Imagine a situation – a close family member has suddenly taken ill and needs to be hospitalised. You do the needful and then realise you lack enough fund as cash deposit for immediate hospitalisation. What if you are unable to manage a lump sum during such a crucial time?

Naina Mathur, 27, a banking professional, experienced a similar situation when her mother had to be hospitalised urgently at midnight and the deposit amount that they charged was unmanageable for her at that point.

In such circumstances, Finway, a digital lending platform, can come to the rescue. Founded in 2017, New Delhi-based Non-Banking Financial Company (NBFC), Finway Capital, offers loans to millions, that too with a minimum turn-around time. Individuals both salaried and self-employed can choose to borrow any amount ranging from Rs. 50,000 to 2 crore with a repayment tenure of 12 to 120 months, with an average interest rate ranging between 11 and 16 per cent.

Cases like Mathur’s are classic millennial and Gen-Z situations where modest income at the beginning of one’s career coupled with lavish spending often make it difficult to sustain the last few days of the month. Any unseen monetary compulsion during this period can have a huge impact on one’s balance sheet for several months ahead.

There are millions like Mathur who often struggle to make ends meet owing to their extravagant lifestyle based on not-so-extravagant income. Borrowing from a bank is not an option owing to the time required for processing loans. This clubbed with a poor credit history further reduces the probability of getting a loan sanctioned, that too within a short turn-around-time.

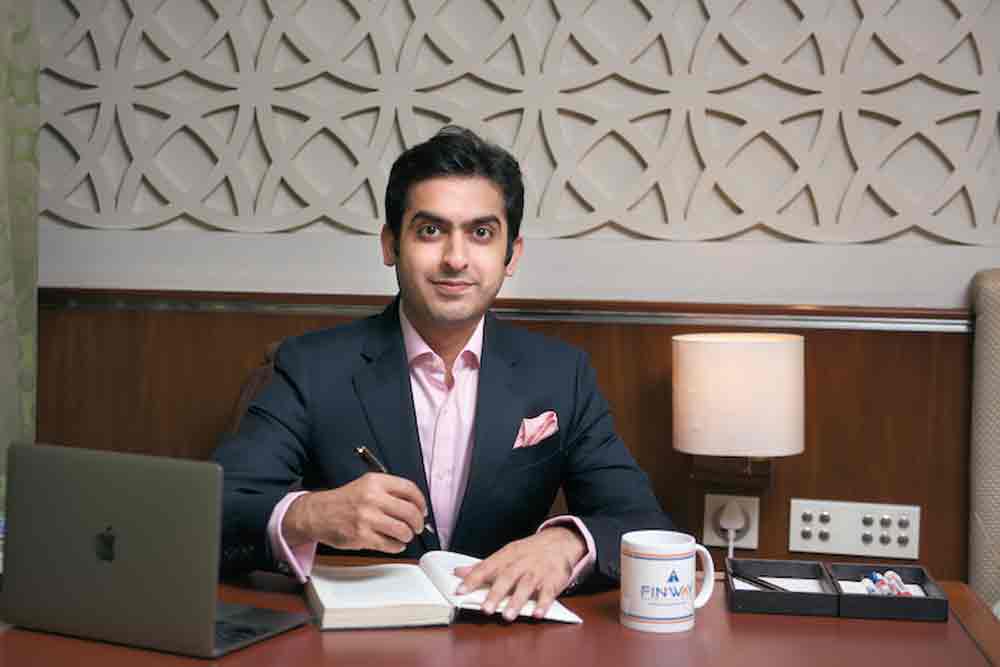

“We offer both secured and unsecured loans to individuals within a very short-span. Our turn-around-time is 24 hours,” said Rachit Chawla, Founder and CEO, Finway. Operational since early 2017, Finway has already disbursed a total loan of `20 crore so far and already registered 80 per cent repeat users. All its activities are regulated under the NBFC lending license guidelines.

“Finway simplifies the borrowing experience by removing complexities from the lending process. Transparency in processing of loan is utmost importance to us, said Chawla. Unlike other lending companies that strictly look for a solid Credit Information Bureau (India) Limited (CIBIL) score to provide credit, Finway banks upon Predictive Intelligence and social media activities of a customer along with CIBIL to assess worthiness of the customer. “We have also ventured into small ticket-size loans, loan against property as well as education loan,” confirmed Chawla.

All that a customer needs to do is approach the website, click on the ‘apply now’ button and proceed with it. Once a customer has furnished every detail including documents like Income Tax Returns and PAN card, the processing begins and its takes barely 24 hours for the amount to be credited to your account after you have registered a mortgage.

“The eligibility is calculated using highly sophisticated technology like Artificial Intelligence (AI) and Predictive Analytics,” Chawla pointed out.

The value proposition for Finway, is to motivate people to fulfill their dreams. Needless to say, this particular act has been responsible for ensuring repeat users amounting to 80 per cent and more than 200 local customers within two-years.

Sandeep Kakkar, 45, a self-employed professional based in Delhi, was in dire need of a loan sometime back. However, since he had a low CIBIL score, most financial institutions turned him down. In such circumstances, a friend told him about Finway. The NBFC came to his rescue when all roads were blocked for him. Despite having a CIBIL score issue, Kakkar was offered a loan.

When enquired on the cyber security aspect, Chawla added that once they get the lead and a primary sale is about to be generated, within two hours a customer care executive approaches the lead, takes other required information, which is then stored in a sensitive platform. “Customers’ data is fully secured with us,” confirmed Chawla.

While most of the customer base is in NCR, it has already started spreading across Haryana, Rajasthan and a few neighbouring states. When asked about demographics, Chawla confirmed that within the unsecured segment, maximum customers fall within the age group of 19 to 28, who are mostly salaried professionals.

On the other hand, the secured loan segments’ customers fall within the age group of 33 and 45.

On the funding part, Chawla said that they have been fortunate enough to have a substantial amount on their balance sheet; but they do look forward to raising debts on books. “

Finway is also active in its Corporate Social Responsibility segment and takes it rather seriously. Abiding by its tagline, Empower People Financially, the organisation has been actively involved in promoting financial literacy through seminars, webinars and interactive videos via social media platforms, especially YouTube.

Finway has also introduced a new, cutting edge loan-processing platform to promote women entrepreneurship. It will provide this service through its website and its soon-to-be-launched mobile app. “The aim is to revolutionise the cumbersome loan processing system with the help of technology,” confirmed its founder.

When asked about the accolades part, Chawla proudly mentioned that Finway has already taken home a lot of awards including BusinessWorld’s Start Up of the Year to Watch Out for.

sampurna@outlookindia.com