There is a growing trend among people to buy term insurance cover that matures after they turn 70. This is fuelled by two factors, primarily. One, the basic construct and exclusions of term insurance does not vary across insurers. So, in a bid to offer a differentiated proposition, insurers have increased the maximum age of coverage, extending it to the magical age of 100 years. Two, several insurance platforms advocate maximising the duration of the insurance cover. This leads to significantly higher premium over a longer period of time. An argument often made in favour of a long-duration cover is that it assures a payout. That is because as you grow older, the possibility of death becomes very real. This argument is, however, flawed and leads to policyholders making poor choices that end in sub-optimal coverage.

The primary purpose of a term insurance cover is to replace the future salary or earnings of the insured (wage earner) in the event of premature or untimely death of the buyer. The dependents or nominees of such policyholders can then use the proceeds of the insurance policy to meet the financial obligations, which would be otherwise fulfilled with the policyholder’s income if he were alive. Now, the retirement age, typically, varies between 58 and 65 years across organisations, and most people stop active work by the age of 65 years. So, a cover after retirement does not serve any purpose, as there is no real income to replace. After retirement, a person may still earn passive income through investments, in the form of dividends or interest income. However, such income does not need replacement, as these continue to accrue to nominees because of inheritance.

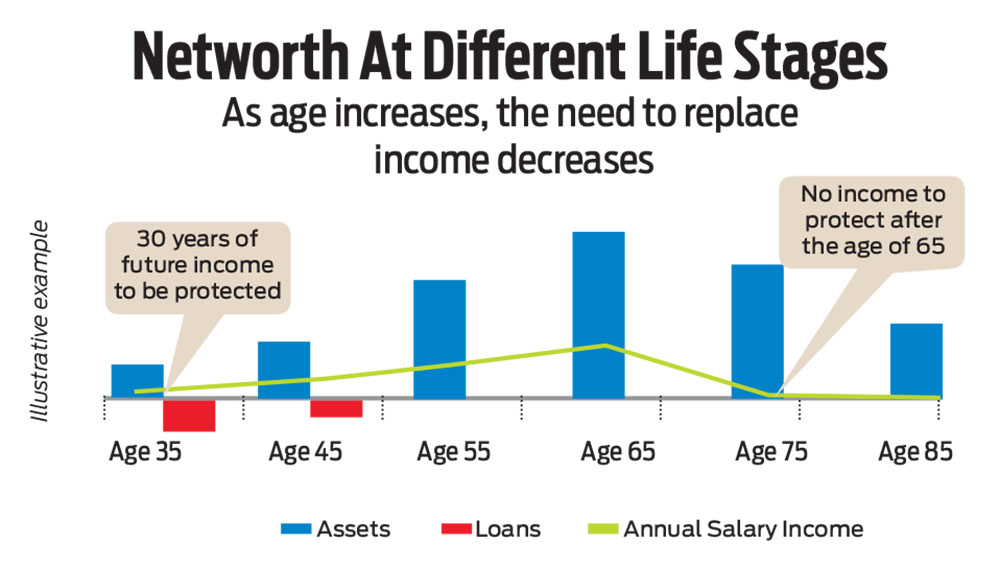

The right coverage for a term insurance plan decreases with age. At 35 years of age, the future financial responsibilities of an individual are at their peak. If a person dies at the age of 35 years, then the sum assured should be sufficient to cover the children’s education, outstanding loans, living expenses for the family, retirement corpus for the spouse, and any future obligations, such as children’s wedding. Until 35 years of age, people have a limited earnings history and meagre savings. In the absence of the right term cover, the family would have to eat into these savings, which would trim the planned milestones. With age, people keep fulfilling their commitments, and building a savings corpus.

On the other hand, if a person dies at the age of 75 years, all the family milestones would have typically been completed, and some assets and a retirment corpus would probably be in place. At this age, even without a term insurance, the family would probably meet all its financial obligations.

In fact, buying long-tenure covers can be detrimental. Term insurance premium is majorly dependent on the age of the policyholder, the duration of coverage, and the sum assured. For example, for a 35-year-old person, the cost of a Rs 1 crore term insurance till the age of 60 would be about Rs 16,500. The same would cost Rs 29,000 for coverage till 85 years. For the first 25 years of the plan, despite the coverage being identical, people end up paying 80 per cent higher premium. Instead, this extra premium can be used to buy an enhanced coverage till the age of 60, which is the period that matters most to the nominees. For a 35-year-old, a Rs 2 crore cover till the age of 60 would cost less than Rs 25,000.

To summarise, one should buy a term insurance until the age 60 or 65 years, and maximise the sum assured. A rule of thumb is to buy coverage equal to 10 times of one’s annual income. Term insurance should be seen as a protection scheme, and not a savings plan. So, it should not be designed to assure a payout.

The writer is co-founder, SecureNow