classifying stocks into one of the six buckets—Fast Growers, Stalwarts, Slow Growers, Cyclicals, Turnarounds and Asset Plays.

Lynch advises evaluating stocks based on various factors. Check the price-to-earnings (P-E) ratio compared to the company’s history and the industry. Look for lower institutional ownership, insider buying, and share buybacks. Assess earnings history, but that’s less vital for asset plays. Analyse financial health, including the balance sheet, debt-to-equity ratio, and cash reserves for stability. Categorise stocks by characteristics for clearer expectations. Lynch emphasises commitment and careful consideration for successful investing.

In One Up On Wall Street, Lynch says: “Never invest in a company before you’ve done the homework on the company’s earning prospects, financial condition, competitive position, and plans for expansion.”

Anand Vardarajan, business head, Tata Asset Management, says, “If you were to think about those six types of companies and apply on the markets, it covers the entire spectrum in terms of the different types of companies and how one looks at them.”

Says Nitin Shanbhag, head of investment products at Motilal Oswal Private Wealth, “Everyone in the investment field should read One Up On Wall Street to get invaluable insights from one of the most successful fund managers in history, Peter Lynch.”

Explaining why the GARP strategy is much talked about, Shanbhag says, “GARP is an equity investment strategy that aims to combine the best of growth investing and value investing. Through GARP, fund managers aim to identify companies that have healthy earnings growth outlook, which are available at reasonable valuations, and which can be held for 3 to 5 years or longer. This strategy is popular in equity markets across geographies and has become increasingly popular amongst most Indian fund managers over the last decade. While GARP is followed by managers with a long-term outlook, managers identifying Turnaround stories are far more opportunistic and will tend to have a relatively shorter investment horizon.”

Indian fund managers have long embraced GARP, even without direct exposure to Lynch’s principles as it combines elements of both value and growth investing.

This is evident when you look at the investing styles of some of the fund managers. For instance, Jinesh Gopani, former head of equity at Axis Mutual Fund, says that his style of investing is growth-focused but he expands on that. He says, “About 21-22 years ago, a pep talk from my boss instilled in me the belief that the equity market revolves around anticipating the future and thriving in a growing economy. Given India’s status as a fast-growing developing economy, a strategy centred on selecting growth-focused stocks will consistently yield results. While valuations hold significance, they must be assessed considering the cost of capital.”

Others have tweaked the growth style of investing. Vardarajan explains the Tata Asset Management approach to investing: “We follow growth at a reasonable price, and we look for stocks where there is value with triggers. We try to straddle growth and value with price being an anchor.”

Even in the alternate investing space, Lynch’s investment style is being used. Suman Bannerjee, chief investment officer, Hedonova, explains, “Hedonova invests in the alternate space, but we have also incorporated the principles of Lynch’s philosophy by focusing on identifying undervalued companies with solid growth potential and sound fundamentals. Through research and analysis, Hedonova seeks to invest in companies trading at reasonable valuations relative to their growth prospects, aligning with Lynch’s GARP investing approach.”

Portfolio Thoughts: Talking about portfolio management, Lynch says: “...your portfolio design may change as you get older. Younger investors with a lifetime of wage-earning ahead of them can afford to take more chances on ten-baggers than older investors who must live off the income from their investments. Younger investors… can experiment and make mistakes before they find the great stocks…. The circumstances vary so widely from person to person that any further analysis of this point will have to come from you.”

His general view is that a portfolio should have a combination of fast-growers to bring alpha, stalwarts for safety during downturns and slow growers for dividends. Cyclicals, turnarounds and asset plays should be looked at if you understand the market dynamics.

***

Stocks To Consider

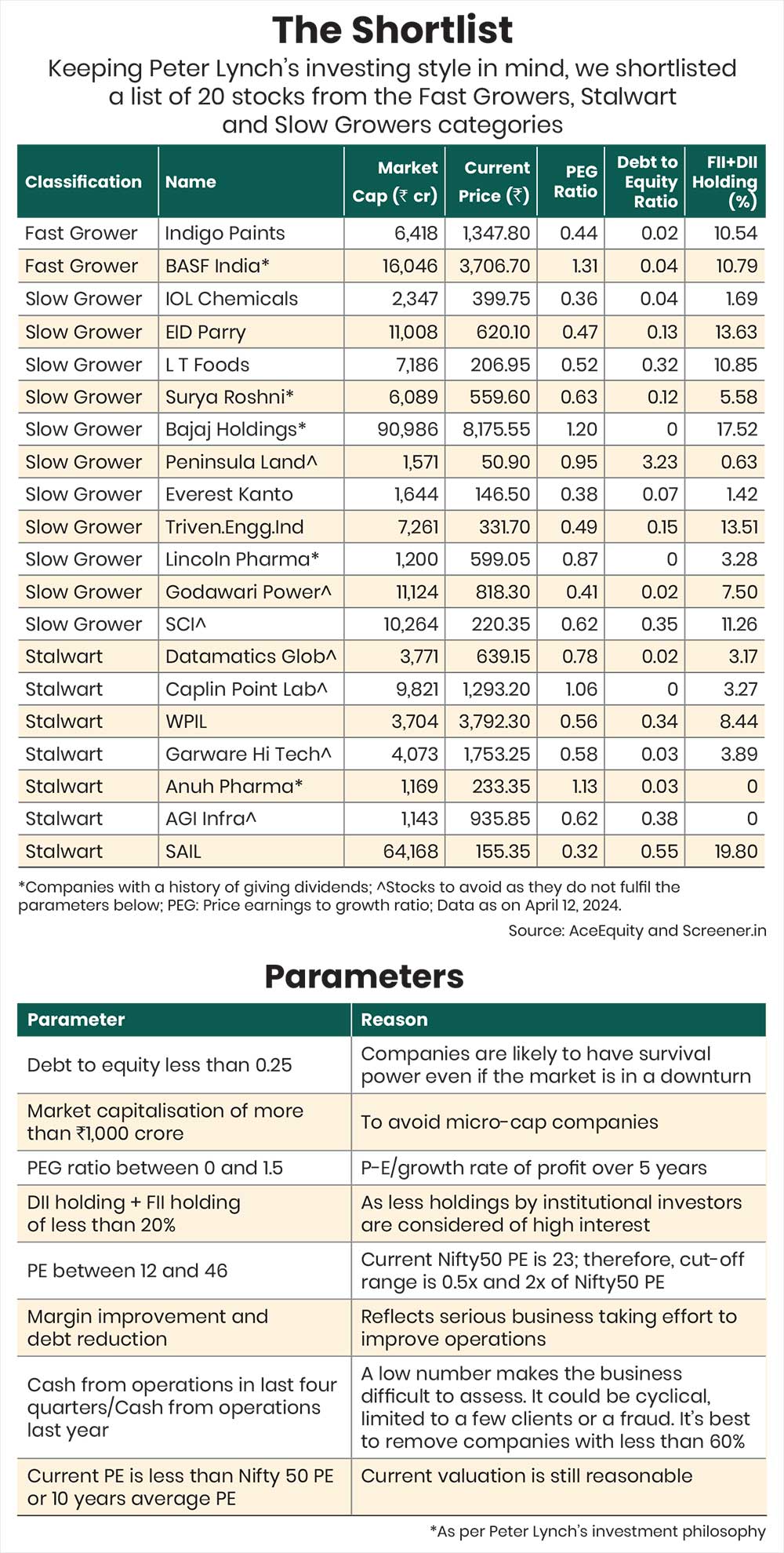

Peter Lynch says in his book, One Up On Wall Street: “It isn’t safe to own just one stock, because in spite of your best efforts, the one you choose might be the victim of unforeseen circumstances. In small portfolios I’d be comfortable owning between three and 10 stocks. There are several benefits: If you are looking for 10-baggers, the more stocks you own the more likely that one of them will become a 10-bagger. Among several fast growers that exhibit promising characteristics, the one that actually goes the furthest may be a surprise.” Keeping in mind his wisdom, of the 20 stocks that we shortlisted quantitatively, we have handpicked six that can be bucketed under the six categories he advocates.

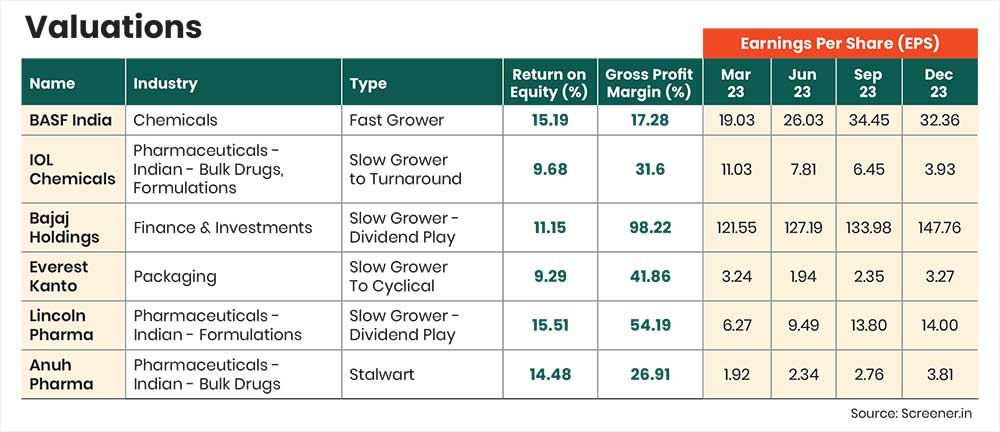

1. BASF India (Fast Grower):

The company is a part of BASF Group, a German multinational and the world’s largest chemical producer. BASF India gets operational, technical and financial support from its group companies. It has significant purchases and sales with its parent and group companies, which gives it better visibility. Investors may consider buying it by tracking the gross margin and P-E. If the trailing P-E is above 60, exit the stock.

2. IOL Chemicals (Slow Grower to Turnaround)

The company operates in pharmaceuticals and specialty chemicals. It’s a top producer of Ibuprofen and Ethyl Acetate, which are widely used in paints and perfumes. In pharmaceuticals, it focuses on active pharmaceutical ingredients (APIs) for pain management and diabetes. The promoters increased their holding by 4.5 per cent in the last three years, and a new CEO was appointed, hinting at a potential turnaround. An increasing gross margin over the next three years is crucial to show that the company is on the path to a turnaround. If P-E increases to more than 60 times, re-evaluate.

3. Bajaj Holdings (Slow Grower - Dividend Play)

Bajaj Holdings & Investment is registered with the Reserve Bank of India (RBI) as a non-banking financial company (NBFC). It holds over 30 per cent stake in Bajaj Auto and Bajaj Finserv. Previously a part of Bajaj Auto, it now focuses on managing investments for income through dividends, interest, and gains from its holdings. Invest if the stock dividend yield is higher than the Nifty 50 dividend yield, and re-visit if it skips paying dividend in a year.

4. Everest Kanto Cylinder (EKC) (Slow Grower to Cyclical)

EKC is a leading manufacturer of high-pressure gas cylinders and equipment for storing natural gas, liquids, and air. With a diverse product range and major clients like Tata Motors and Bajaj Auto, it operates across India, the UAE, the US, and also exports to 25-plus countries. It has expansion plans in India and Hungary to boost production and is looking at joint ventures in Europe and the Middle East, which are poised to benefit it from the global shift towards gas-based economies. Investors should monitor capacity utilisation and returns on assets to gauge stock performance and debt-to-equity ratio.

5. Lincoln Pharmaceuticals (Slow Grower – Dividend Play)

Gujarat-based Lincoln Pharmaceuticals (LPL) have created over 600 types of medicines, with many more in development. They sell their products in over 60 countries and plan to expand their reach to 90 nations. Their research labs are approved by the US Food and Drug Administration (USFDA). They aim to earn Rs 750 crore by 2026. One should invest in a staggered manner in the stock, as execution will be the key. The company has paid dividends regularly. Sell if the promoter group’s ownership drops below 50 per cent or if it stops paying dividend.

Anuh Pharma (Stalwart)

Anuh Pharma is a key player in bulk drugs manufacturing, focusing on macrolides (an antibiotic used to treat bacterial infections) and anti-TB products. With many World Health Organization and USFDA approvals, it exports to 57 countries. It plans a Rs 5 crore capex for capacity enhancement in FY24 to achieve a growth rate of 15-20 per cent, with 11 new products targeting lifestyle diseases. This segmentation can benefit the company and, therefore, one may consider investing in the stock in a staggered manner. Also monitor regulatory compliance and approvals, and its profit or EPS growth rate in FY25.

*Investments in securities markets are subject to market risks, consult a Sebi-registered investment advisor before investing.

The author is a Sebi-registered research analyst and a financial writer