The name Life Insurance Corporation of India (LIC) is synonymous with insurance and savings in the country. Even today, despite higher financial awareness and availability of a myriad other asset classes, the elders of the family advise young professionals and businesspeople to buy an “LIC policy”.

The fact that the insurer has 28.60 crore policyholders, as on March 31, 2021, according to the draft red-herring prospectus (DRHP) of its initial public offer (IPO), stands testimony to LIC’s strength. If all the LIC policyholders are put together, they will form a country with the fourth-largest population in the world.

Whether it’s advisable to buy life insurance for savings is a matter of debate for another time, but there’s no doubt about the influence LIC has had over Indian savers over the last about 65 years of its existence.

Lion’s Share

LIC started with a capital of only Rs 5 crore in 1956. But today it manages assets worth over Rs 39.6 lakh crore (as on September 30, 2021). That’s bigger than the GDP of more than 75 per cent of the countries in the world.

LIC owns over 19 per cent of all government bonds, making it bigger than the Reserve Bank of India, which has 11 per cent of the bonds. The insurer’s current stake in the Indian stock market stands at 4 per cent. In short, LIC is India’s largest institutional investor.

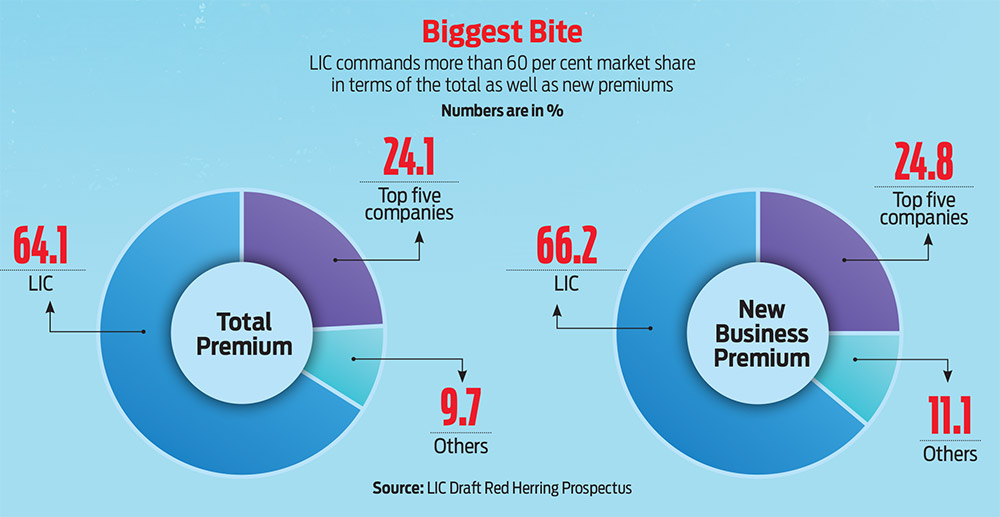

Until 2000, when the government opened the doors to private companies in the insurance business, LIC enjoyed a monopoly and commanded 100 per cent market share. However, since then it has been facing stiff competition. Currently, there are 24 life insurance players in the market. “We face significant competition in India and overseas in respect of our life insurance business and other sectors or industries in which we operate,” admits the LIC DRHP.

Still, LIC holds a 64.1 per cent market share in the Indian insurance business in terms of total premiums collected and has a 66.2 per cent market share in terms of new business premiums (NBP). It also commands 74.6 per cent market share in terms of the number of individual policies issued, and 81.1 per cent market share in the number of group policies issued for financial year 2021. It has an enviable number of individual agents (1.35 million), which is 55 per cent of all individual agents in India as on September 30, 2021.

“We are the market leader by substantial margin. Our average production by an agent is 15 policies per year (compared) to around four policies per year by the nearest competitor. Customers have always been centric to our operation and, therefore, we have the 61st month persistency of 61 per cent, which is one of the highest. In the last one decade from 2011 to 2021, we have lost just three per cent share,” said M.R. Kumar, chairman, LIC, during a media interaction. Persistency ratio shows the renewal rate of policies bought from an insurer and indicates how sticky policyholders are.

From Market Share To Market Cap

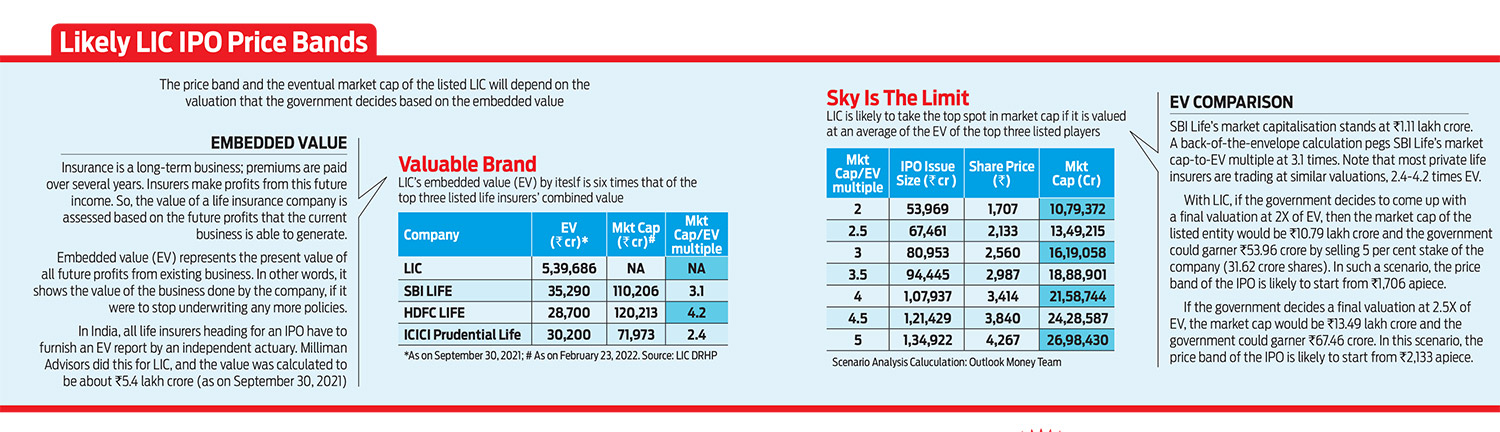

Given the sheer size and reach of the behemoth, the all-important question is: what will the likely market capitalisation of LIC be? The two biggest factors that will help answer the question are how the embedded value of the company has increased due to internal changes in profit distribution among policyholders and shareholders; and the valuation of the company compared with its peers.

Re-Channeling Profits Into The Company: Some of the profits that the insurer earlier shared with the policyholders will now go to the shareholders, increasing the value of the company.

Let’s understand this in detail. Insurers allow policyholders to benefit from the company’s profits—in the form of dividends or bonuses—through participating (par) policies. LIC, however, extended this benefit even to the holders of its non-participating (non-par) policies. That will stop now.

Prior to the amendment to Section 24 of the Life Insurance Corporation Act, LIC had only one consolidated ‘Life Fund’ in respect of its life insurance business. Consequent to the amendment, the LIC board was mandated to maintain two separate funds—a participating policyholders’ fund and a non-participating policyholders’ fund.

LIC shared 95 per cent of its participating surplus with policyholders, leaving only 5 per cent for the shareholders, from a common pool for both par and non-par policies. Now, LIC will separate the pool for par policyholders. It will share the entire non-par surplus with shareholders and will also increase the shareholder allocation in the par category surplus from the current 5 per cent to 7.5 per cent in FY23 and FY24 and, finally, to 10 per cent from FY25. “The amendment puts LIC in consonance with other players. After the transition period (by 2024-25), we will be perfectly aligned with the private players,” says K.R. Ashok, chief actuarial, LIC.

In effect, this will benefit the shareholders and increase the company’s value or market cap.

Cataclysmic Shift In Valuations: With the change in distribution of surplus among policyholders and shareholders, there will be a cataclysmic shift in LIC’s valuations eventually. The first impact has already taken place: LIC’s embedded value has been calculated at a high Rs 5.39 lakh crore (as of September 30, 2021). In comparison, the embedded value of its PSU rival SBI Life Insurance stands at Rs 35,290 crore. Embedded value refers to the current value of the company after taking into account future risks and profits.

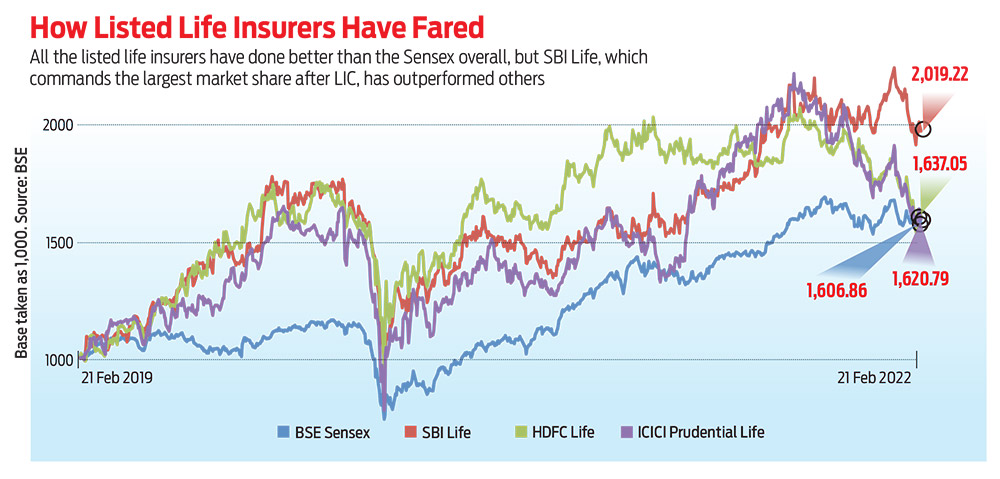

SBI Life’s market cap stands at Rs 1.10 lakh crore (as of February 23, 2022). A back-of-the-envelope calculation pegs SBI Life’s market cap-to-embedded value at 3.1 times. Note that most private life insurance companies are trading at about similar valuations of 2.4-4,2 times embedded value (see Likely LIC IPO Price Bands).

Drawing on that, if LIC can command a valuation of three times its embedded value, its market cap would be easily driven to over Rs 16 lakh crore, placing it among India’s top companies by market cap. For instance, Reliance Industries has a market cap of Rs 16.06 lakh crore, while IT behemoth TCS has a market valuation of Rs 13.18 lakh crore. If LIC is indeed able to command a good valuation, it may easily be able to pip TCS to the second spot in the league of most valuable companies, while giving oil major Reliance Industries a run for its money and challenging it for the top spot.

The scales, in fact, could easily get tilted in LIC’s favour because another important yardstick, the value of new business (VNB) margin, is set to increase further. “Its (LIC’s) VNB margins have already moved from 2.8 per cent to 9.9 per cent and will reach 12.3 per cent once surplus distribution fully equates to (that of) private players (10 per cent). Its non-par margins (gross) are 83 per cent versus 11 per cent for par products, and despite contributing only 4 per cent of the APE (annualised premium equivalent), non-par accounts for one-third of VNB,” states a recent report by Credit Suisse India. Hence, LIC believes a shift in focus to non-par can significantly raise its profitability—a 10 per cent shift in the APE mix from par to non-par can push up VNB margins to 20 per cent, the report added. “However, even post margin uptick, VNB to embedded value for LIC is lower, at 1 per cent, versus 5.5-7.5 per cent for private players,” states the report.

High Profit Potential: Another important factor that analysts have been highlighting is that LIC’s net profit is low compared to its assets under management (AUM), which leaves room for expansion in the future. “We observe that LIC has a reported net profit (NP) of only Rs 29 billion (Rs 2,900 crore) in FY21 despite managing a very large AUM of Rs 35 trillion (Rs 35 lakh crore) as of March 2021. In our opinion, this reported NP is highly understated and does not capture the true earning potential of LIC,” states a report by Haitong Securities India, a Singapore-based company.

The report adds that after adjusting for net profit post its surplus policy change, deferring acquisition costs, and adjusting additional recurring income on increased investment, LIC’s net profit could be higher. “We observe that LIC could have potentially reported a NP of Rs 291 billion (Rs 29,100 crore) in FY21, which is around 10 times higher than its reported NP of Rs 29 billion (Rs 2,900 crore). Based on these adjustments, LIC’s last five-year adjusted NP CAGR (compounded annual growth rate) comes out to be 10 per cent and last five-year average ROE (return on equity) is 18 per cent,” states the report, dated February 7, 2022.

Of course, given the accounting policies in India for insurance firms, it’s likely that LIC’s net profits could only rise marginally. However, over the next two years, the changes should result in an improvement in profitability and shareholder returns, and ultimately in valuations.

Palpable Buzz

Considering the likely issue size and deteriorating market sentiments due to geopolitical events, questions are being raised on whether the IPO will get enough subscribers?

Market experts believe that getting subscription is not a big problem as even many loss-making companies got tremendous response in the recent past.

It is the valuation that will play a major role, they believe. “No one buys a company purely on the basis of market capitalisation (size). What is important are the prevailing valuations and growth prospects,” says Nitin Shanbhag, head, investment products, Motilal Oswal Private Wealth Management. In the last one year or so, insurance companies have not done well as higher claims due to Covid hit their books and, consequently, their share prices. “I believe that more than LIC, insurance as a sector has a long way to go considering lower penetration,” adds Shanbhag.

The brand value will also have a role to play in attracting investors. “LIC is deeply ingrained in the Indian ecosystem and mindset, so it has tremendous brand value. If priced well, current geopolitical situation notwithstanding, we are likely to see tremendous response from retail as well as institutional investors,” says Pranav Haldea, managing director, Prime Database.

Haldea also advocates lower pricing of the IPO. Even if the government gives a discount on 5 per cent of the stake, it will strengthen the balance sheet of the government in future.

The astounding rise in new demat accounts in financial year 2021—a record 1.42 crore new demat accounts were opened—points at upbeat market investing sentiment. The total figure has surpassed the 8 crore mark.

Besides, even if a small segment of LIC’s customers, employees and agents participate, the IPO will sail through comfortably. There is a huge response from policyholders to open demat accounts and update their PAN. “Roughly, we have linked more than 6-7 million policies with PAN,” says Kumar.

The buzz is palpable and the journey for the behemoth has just begun. Initial roadblocks like market volatility due to geopolitical developments could well be temporary. Watch this space to find out how what is perhaps the biggest IPO story in India, unfolds.

***

How Big Is LIC?

- It started with a capital of Rs 5 crore in 1956. Today it manages assets of over Rs 39 lakh crore

- It owns over 19 per cent of all government bonds, which makes it bigger than the Reserve Bank of India with 11 per cent

- It is India’s largest institutional investor—4 per cent stake in the stock market

- 74.6 per cent of individual policies issued belong to LIC (FY21)

- It has 81.1 per cent market share in terms of number of group policies issued for fiscal 2021

***

Top 5 IPOs By Size

LIC is set to be the largest IPO in the history of the India stock market with an expected size of Rs 60,000-70,000 crore, about four times the recent One97 Communications IPO

Rs 18,300 cr One 97 Communications November 8, 2021

Rs 15,199 cr Coal India October 18, 2010

Rs 11,257 cr General Insurance Corp. Of India October 11, 2017

Rs 10,341 cr SBI Cards & Payment Services March 2, 2020

Rs 10,123 cr Reliance Power January 15, 2008

Source: Prime Database

kundan@outlookindia.com