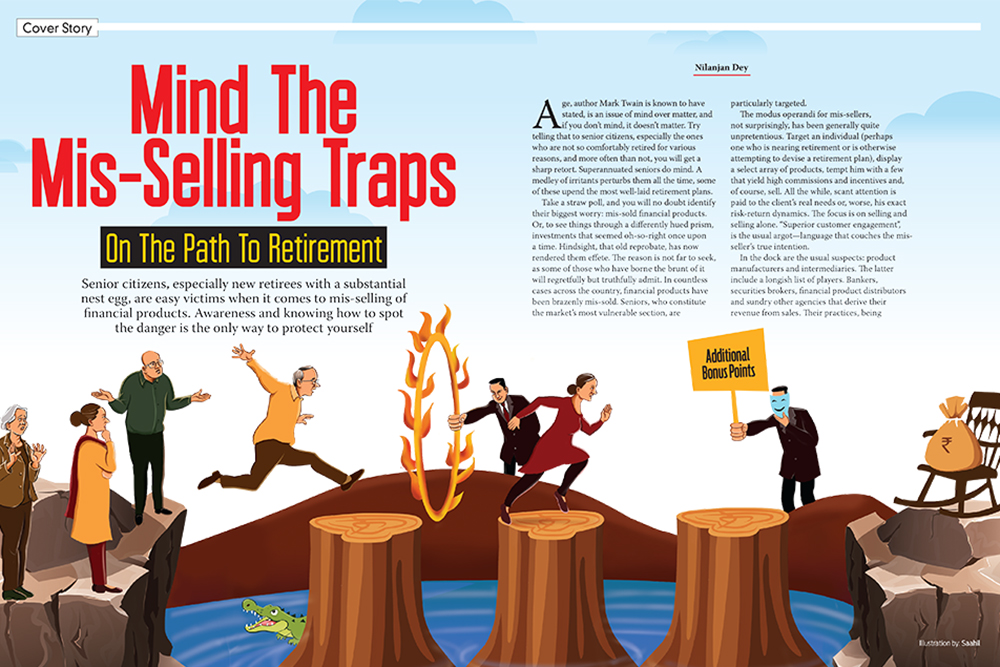

Mind The Mis-Selling Traps On Path To Retirement

Many senior citizens are trapped by the fact that they have a foot in two worlds. During their early working years, the investment options and available knowledge were limited. Since many of the products available now were not available in the market then, investors who are in the higher age groups could not invest in them and get the advantage thereof.

If lack of options was the problem some 40 years back, high use of digital processes is a hurdle now when they are in their 60s, 70s or even older.

Hence, they are in the unenviable position of having to make up for poor choice of products earlier and trying to keep up with the fast-paced technology changes taking place now.

Higher the risk, sweeter the reward.

Soma Bhatnagar

‘NPS Will Offer More Flexible Investing Options’

It is good news that the National Pension System (NPS) will come up with more products in the future. One aspect that should be considered is removing the compulsion of taking an annuity, which makes NPS unattractive as of now. For the purpose of retirement planning, I already invest in equity mutual funds, index funds, and Public Provident Fund (PPF). If NPS is able to offer something that tops these three, I would be happy to invest in it. Hopefully, the Indian government will come up with retirement products apart from NPS.

Nithya Vidyanathan, Chennai

Behind The Scenes

I am glad to know that many crypto exchanges need to follow the Advertising Standards Council of India (ASCI) guidelines for advertisements on different media. Cryptocurrencies are new and highly volatile. Many people are always on the lookout to make a quick buck. Just the way people are warned against ponzi schemes and the addictive nature of online gaming, suitable warning is needed regarding the risks in cryptocurrencies. Moreover, many young people have taken to crypto investing, and it is only prudent that they are made aware of the pitfalls, too.

Bhuvan Chhabra, Ludhiana

More The Merrier

I have been a subscriber of Outlook Money for the past 12 years. My financial knowledge started with the magazine, and I want to take it forward with my equity investing knowledge. Features on how to pick stocks, how to read the balance sheets or find the valuation of a company, would be very useful.

Dr Ritesh Sharma, Vapi

The February (Budget And You) and March (Calling The Shots) issues are much appreciated. They had many articles that provided useful knowledge.

Saurabh Kesharwani, Sagar