Smart And Wealthy Money Tips

The anniversary issue of Outlook Money was well thought out. All the 24 money moves are simple and easy to implement. Most Indians fail to adopt a financial strategy, and suffer badly in times of crisis. Often, our short-term needs override our long-term considerations.

This issue can help investors from all age groups decide on how to start with the basics of investing. It lists all the aspects of one’s financial life, right from financial discipline to organising one’s investing priorities. What stands out especially is that the facets that are often ignored, such as, having a Will, have also been included.

I like the small financial tips and little-known facts that are spread across the package. This would come handy even for my children when they come of age.

–Partho Chakrabarty, email

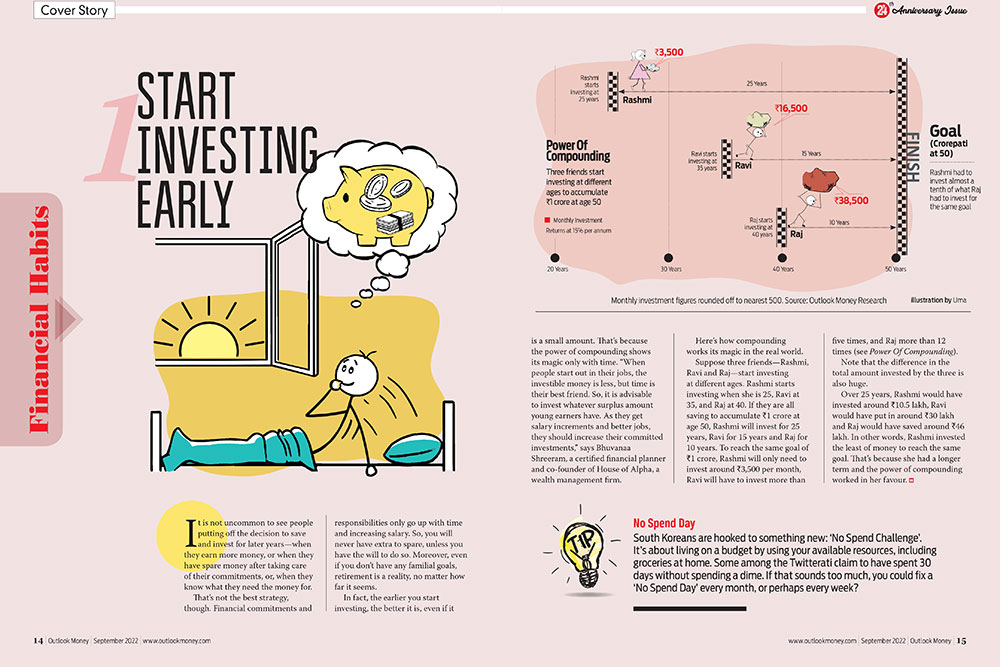

Grow Your Savings

The topic Start Investing Early was spot on. Indeed, saving small amounts at a time can help achieve big goals later in life. Unfortunately, our spending urge is often driven by the need for immediate gratification or temporary comforts, and ignores the future. Sadly, when time is on our side, saving for mid-life or old age doesn’t ring a bell for many of us, as we assume that everything will be taken care of when income grows, not realising that small steps compounded over time could make a huge difference. Therefore, instilling healthy financial habits early on could save a great deal of stress later.

–Jayshree Patel, email

Spending Wisely

When it came to credit card spending, I used to be extravagant and foolish. So, the topic, Be Careful With Credit, may have resonated with many others like me. While shopping was a pleasure trip for me, it can have severe consequences if credit card purchases or other expenses lead to uncontrollable debt. Although I knew all along about what I was getting into, the ease and allure of credit card shopping got the better of reason. Initially, it didn’t hurt as the equated monthly instalments (EMIs) were few. However, when the EMIs got bigger, I soon realised I could go bankrupt. Fortunately, after lots of self-introspection for months, I was finally able to control my shopping obsession.

–Priyanka Behl, email

Choose A Cover

Picking a term plan from the array of products available in the market could be tricky. The article Cover The Gaps highlights some vital points that should help buyers select the right policy for themselves. Deciding on whether to go for a traditional life cover or term plan could itself be a major challenge. Though the benefits are clearly defined, the buyer often grapples with the options. I found the article very helpful as I also look forward to buying a term plan in the future.

–Mehgnad Joshi, email