Reaching the pinnacle of Mt Everest is a pipe dream that a lot of mountaineers have. But making that dream come true is not simple at all—it requires years of physical and mental training, consistency, careful planning and a focused approach. Even then, most mountaineers are unable to take the arduous road without the sherpas, known for their skills in mountaineering, to guide them.

The dream of achieving financial freedom—the pinnacle of one’s financial life—is no different. Just like mountaineering, to realise the financial freedom dream, you would need years of planning, training, consistency, a focused approach, and a financial advisor to guide you on the path.

In both the cases, choosing the right guide is the key to success because misinformation, bad advice or a wrong decision can spell disaster. W. Bhaktaraj, 68, a former sub-divisional officer (SDO) in the Manipur government, lost a substantial amount of money when he invested his earnings from the stock market in dubious schemes that promised huge monthly returns. “I didn’t reinvest the money in stocks as I was retired and cash was limited; one of my children was also unemployed at the time; and I needed regular cash flow,” says Bhaktaraj.

But that’s precisely where the problem lies. In a country that is bursting at its seams with a population of about 1.4 billion at present, the number of financial advisors is a minuscule percentage.

Choosing an advisor who is right for you from this small pool is challenging for investors, especially for those living in the smaller cities and under-penetrated regions, in terms of financial awareness, as they have limited infrastructure to fall back on and fewer choices.

Who Advises India?

For years together, Indians largely depended on financial agents to take care of their investment needs. The majority of these investments, however, were based on how much commissions the agents earned rather than the returns they would give to the investors.

To weed out commission-based mis-selling and to ensure that investors had access to unbiased advice, capital markets regulator Securities and Exchange Board of India (Sebi) introduced investment advisor regulations in 2013. The aim was to shift the market from a commission-based model to a fee-based one.

However, 10 years since the inception of this regulation, the number of Sebi-registered investment advisors (RIAs) remains abysmally low compared to the vast population of investors. As on July 13, 2023, there are only 1,331 RIAs in India compared to at least 120 million demat account holders and a little over 150 million mutual fund folios, according to the latest data from Sebi, Central Depository Services Ltd (CDSL), National Securities Depository Ltd (NSDL, and the Association of Mutual Funds in India (Amfi), respectively. There are 139, 764 MFDs in India as of June 30, 2023, according to Amfi.

Says Dilshad Billimoria, a Sebi RIA and managing director and principal officer, Dilzer Consultants, a financial planning firm: “The penetration of good financial advice is very low in India. According to the income tax data from 2019, the number of valid Permanent Account Number (PAN) holders in India is 445 million, but there are only 990 Sebi RIAs, as per May 2023 data from BSEASL (only BASL-approved RIAs are qualified to give financial advisory). Assuming that 50 per cent of these 445 million PAN holders invest, the advisor to client ratio is 1:230000! It is not practically possible for an advisor to serve so many clients in a good way.” The only option is to add more RIAs in the industry, she adds.

The overall number of RIAs is low, but another problem is their distribution across the country.

Of the 31 states and Union Territories (UTs) for which data is available on the Sebi website, seven have no RIAs, while 17 states and UTs have less than 10 RIAs each, and only three have more than 100 RIAs each. Maharashtra has the highest number of RIAs at 521.

Outlook Money dug deeper into the numbers and found that there are more advisors in regions where there is higher flow of money or higher investment in financial assets.

For instance, Maharashtra leads the pack with the highest number of RIAs. At the same time, the state also makes the largest contribution to mutual funds with average assets under management (AAUM) of Rs 19 lakh crore, which is almost half of the Rs 43 lakh crore mutual fund industry. Similarly, the number of RIAs based in the state are almost half of the total RIAs across the country.

States like Bihar and Uttar Pradesh, which are among those with the highest population, have a significantly lower number of RIAs, highlighting the need for increased access to professional investment advice in such regions. However, the per capita investment in MFs in these states is minuscule if we compare it with smaller states such as Goa and Sikkim, which too are short on RIAs, four and nil, respectively (see Show Me The Money).

The bigger cities in the states or the ones that are industrial or financial hubs are seen to have a higher concentration of RIAs. For instance, in Haryana, the majority of advisors are based in Gurugram. Similarly, among the total of 156 RIAs in Madhya Pradesh, most are concentrated in Indore, and are primarily involved in the stock advisory business.

“Financial advisory services may not be widely known or understood in smaller cities. As a result, the demand for certified financial planners (CFPs) and RIAs may be relatively limited in smaller cities, leading to fewer professionals establishing practices there,” says Krishan Mishra, CEO, Financial Planning Standards Board (FPSB), India.

The gap left because of the lower number of RIAs is filled by CFPs, qualified personal finance professionals (QPFPs), mutual fund distributors (MFDs), chartered accountants (CAs), bank relationship managers (RMs) and even insurance agents, among others.

CFPs are professionals who are registered with the FPSB of the US, which has a subsidiary in India. “CFPs are financial planners who have committed to rigorous standards of competency, ethics and professionalism and have obtained a globally recognised certification in financial planning,” says Mishra. For the certification, individuals have to pass exams in the fields of investment management, taxation, retirement planning, insurance and holistic financial planning. Until recently, Sebi accepted the CFP certification for the RIA profession.

QPFPs are certified by Network FP, a community of about 1,000 financial advisors and distributors spread across more than 100 cities in India. “QPFPs have to fulfil mainly three criteria, including having an industry licence and a qualification, such as CFP certification or chartered wealth managers,” says Sadique Neelgund, founder and director of Network FP.

MFDs are essentially agents who sell and distribute mutual fund products and are regulated by guidelines of Sebi and Amfi. There are 122,000 MFDs in India as of March 2023, according to data from Amfi.

If we were to include all categories of advisors, the numbers are still low and there are multiple reasons for that. Lack of awareness, the unwillingness of investors to pay an upfront fee and tightening of Sebi norms for RIAs (see The Unintended Scapegoats) top the list.

With low financial awareness, especially in smaller cities, many advisors find it difficult to operate there.

Take the case of businessman and property developer Raj Kumar Verma, 31, who is based in Dibrugarh, Assam. He started his career by signing up as an agent with an insurance company in 2013. The job introduced him to financial instruments and money management, but he couldn’t pursue a career in the field, as the locals have little knowledge about financial products, leaving him with limited clients.

A survey by the Reserve Bank of India (RBI), released earlier this year, Determinants of Financial Literacy and Financial Inclusion in Northeastern Region of India: A Case Study of Mizoram, found that 32 per cent of respondents were unaware about any financial product except savings bank accounts. Nearly 20 per cent lacked awareness of basic payment options, and 43 per cent lacked knowledge of how to use them. While the study identified several factors hindering financial inclusion and literacy, the awareness level varied depending on the place of residence, education, employment type, income levels, joint or nuclear family, etc. The situation is similar in other under-penetrated regions as well.

Dearth Of Genuine Advice

Not all small cities are closed to investments though, especially after the increased popularity of mutual fund systematic investment plans (SIPs) and equities during the Covid period.

“Post-Covid, there has been a significant increase in digital adoption, particularly in terms of communication and execution. During the Covid period, investors experienced steep volatility in the financial markets: the subsequent recovery instilled trust, confidence and risk appetite. The continuous rise in the market post-Covid has brought optimism among investors,” says Prabin Agarwal, an MFD based in Siliguri. Agarwal manages the finances of 2,000-plus families and handles assets worth Rs 400 crore.

In terms of products, the expanding basket of investment products has provided investors access to a broader range of suitable choices, Agarwal adds.

Though the number of investors is going up, there are not enough advisors. “The financial advisory landscape in India is inadequate in terms of reaching the masses. People in India usually rely on input from family, friends or colleagues to guide their financial decision-making or may not have access to proper financial advice. While there are financial advisory firms and professionals operating in the country, their reach may be limited to urban areas or higher-income segments of the population,” says FPSB’s Mishra.

Dearth of professionals coupled with low financial awareness breeds another set of advisors—the do-it-yourself (DIY) kinds. This segment often creates untenable and risky or over-protected portfolios that are unable to cater to their goals or beat inflation.

Raj Kumar falls in the latter category. Assam has just three RIAs currently, and despite working with an insurance company in the past, he does not have much idea about investing in equities. His portfolio largely consists of endowment insurance policies and real estate.

“Had there been scope to learn about financial markets, I would have invested in stocks and mutual funds early on, which would have given me a firm headstart to reach my goals faster,” says Raj Kumar, who pays about Rs 2 lakh annually for the premiums of various insurance policies that he has.

He now plans to invest in the stock market to financially secure his small family of wife, two daughters and parents, and is actively looking for a professional to guide him.

However, the rise of online platforms is changing the game somewhat. “There has been a rise in DIY investors who prefer investing through user-friendly apps and platforms,” says Agarwal.

Ranchi-based Arun Kumar, 51, an internal audit manager with a CA firm, mostly relies on platforms to tweak his mutual fund portfolio. For shares, he mostly takes the help of local share brokers. He says Internet has made things much easy for people like him in tier-II cities or small towns. They just have to search on Google for Sebi RIAs at their location, or they can directly access the websites or app platforms of the different mutual funds through their computer or mobile to start with their investing journey.”

A lot of people end up handing over their hard-earned money to people who may not be the best advisors.

Umesh Kumar Aneja, 52, who is a business consultant based in Ghaziabad, manages his money himself based on the advice of his family and friends “who have been managing their money well.” He has never invested in the stock market but is curious about it. Though he knows about fixed deposits (FDs), he hasn’t locked into the higher rates yet and is also unaware about the recent rate hikes in small savings schemes of the government.

“I feel there is scope for me to learn, but there’s no one to give me proper advice. I wish someone could tell me how to break up my salary into expenses and investments, how to be free of debt etc,” says Umesh, who doesn’t know who RIAs or CFPs are. He is now considering putting some money in a real estate deal based on a YouTube video, which may or may not be advisable for him.

Another set of investors that gets left out from the advisory domain is the one with transferable jobs.

For Abhijit Chanda, 50, a Ranchi-based project coordinator with Plan International (India), an international development agency working for children and women, remote locations and postings were a setback in his investment journey initially.

“I did not get any professional financial advisor in my location, Ranchi, to guide me on goal-based investment and future financial planning. I did not know about Sebi RIAs at all. I have not been able to invest my hard-earned money and I still do not have good savings at the age of 50,” says Abhijit.

He admits that he has been mis-guided on investment products quite a few times. “I understand that the options suggested by the agents here are mostly beneficial to them and not for investors like me. I have very limited access to information about the products. I have to rely on the agents. I tried getting the necessary information from the Internet, but couldn’t get reliable information,” he adds.

There are still others who end up parking most of their savings in bank accounts or small savings schemes, besides a smattering of insurance policies and SIPs, on the back of their recent popularity.

Most of Kanpur-based businessman Pradeep Singh’s, 47, surplus earnings are lying in his savings accounts. He has also invested some of his savings in SIPs, FDs, Public Provident Fund (PPF), and Kisan Vikas Patra (KVP) based on the advice received from friends and family.

“I have tried to find out about some financial advisory firms through the Internet or people close to me, but have not been able to find anyone who can assist me with my savings,” says Pradeep. He says he finds some answers on the Internet, but wants an advisor who can take responsibility and suggest the right mix of instruments based on his and the needs of his family, consisting of his wife and 18-year-old son.

“There is a genuine need for quality investment advice from true-blue financial advisors who do comprehensive financial planning and advisory, and not just on stocks and trading,” says Billimoria.

What Should You Do?

One of the major issues that Suman Biswas, 45, who works at a private company in Siliguri, West Bengal, faced is the lack of awareness about where to seek reliable guidance from. There are limited number of RIAs in the region as there are only 34 RIAs across the state. This impacted his financial decision-making process for a long time, until he went DIY after doing individual research through online material.

“I often found myself making important financial choices without fully understanding the potential consequences. I relied on limited knowledge and instinct, which wasn’t always the best approach. Without access to proper guidance, I was hesitant to take risks or explore various investment options, which might have been beneficial for my financial goals,” he says.

Suman’s wife manages a small business and they have an education goal for their 9-year-old son besides their own retirement. Though Suman managed to make informed decisions backed by his own research, not everyone has the time, wherewithal or understanding to do so.

Therefore, seeking guidance becomes imperative.

Given the limited number of RIAs in India, the other sets of investment advisors such as CFPs and MFDs are currently playing a crucial role in guiding investors through the complexities of the financial market and helping them achieve financial freedom. Also, they are not just limited to smaller cities, but form a significant chunk of the advisory landscape even in the metros and bigger cities.

“In smaller cities, people mostly trust channels, such as MFDs and banking institutions for their investment needs. Additionally, beginners in smaller cities are also increasingly onboarded through online platforms,” says Agarwal of Siliguri.

For the longest time, Vineeta Varma, 46, who used to work as an operational manager in Thiruvananthapuram, Kerala, bought mutual funds from MFDs and unit-linked insurance plans (Ulips) from bank RMs who used to visit her office. “Unfortunately, these individuals often provided biased advice, prioritising products from their institutions,” says Vineeta, who moved to online platforms later, but still did not get comprehensive advice.

It was during the pandemic that Vineeta, who has now stopped working, discovered fee-only RIAs through the Fees Only India website. She chose an RIA after submitting proposals to many. The RIA did a thorough assessment of her risk appetite and existing investments, she says, which helped her streamline her portfolio and gain clarity on her investment goals.

But are RIAs the only competent people in the market? Neelgund feels that as long as the advisor fulfils certain basic criteria, it may not be necessary that individuals only approach RIAs for advice, especially because it’s hard to find them everywhere.

“Aren’t qualified people, such as CFPs, QPFPs, chartered wealth managers, CAs etc. competent enough to give advice? People should look at two Cs—competency and character. Competency is about knowledge of products, solutions, markets, process etc. Character is about integrity, honesty, ethics. But competency without character is dangerous,” says Neelgund. What should matter is the integrity and trustworthiness of an individual, which frankly speaking no regulation can ensure, he adds.

However, these advisors, including CFPs, are not considered by Sebi to have valid qualification to provide advice. “The difference between RIAs and CFPs is that the former can recommend direct plans but gets fees from clients. The CFPs cannot take fees (if they are not registered with Sebi) but can take commissions and recommend only regular plans,” says Rajesh Minocha, an Amfi-registered MFD and CFP.

Even MFDs are now allowed to give “incidental advice”. According to Ketan Nanivadekar, an Amfi-registered MFD based in Aurangabad, Maharashtra, “As per Sebi regulations, MFDs can continue to offer mutual funds with incidental advice. Earlier, CFPs used to provide financial planning services and charge a fee for that. Plus, they also used to be MFDs and earn commissions accordingly.” Nanivadekar helps manage the finances of about 250 families and handles assets worth over Rs 100 crore.

Though some investors prefer to seek advice from social media platforms, MFDs may be a better choice.

“The millennial generation, even in small cities, get influenced by YouTube and some motivated campaigns. But within 1-3 years, they understand the problem. Many such investors have come to us and are now investing through us in regular plans. They need someone whom they can talk to any time, who help them with their goal planning, who can manage their emotions during turbulent markets, offer facilities to track their investments online and offer other financial products as well,” says Ajay Sharma, an Amfi-registered MFD based in Sonipat, Haryana. Sharma helps manage the finances of 275-plus families and handles assets worth Rs 60 crore.

The limitation, however, is the fact that not all of them may be able to cater to holistic financial planning needs, even while catering to the broader investment needs of individuals. “While mutual fund distributors, agents, and CAs can provide certain financial advice, their expertise in providing comprehensive financial planning advice may be limited,” says Mishra.

Billimoria explains further. “MFDs are great in what they do, but some of them only deal in single products like mutual funds. That’s why they are called mutual fund distributors. RIAs work with multiple assets and product options and situations. For example, they will be able to handle the situation if someone needs a Will or needs estate planning to be done.”

The only way out is to do proper due diligence before settling on an advisor, RIA or others (see 10-Point Checklist To Choose A Financial Advisor).

Says Minocha: “If RIA is not available, then the person can take the views from the CFP. But as per the current regulations, the CFP should not charge any money for the advice, if he or she is in commission mode. This should be done after a suitability check with proper risk assessment.” The right advice is one that is given with a client-first approach and should be offered even if the product is not being offered by the person, but is relevant and suitable for the client, he adds.

The Way Forward

The financial advisory market has the potential to grow manifold given the low penetration of advisors, especially the registered ones.

Says Mishra: “India has a vast population, and a significant portion of the population is underbanked and hence not familiar with the benefits of financial planning. This suggests that there is a potential market for financial advisory services to reach a larger number of individuals and provide them with guidance on managing their finances effectively.”

This scope has now expanded because people who started dabbling in equities during the Covid period saw the potential of growth and are now asking for more. In addition, they have also understood why seeking protection through insurance is important during this period.

“Post Covid, people have realised the importance of investment as well as term insurance. All this has triggered the involvement of people in investment,” says Murari Lal Likhmania, an Amfi-registered MFD from Jamshedpur. Likhmania manages the finances of 500-plus families and handles assets worth Rs 15 crore.

Agrees Sonipat’s Sharma. “It’s much better than it was 5-6 years ago. Before investing, they ask many questions about markets, risks, volatility and even geo-political events. They ask about the probability and quantum of losing money. Over 50 per cent of the new clients that we meet talk about their goals, about diversification and different market caps etc.”

However, even though awareness about investments has gone up in recent years, people are still hesitant to traverse the path of disciplined and planned investing.

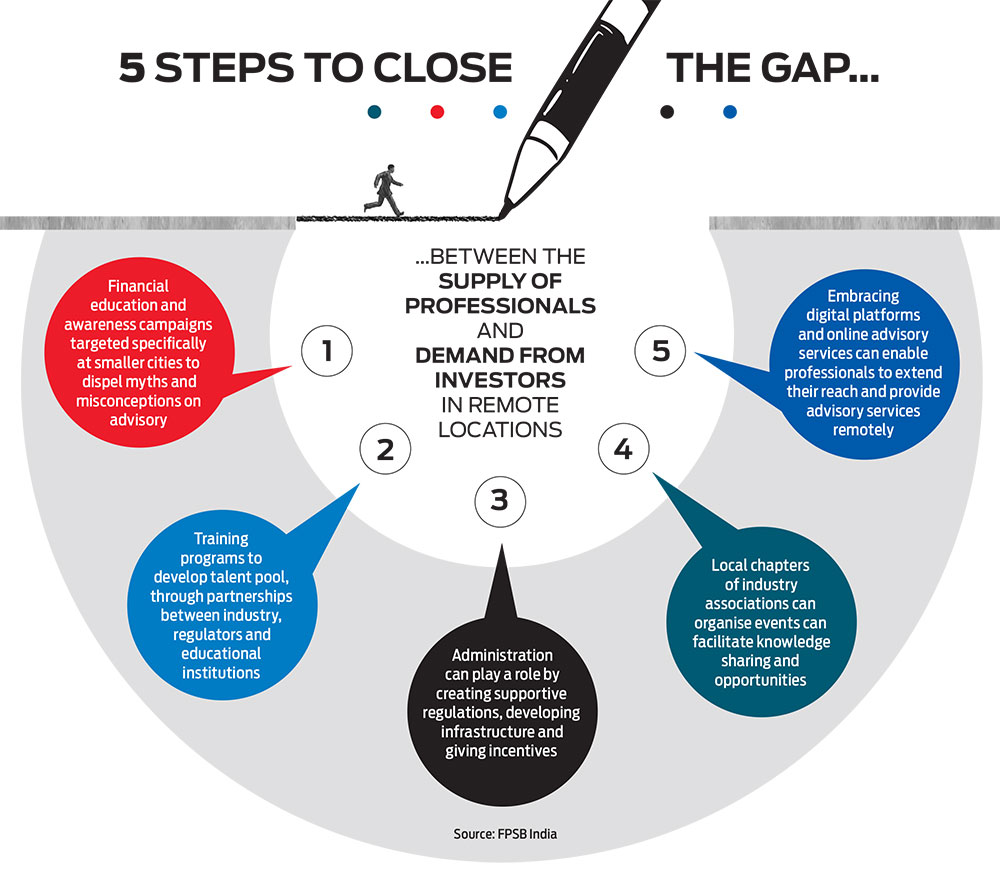

Mishra feels that certain measures by the government can make a difference. He suggests organising more financial education and awareness campaigns, local trainings and certifications, and leveraging technology and others (see Close The Gap).

Regulation can also go a long way in this effort. Says Billimoria: “Sebi should create a framework that is strict, but not strict at the same time, to grow the financial advisory community in India the right way. First, a distinction from stock tip providers and true-blue financial advisors should be made. Second, the onboarding and licence requirements to become a Sebi RIA should be less stringent. Colleges are waiting to place students, but Sebi’s stringency is causing a disconnect.”

“The market dynamics will fall in place when the regulator pushes for transparency (on the supply side) and financial literacy (on the demand side). Micro-managing will disturb the market dynamics,” says Neelgund. He feels broadening the scope of who can be a financial advisor will solve the problem to a large extent.

Regulations are fast changing in the financial advisory domain. It remains to be seen the direction it takes in the future so that a larger slice of citizens can access good advice, which remains the key to attaining financial freedom. Until then, it will be a mix of regulated and unregulated entities who will continue to cater to India’s diverse needs. Choosing the right financial advisor, irrespective of the nomenclature, is therefore, the key.

With inputs from Meghna Maiti, Versha Jain, Sanjeeb Baruah, Sutirtha Sanyal, and Aaron Charly Varghese